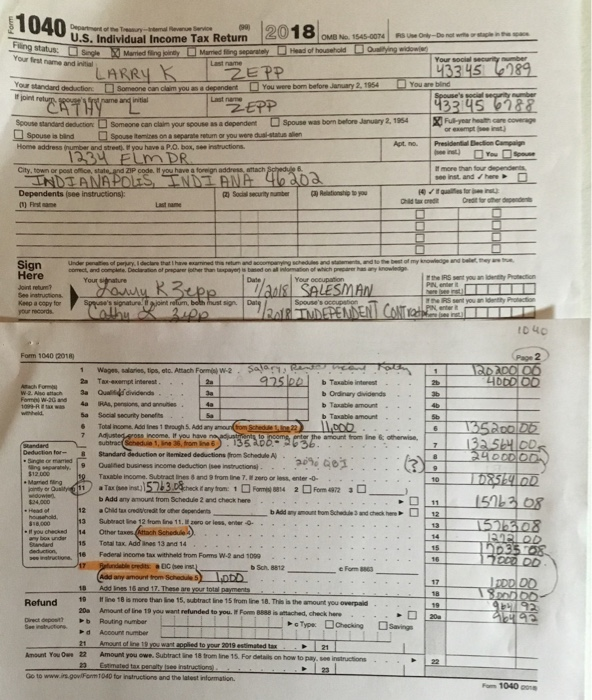

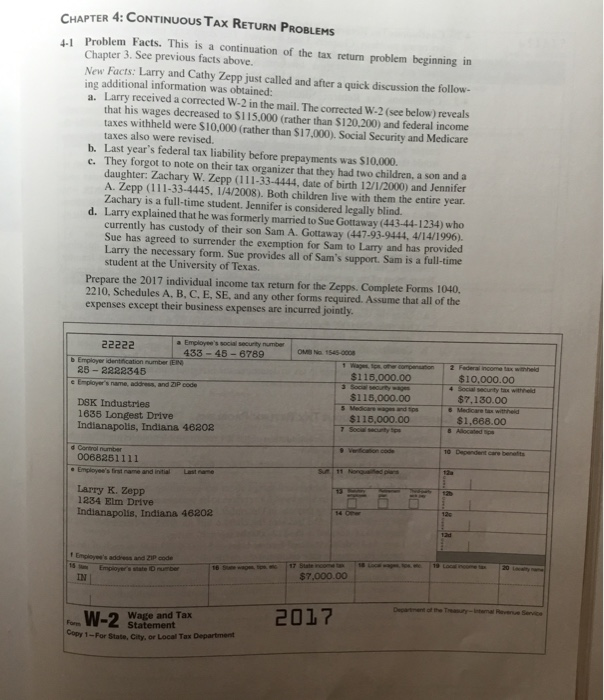

U.S. Individual Income Tax Return G igjoindy Mamed ling separately Head 2EPP Your standard deduction lam you as a dependent You were bom before January 2, 1954 You are blind Someone can claim your spouse as a dependent Spouse was born betore January 2, 1954 Spouse itemizes on a separate reburn or you were duai-stabus alien Scouse standard deduction Full year eath care coverag Spouse tind Apt. no. Presidential Dection Campaie Home address (number and street) I you have a P.O. box, see instructions City, town or pest office, stat Dependents (see instructions): t more than four dependents see inst andhere ZIP code. It you have a foreign address atach Social security sunberRelationship to you Signcomect, and Here Joint reture tthe IRS sent you an ldenity Prccien Yout your records Form 1040 01 Page 2 2a Tax-axempt interest W2 Ano stach 3a Qual dividends b Ordinay dividends b Taxable amount b Taxable amount Sa Social security beneths Total income. Add Ines 1 trough 5. Add any amount from Ine& otherwise, 1, ine 36, from 135 Deduction for-& Standard or iRemized deductions from Schedude A b Add any amount from Schedule 2 and check here Child tax credicredit for her dependent 13 Subtract ine 12 from ine 11, zero or less, eter- 5 Total tax. Add anes 13 ana 14 Federal income tax withhald trom Foms W.2 and 1099 b Sch. 8812 Add any amount trom Schedule 5 10 fline 18 is more than ine 15, subtract Iine 15 from line 18. This is the amount you overpaid 20a Amount of line 19 you want refunded to you It Fom 8888 isafttached, check here Drect onpeot? b Routing number knsunt You Own 22 Amount you wSubtract ine 18 rom line 15 For detais onhow topay, se instructions Go to www.irs.govlForm T040 for instructions and the latest information. Type Checking Savinge Amount of ine 19 you want coglied to your 2019 estimatedtax CHAPTER 4: CONTINUOUS Tax RETURN PROBLEMS 41 Problem Facts. This is a continuation of the tax return problem beginning in New Facts: Larry and Cathy Zepp just called and after a quick discussion the follow- Chapter 3. See previous facts above. ing additional information was obtained: a. Larry received a corrected W-2 in the mail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120,200) and federal income taxes withheld were $10,000 (rather than $17.000). Social Security and Medicare taxes also were revised. b. Last year's federal tax liability before prepayments was $10.000. c. They forgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (111-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008). Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind. d. Larry explained that he was formerly married to Sue Gottaway (443-44-1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Larry and has provided Larry the necessary form. Sue provides all of Sam's support. Sam is a ful-time student at the University of Texas. Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040. 2210, Schedules A. B, C. E, SE, and any other forms required. Assume that all of the expenses except their business expenses are incurred jointly 433-45-6789 tax whheld $115.000.00$10.000.00 $115,000.00 $115,000.00 $10,000.00 $7,130.00 $1,668.00 25 2222345 security tax withhelid DSK Industries 1635 Longest Drive Indianapolis, Indiana 46202 0068261111 s first name and initial Larry K. Zepp 1234 Elm Drive Indianapolis, Indiana 46202 ! Employes's address and Z1P code 1 Employers siate Du $7,000.00 IN Wage and Tax 2017 Copy 1-For State, City, or Local Tax Department U.S. Individual Income Tax Return G igjoindy Mamed ling separately Head 2EPP Your standard deduction lam you as a dependent You were bom before January 2, 1954 You are blind Someone can claim your spouse as a dependent Spouse was born betore January 2, 1954 Spouse itemizes on a separate reburn or you were duai-stabus alien Scouse standard deduction Full year eath care coverag Spouse tind Apt. no. Presidential Dection Campaie Home address (number and street) I you have a P.O. box, see instructions City, town or pest office, stat Dependents (see instructions): t more than four dependents see inst andhere ZIP code. It you have a foreign address atach Social security sunberRelationship to you Signcomect, and Here Joint reture tthe IRS sent you an ldenity Prccien Yout your records Form 1040 01 Page 2 2a Tax-axempt interest W2 Ano stach 3a Qual dividends b Ordinay dividends b Taxable amount b Taxable amount Sa Social security beneths Total income. Add Ines 1 trough 5. Add any amount from Ine& otherwise, 1, ine 36, from 135 Deduction for-& Standard or iRemized deductions from Schedude A b Add any amount from Schedule 2 and check here Child tax credicredit for her dependent 13 Subtract ine 12 from ine 11, zero or less, eter- 5 Total tax. Add anes 13 ana 14 Federal income tax withhald trom Foms W.2 and 1099 b Sch. 8812 Add any amount trom Schedule 5 10 fline 18 is more than ine 15, subtract Iine 15 from line 18. This is the amount you overpaid 20a Amount of line 19 you want refunded to you It Fom 8888 isafttached, check here Drect onpeot? b Routing number knsunt You Own 22 Amount you wSubtract ine 18 rom line 15 For detais onhow topay, se instructions Go to www.irs.govlForm T040 for instructions and the latest information. Type Checking Savinge Amount of ine 19 you want coglied to your 2019 estimatedtax CHAPTER 4: CONTINUOUS Tax RETURN PROBLEMS 41 Problem Facts. This is a continuation of the tax return problem beginning in New Facts: Larry and Cathy Zepp just called and after a quick discussion the follow- Chapter 3. See previous facts above. ing additional information was obtained: a. Larry received a corrected W-2 in the mail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120,200) and federal income taxes withheld were $10,000 (rather than $17.000). Social Security and Medicare taxes also were revised. b. Last year's federal tax liability before prepayments was $10.000. c. They forgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (111-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008). Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind. d. Larry explained that he was formerly married to Sue Gottaway (443-44-1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Larry and has provided Larry the necessary form. Sue provides all of Sam's support. Sam is a ful-time student at the University of Texas. Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040. 2210, Schedules A. B, C. E, SE, and any other forms required. Assume that all of the expenses except their business expenses are incurred jointly 433-45-6789 tax whheld $115.000.00$10.000.00 $115,000.00 $115,000.00 $10,000.00 $7,130.00 $1,668.00 25 2222345 security tax withhelid DSK Industries 1635 Longest Drive Indianapolis, Indiana 46202 0068261111 s first name and initial Larry K. Zepp 1234 Elm Drive Indianapolis, Indiana 46202 ! Employes's address and Z1P code 1 Employers siate Du $7,000.00 IN Wage and Tax 2017 Copy 1-For State, City, or Local Tax Department