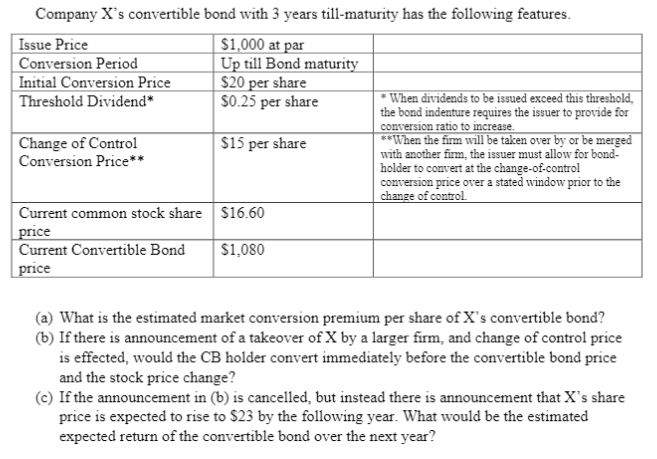

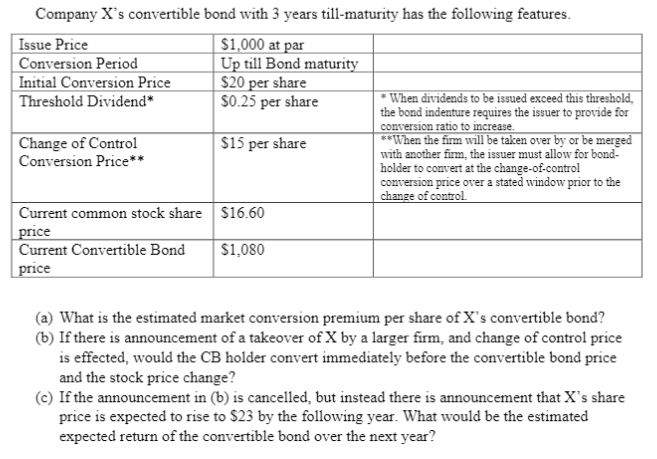

Company X's convertible bond with 3 years till-maturity has the following features. Issue Price $1,000 at par Conversion Period Up till Bond maturity Initial Conversion Price $20 per share Threshold Dividend* $0.25 per share * When dividends to be issued exceed this threshold, the bond indenture requires the issuer to provide for conversion ratio to increase. Change of Control $15 per share **When the firm will be taken over by or be merged Conversion Price** with another firm, the issuer must allow for bond- holder to convert at the change-of-control conversion price over a stated window prior to the change of control. Current common stock share $16.60 price Current Convertible Bond $1,080 price (a) What is the estimated market conversion premium per share of X's convertible bond? (b) If there is announcement of a takeover of X by a larger firm, and change of control price is effected, would the CB holder convert immediately before the convertible bond price and the stock price change? C) If the announcement in (b) is cancelled, but instead there is announcement that X's share price is expected to rise to $23 by the following year. What would be the estimated expected return of the convertible bond over the next year? Company X's convertible bond with 3 years till-maturity has the following features. Issue Price $1,000 at par Conversion Period Up till Bond maturity Initial Conversion Price $20 per share Threshold Dividend* $0.25 per share * When dividends to be issued exceed this threshold, the bond indenture requires the issuer to provide for conversion ratio to increase. Change of Control $15 per share **When the firm will be taken over by or be merged Conversion Price** with another firm, the issuer must allow for bond- holder to convert at the change-of-control conversion price over a stated window prior to the change of control. Current common stock share $16.60 price Current Convertible Bond $1,080 price (a) What is the estimated market conversion premium per share of X's convertible bond? (b) If there is announcement of a takeover of X by a larger firm, and change of control price is effected, would the CB holder convert immediately before the convertible bond price and the stock price change? C) If the announcement in (b) is cancelled, but instead there is announcement that X's share price is expected to rise to $23 by the following year. What would be the estimated expected return of the convertible bond over the next year