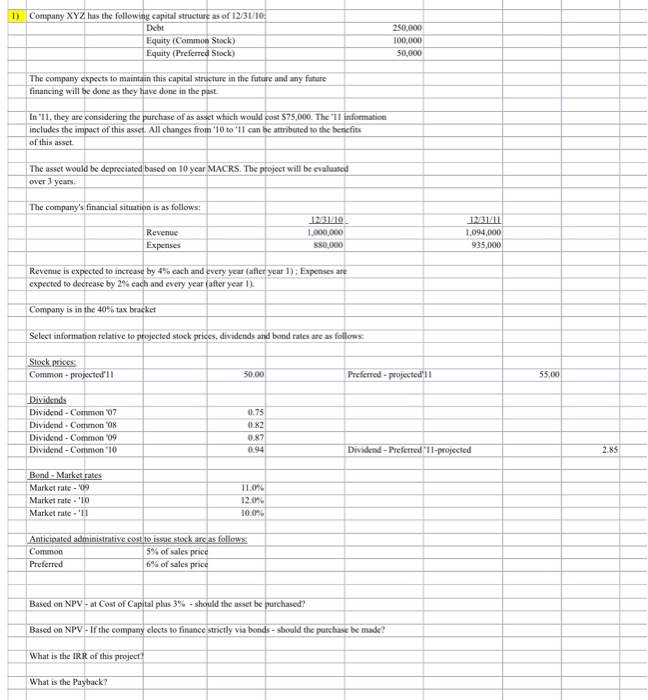

Company XYZ has the following capital structure as of 12/31/10 Debt 250.000 Equity (Commend Stock) 100.000 Equity (Preferred Stock) 50.000 The company experts to maintain this capital structure in the Furies and any fauna financing will be done at they have done in the plot. In '11. they are considering the pure tunic of as asset which would cost S75.000. The '11 information includes the impact all can he attributed to the of this asset. The asset would be depreciated based on 10 year MAI RS I he project will be evaluated over 3 year. Revenue is expected to increase by 4%. Each and every year (after year 1). Expresses are expected to decrease by 2% cad) and ecru year (after year 11 Company h in the 40% tax bracket Select information relative to projected slick prices, dividends and bond rates are as follows Anticipated administrative cost to issue Mock arc as follows Based on NPV - at Cost of Capital plus 3% - should the asset be purchased? Based on SPY - If the company elects to finance strictly bonds - should the purchase be made? What is the IRR of this project'.' What is the Payback? Company XYZ has the following capital structure as of 12/31/10 Debt 250.000 Equity (Commend Stock) 100.000 Equity (Preferred Stock) 50.000 The company experts to maintain this capital structure in the Furies and any fauna financing will be done at they have done in the plot. In '11. they are considering the pure tunic of as asset which would cost S75.000. The '11 information includes the impact all can he attributed to the of this asset. The asset would be depreciated based on 10 year MAI RS I he project will be evaluated over 3 year. Revenue is expected to increase by 4%. Each and every year (after year 1). Expresses are expected to decrease by 2% cad) and ecru year (after year 11 Company h in the 40% tax bracket Select information relative to projected slick prices, dividends and bond rates are as follows Anticipated administrative cost to issue Mock arc as follows Based on NPV - at Cost of Capital plus 3% - should the asset be purchased? Based on SPY - If the company elects to finance strictly bonds - should the purchase be made? What is the IRR of this project'.' What is the Payback