Answered step by step

Verified Expert Solution

Question

1 Approved Answer

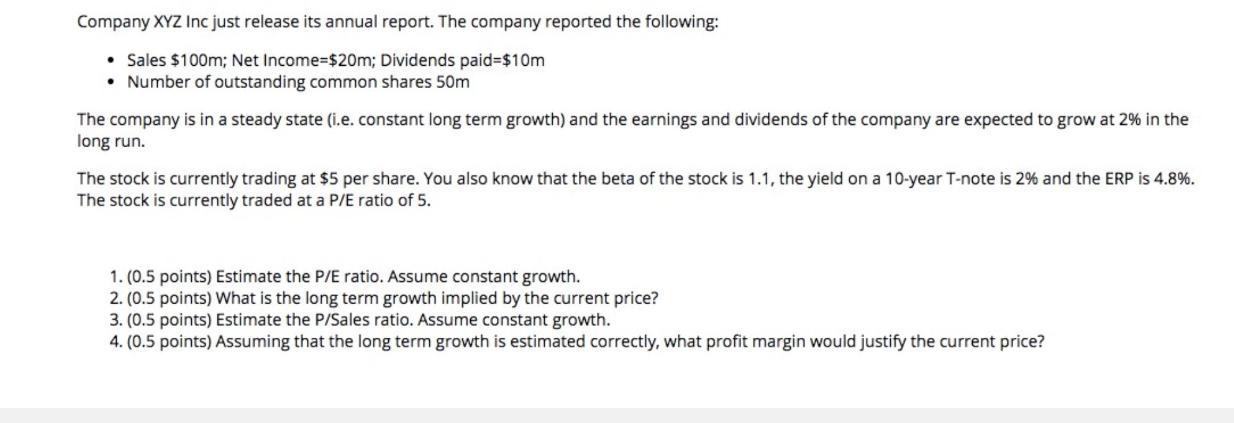

Company XYZ Inc just release its annual report. The company reported the following: Sales $100m; Net Income $20m; Dividends paid=$10m Number of outstanding common

Company XYZ Inc just release its annual report. The company reported the following: Sales $100m; Net Income $20m; Dividends paid=$10m Number of outstanding common shares 50m The company is in a steady state (i.e. constant long term growth) and the earnings and dividends of the company are expected to grow at 2% in the long run. The stock is currently trading at $5 per share. You also know that the beta of the stock is 1.1, the yield on a 10-year T-note is 2% and the ERP is 4.8%. The stock is currently traded at a P/E ratio of 5. 1. (0.5 points) Estimate the P/E ratio. Assume constant growth. 2. (0.5 points) What is the long term growth implied by the current price? 3. (0.5 points) Estimate the P/Sales ratio. Assume constant growth. 4. (0.5 points) Assuming that the long term growth is estimated correctly, what profit margin would justify the current price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer your questions regarding Company XYZ Incs annual report and the valuation metrics well use the given information and assumptions Given Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started