Answered step by step

Verified Expert Solution

Question

1 Approved Answer

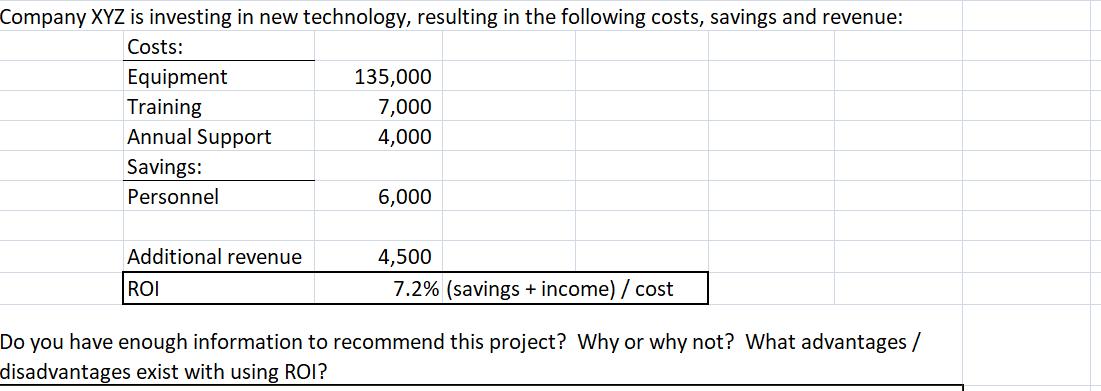

Company XYZ is investing in new technology, resulting in the following costs, savings and revenue: Costs: Equipment Training Annual Support Savings: Personnel Additional revenue

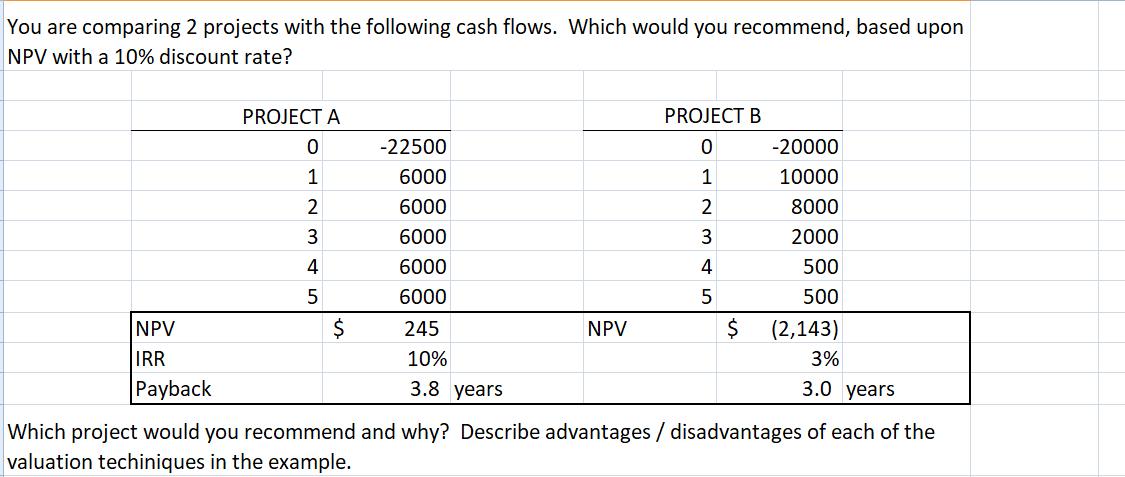

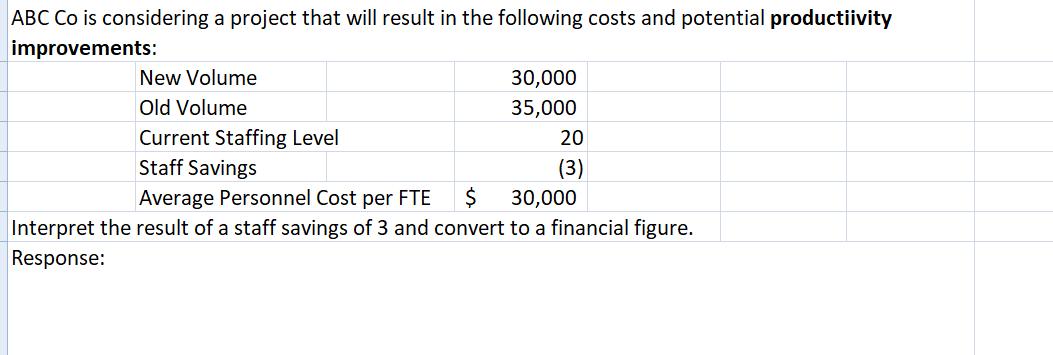

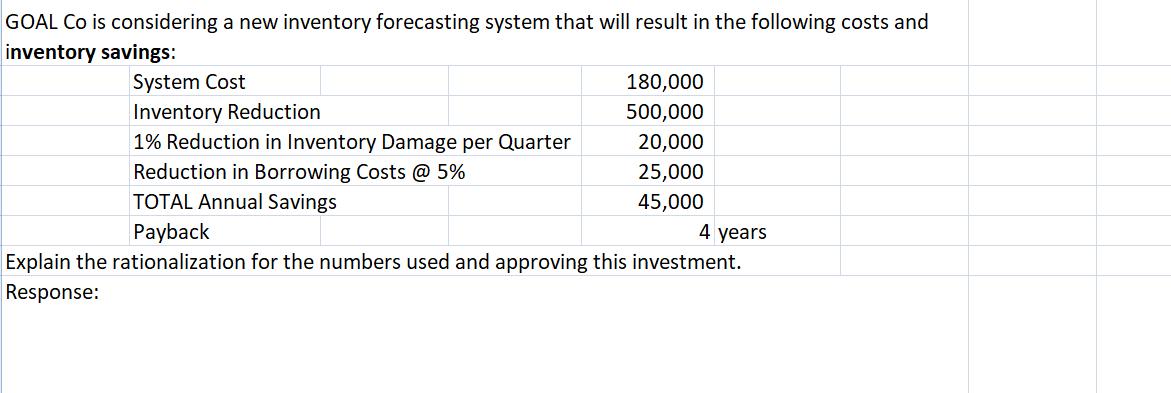

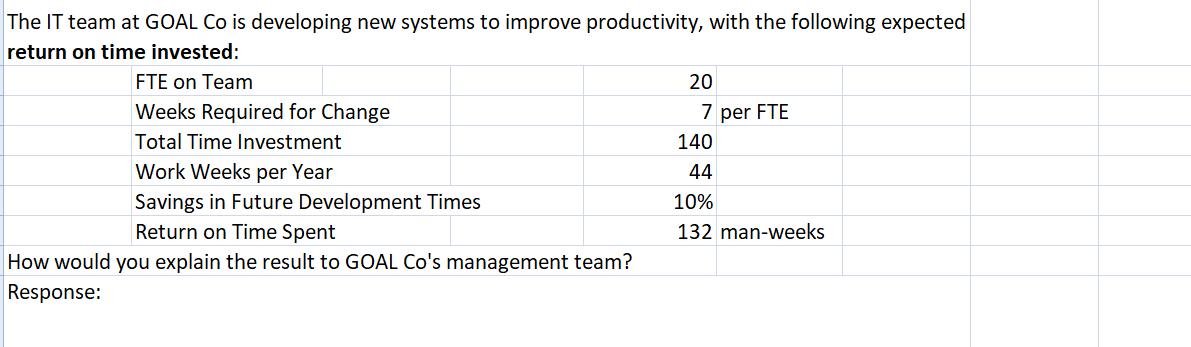

Company XYZ is investing in new technology, resulting in the following costs, savings and revenue: Costs: Equipment Training Annual Support Savings: Personnel Additional revenue ROI 135,000 7,000 4,000 6,000 4,500 7.2% (savings + income) / cost Do you have enough information to recommend this project? Why or why not? What advantages / disadvantages exist with using ROI? You are comparing 2 projects with the following cash flows. Which would you recommend, based upon NPV with a 10% discount rate? NPV IRR Payback PROJECT A 0 1 2 3 4 5 $ -22500 6000 6000 6000 6000 6000 245 10% 3.8 years NPV PROJECT B 0 1 2 3 4 5 $ -20000 10000 8000 2000 500 500 (2,143) 3% years Which project would you recommend and why? Describe advantages / disadvantages of each of the valuation techiniques in the example. 3.0 ABC Co is considering a project that will result in the following costs and potential productiivity improvements: New Volume Old Volume Current Staffing Level Staff Savings 30,000 35,000 20 (3) Average Personnel Cost per FTE $ 30,000 Interpret the result of a staff savings of 3 and convert to a financial figure. Response: GOAL Co is considering a new inventory forecasting system that will result in the following costs and inventory savings: 180,000 500,000 20,000 25,000 45,000 4 years Payback Explain the rationalization for the numbers used and approving this investment. Response: System Cost Inventory Reduction 1% Reduction in Inventory Damage per Quarter Reduction in Borrowing Costs @ 5% TOTAL Annual Savings The IT team at GOAL Co is developing new systems to improve productivity, with the following expected return on time invested: FTE on Team Weeks Required for Change Total Time Investment Work Weeks per Year Savings in Future Development Times Return on Time Spent How would you explain the result to GOAL Co's management team? Response: 20 7 per FTE 140 44 10% 132 man-weeks

Step by Step Solution

★★★★★

3.53 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

Do you have enough information to recommend this project Why or why not What advantages disadvantages exist with using ROI No you do not have enough information to recommend this project ROI is a usef...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started