Question

Houston Imaging Center is evaluating the purchase of a refurbished ultrasound machine. The machine requires an initial investment of $21,000 and will generate after-tax

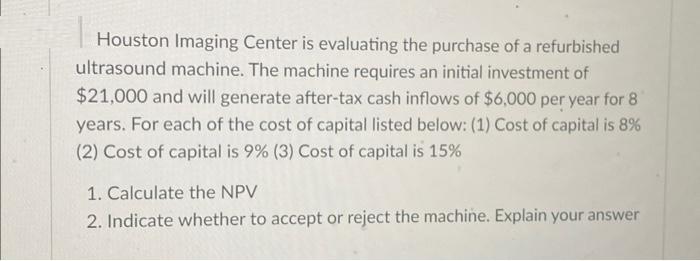

Houston Imaging Center is evaluating the purchase of a refurbished ultrasound machine. The machine requires an initial investment of $21,000 and will generate after-tax cash inflows of $6,000 per year for 8 years. For each of the cost of capital listed below: (1) Cost of capital is 8% (2) Cost of capital is 9% (3) Cost of capital is 15% 1. Calculate the NPV 2. Indicate whether to accept or reject the machine. Explain your answer

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 1 NP V at 8 21 000 6 000 1 08 1 6 000 1 08 2 6 000 1 08 8 19 8 18 59 2 NP V at 9 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of managerial finance

Authors: Lawrence J Gitman, Chad J Zutter

12th edition

9780321524133, 132479540, 321524136, 978-0132479547

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App