Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company XYZ Manufacturer Limited is involved in the production of antiseptic products. Recently Company has started manufacturing of Sanitizers due to overwhelming demand of this

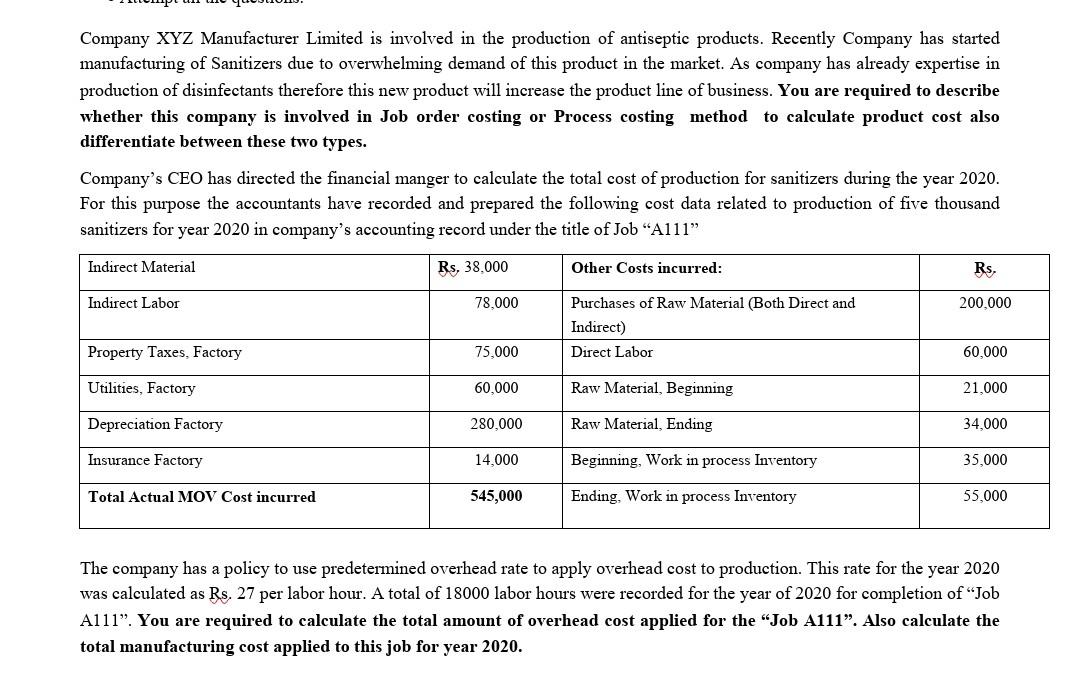

Company XYZ Manufacturer Limited is involved in the production of antiseptic products. Recently Company has started manufacturing of Sanitizers due to overwhelming demand of this product in the market. As company has already expertise in production of disinfectants therefore this new product will increase the product line of business. You are required to describe whether this company is involved in Job order costing or Process costing method to calculate product cost also differentiate between these two types. Company's CEO has directed the financial manger to calculate the total cost of production for sanitizers during the year 2020. For this purpose the accountants have recorded and prepared the following cost data related to production of five thousand sanitizers for year 2020 in company's accounting record under the title of Job "A111" Indirect Material Rs. 38,000 Other Costs incurred: Rs. Indirect Labor 78,000 200,000 Purchases of Raw Material (Both Direct and Indirect) Direct Labor Property Taxes, Factory 75,000 60.000 Utilities, Factory 60,000 Raw Material, Beginning 21,000 Depreciation Factory 280,000 Raw Material, Ending 34,000 Insurance Factory 14.000 Beginning, Work in process Inventory 35,000 Total Actual MOV Cost incurred 545,000 Ending, Work in process Inventory 55,000 The company has a policy to use predetermined overhead rate to apply overhead cost to production. This rate for the year 2020 was calculated as Rs. 27 per labor hour. A total of 18000 labor hours were recorded for the year of 2020 for completion of Job A111". You are required to calculate the total amount of overhead cost applied for the "Job A111". Also calculate the total manufacturing cost applied to this job for year 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started