Question

Company Zee started producing digital clocks recently, which required an investment of $1,600,000 in assets. The following data provides the costs of producing and selling

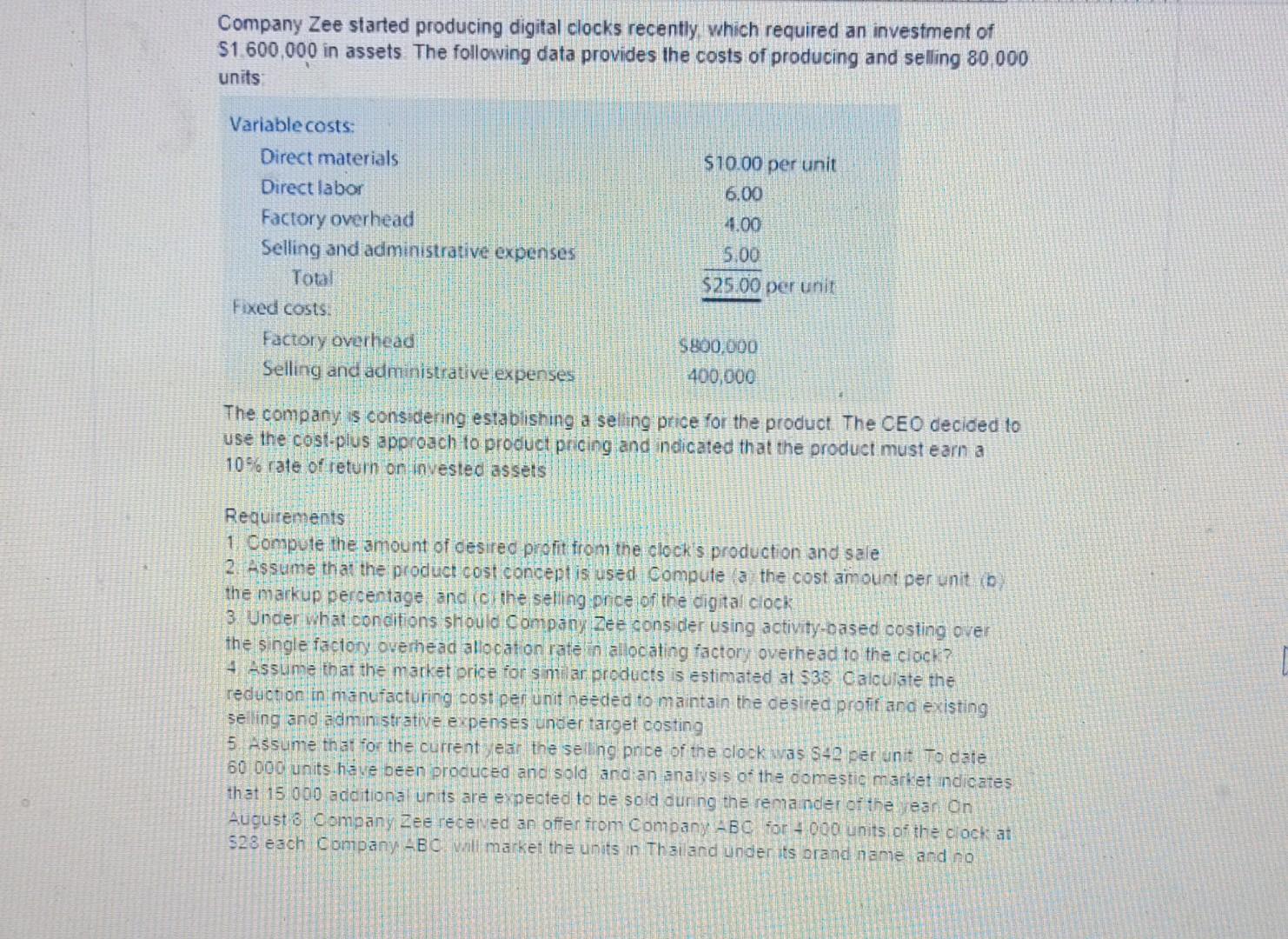

Company Zee started producing digital clocks recently, which required an investment of $1,600,000 in assets. The following data provides the costs of producing and selling 80,000 units: Variable costs: Direct materials Direct labor Factory overhead Selling and administrative expenses Total Fixed costs: Factory overhead Selling and administrative expenses $10.00 per unit 6.00 4.00 5.00 $25.00 per unit $800,000 400,000 The company is considering establishing a selling price for the product. The CEO decided to use the cost-plus approach to product pricing and indicated that the product must earn a 10% rate of return on invested assets Requirements 1. Compute the amount of desired profit from the clock's production and sale 2. Assume that the product cost concept is used. Compute (a) the cost amount per unit. (b) the markup percentage, and (c) the selling price of the digital clock. 3. Under what conditions should Company Zee consider using activity-based costing over the single factory overhead allocation rate in allocating factory overhead to the clock? 4. Assume that the market price for similar products is estimated at $38 Calculate the reduction in manufacturing cost per unit needed to maintain the desired profit and existing selling and administrative expenses under target costing 5. Assume that for the current year, the selling price of the clock was $42 per unit To date, 60 000 units have been produced and sold and an analysis of the domestic market indicates that 15.000 additional units are expected to be sold during the remainder of the year. On August 8 Company Zee received an offer from Company ABC. for 4.000 units of the clock at $28 each. Company ABC will market the units in Thailand under its brand name and no K

Company Zee slarted producing digital clocks recently which required an investment of $1.600,000 in assets. The following data provides the costs of producing and selling 80,000 units: The company is considering establishing a seling price for the product. The CEO decided to use the cost-plus approach to procuct pricing and indicated that the product must earn a 10% rate of return on invested assets Requirements 1. Compule the amount of cesirec profit from the clock's production and sale 2. Assume that the product cost concept is used compute a the cost amount per unit ib the markup percentage and (c) the seling price of the cigital clock 3. Uncer what concifions shoulo Company Zee cons der using activity-oased costing over the single factory overhead allocation rate in alocating factory overhead to the clock? 4 - sssume that the market price for s miar products is estimated at 538 . Calculate the reduction in manufacturing cost per unit needed to maintain the desired proif and existing seling and admin strative expenses under target costing 5. Assume that for the current ear the seiling price of the olock was $42 per unit to date 60.000 units have been procuced ano sold and an analys s of the domestic market ndicates that 15000 additiona units are expeoted to be sold during the remander of the yean On August 8 Company Zee received an offer from Company ABC for 4000 units of the clock: at S28 each Company BC. vill market the units in Thaiand under its brand name and no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started