Question

Company-specific Questions This part of the project requires you to conduct a financial statement analysis of a publicly listed company. You will be assigned one

Company-specific Questions

Company-specific Questions

This part of the project requires you to conduct a financial statement analysis of a publicly listed company. You will be assigned one of the following companies to complete this part (Please refer to the list under Assessments on Blackboard):

- Woolworths (Stock Code: WOW)

An essential element of this project is identifying and obtaining relevant, publicly available information. Therefore, you should ensure that you are able to access sufficient information for the assigned company. I have provided links to the relevant annual reports on Blackboard for your convenience. You are required to answer all the questions in Part B.

C

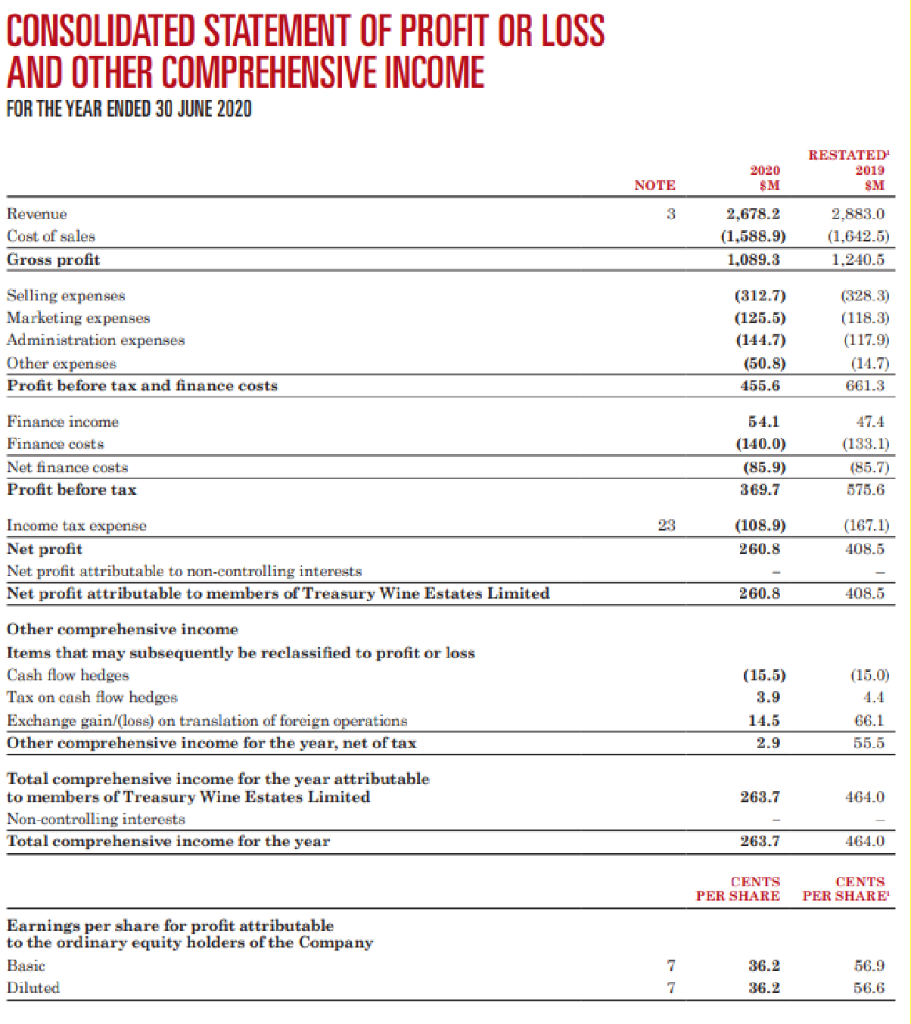

Assume that, as a credit analyst, you are evaluating the company. Use the most appropriate ratios for the most recent year from the annual report and evaluate whether one should provide a loan to this company. [Use at least 4 ratios].

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 RESTATED 2019 SM 2020 SM NOTE Revenue Cost of sales Gross profit 2.678.2 (1,588.9) 1,089.3 2.883.0 (1.642.5) 1.240.5 Selling expenses Marketing expenses Administration expenses Other expenses Profit before tax and finance costs (312.7) (125.5) (144.7) (50.8) 455.6 (328-3) (118.3) (117.9) (14.7) 661.3 Finance income Finance costs Net finance costs Profit before tax 54.1 (140.0) (85.9) 369.7 47.4 (133.1) (85.7) 575.6 (108.9) 260.8 (167.1) 408.6 260.8 408.5 Income tax expense Net profit Net profit attributable to non-controlling interests Net profit attributable to members of Treasury Wine Estates Limited Other comprehensive income Items that may subsequently be reclassified to profit or loss Cash flow hedges Tax on cash flow hedges Exchange gain/(Loss) on translation of foreign operations Other comprehensive income for the year, net of tax (15.0) (15.5) 3.9 14.5 2.9 66.1 55.5 263.7 464.0 Total comprehensive income for the year attributable to members of Treasury Wine Estates Limited Non-controlling interests Total comprehensive income for the year 263.7 464.0 CENTS PER SHARE CENTS PER SHARE Earnings per share for profit attributable to the ordinary equity holders of the Company Basic Diluted 7 7 36.2 36.2 56.9 56.6 CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 RESTATED 2019 SM 2020 SM NOTE Revenue Cost of sales Gross profit 2.678.2 (1,588.9) 1,089.3 2.883.0 (1.642.5) 1.240.5 Selling expenses Marketing expenses Administration expenses Other expenses Profit before tax and finance costs (312.7) (125.5) (144.7) (50.8) 455.6 (328-3) (118.3) (117.9) (14.7) 661.3 Finance income Finance costs Net finance costs Profit before tax 54.1 (140.0) (85.9) 369.7 47.4 (133.1) (85.7) 575.6 (108.9) 260.8 (167.1) 408.6 260.8 408.5 Income tax expense Net profit Net profit attributable to non-controlling interests Net profit attributable to members of Treasury Wine Estates Limited Other comprehensive income Items that may subsequently be reclassified to profit or loss Cash flow hedges Tax on cash flow hedges Exchange gain/(Loss) on translation of foreign operations Other comprehensive income for the year, net of tax (15.0) (15.5) 3.9 14.5 2.9 66.1 55.5 263.7 464.0 Total comprehensive income for the year attributable to members of Treasury Wine Estates Limited Non-controlling interests Total comprehensive income for the year 263.7 464.0 CENTS PER SHARE CENTS PER SHARE Earnings per share for profit attributable to the ordinary equity holders of the Company Basic Diluted 7 7 36.2 36.2 56.9 56.6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started