Question

Comparative Analysis Problem: PepsiCo, Inc. vs. The Coca-Cola Company CT13-2. PepsiCo's financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are

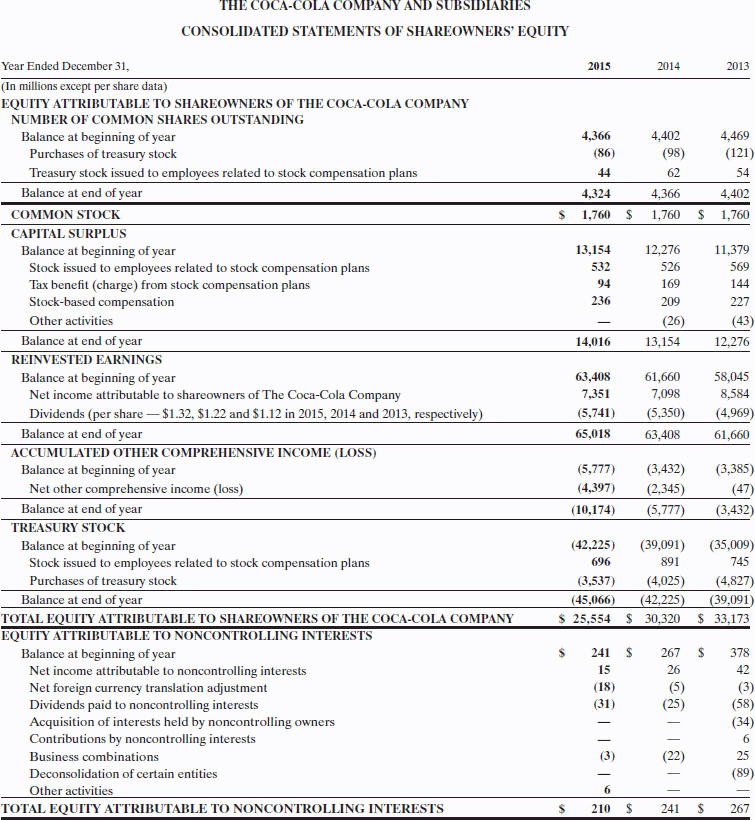

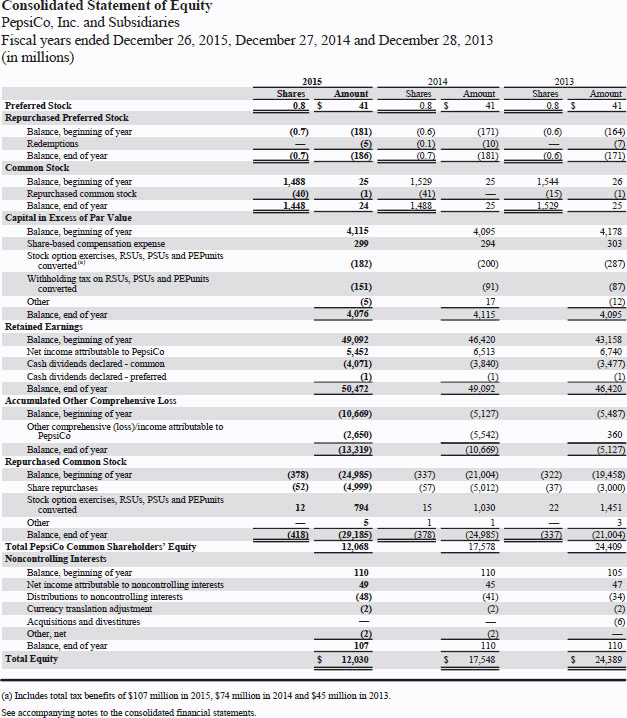

Comparative Analysis Problem: PepsiCo, Inc. vs. The Coca-Cola Company CT13-2. PepsiCo's financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. Instructions for accessing and using the complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements, are also provided in Appendices B and C, respectively. Instructions (a) Based on the information contained in these financial statements, determine each of the following for each company. 1.The percentage increase (decrease) in (i) net sales and (ii) net income from 2010 to 2011. 2.The percentage increase in (i) total assets and (ii) total common stockholders' (shareholders') equity from 2014 to 2015. 3.The basic earnings per share and price-earnings ratio for 2011. (For both PepsiCo and Coca-Cola, use the basic earnings per share.) Coca-Cola's common stock had a market price of $75.05 at the end of fiscal-year 2011, and PepsiCo's common stock had a market price of $66.35. (b) What conclusions concerning the two companies can be drawn from these data?

Comparative Analysis Problem: PepsiCo, Inc. vs. The Coca-Cola Company CT13-2. PepsiCo's financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. Instructions for accessing and using the complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements, are also provided in Appendices B and C, respectively. Instructions (a) Based on the information contained in these financial statements, determine each of the following for each company. 1.The percentage increase (decrease) in (i) net sales and (ii) net income from 2010 to 2011. 2.The percentage increase in (i) total assets and (ii) total common stockholders' (shareholders') equity from 2014 to 2015. 3.The basic earnings per share and price-earnings ratio for 2011. (For both PepsiCo and Coca-Cola, use the basic earnings per share.) Coca-Cola's common stock had a market price of $75.05 at the end of fiscal-year 2011, and PepsiCo's common stock had a market price of $66.35. (b) What conclusions concerning the two companies can be drawn from these data?

Edit: I am assuming the year of 2010 and 2011 is a typo.

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY 2015 Year Ended December 31 (In millions except per share data) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 2014 2013 NUMBER OF COMMON SHARES OUTSTANDING 4,469 (121) 54 4,402 $ 1,760 $ 1,760 $1,760 4,402 (98) Balance at beginning of year Purchases of treasury stock (86) Treasury stock issued to employees related to stock compensation plans Balance at end of year 4,324 4,366 COMMON STOCK CAPITAL SURPLUS Balance at beginning of year 13,1542,276 11,379 569 144 227 532 Stock issued to employees related to stock compensation plans Tax benefit (charge) from stock compensation plans Stock-based compensation Other activities 526 169 209 (26) 236 (43) Balance at end of year 14,016 12,276 REINVESTED EARNINGS 61,660 58,045 8,584 (5,741) 5,350 (4,969) 61,660 63,408 7,351 Balance at beginning of year Net income attributable to shareowners of The Coca-Cola Company 7,098 $1.32, S1.22 and $1.12 in 2015, 2014 and 2013, respectivel Dividends (per share Balance at end of year 65,018 63.408 ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) (5,777 3,432 3,385) (47) (10,174) (5,777) 3,432) Balance at beginning of year (4,397) (2,345) Net other comprehensive income (loss) Balance at end of year TREASURY STOCK Balance at beginning of year (42,225 (39,091) (35,009) 891 Stock issued to employees related to stock compensation plans Purchases of treasury stock (3,537)(4,025) (4,827) Balance at end of vear (45,066 (42,225 39.091 25,554 30,320 33,173 TOTAL EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS Balance at beginning of year $ 241 267 S 378 26 Net income attributable to noncontrolling interests Net foreign currency translation adjustment Dividends paid to noncontrolling interests Acquisition of interests held by noncontrolling owners Contributions by noncontrolling interests Business combinations Deconsolidation of certain entities Other activities 18) (34) 25 TOTAL EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS $ 210 241 267 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY 2015 Year Ended December 31 (In millions except per share data) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 2014 2013 NUMBER OF COMMON SHARES OUTSTANDING 4,469 (121) 54 4,402 $ 1,760 $ 1,760 $1,760 4,402 (98) Balance at beginning of year Purchases of treasury stock (86) Treasury stock issued to employees related to stock compensation plans Balance at end of year 4,324 4,366 COMMON STOCK CAPITAL SURPLUS Balance at beginning of year 13,1542,276 11,379 569 144 227 532 Stock issued to employees related to stock compensation plans Tax benefit (charge) from stock compensation plans Stock-based compensation Other activities 526 169 209 (26) 236 (43) Balance at end of year 14,016 12,276 REINVESTED EARNINGS 61,660 58,045 8,584 (5,741) 5,350 (4,969) 61,660 63,408 7,351 Balance at beginning of year Net income attributable to shareowners of The Coca-Cola Company 7,098 $1.32, S1.22 and $1.12 in 2015, 2014 and 2013, respectivel Dividends (per share Balance at end of year 65,018 63.408 ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) (5,777 3,432 3,385) (47) (10,174) (5,777) 3,432) Balance at beginning of year (4,397) (2,345) Net other comprehensive income (loss) Balance at end of year TREASURY STOCK Balance at beginning of year (42,225 (39,091) (35,009) 891 Stock issued to employees related to stock compensation plans Purchases of treasury stock (3,537)(4,025) (4,827) Balance at end of vear (45,066 (42,225 39.091 25,554 30,320 33,173 TOTAL EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS Balance at beginning of year $ 241 267 S 378 26 Net income attributable to noncontrolling interests Net foreign currency translation adjustment Dividends paid to noncontrolling interests Acquisition of interests held by noncontrolling owners Contributions by noncontrolling interests Business combinations Deconsolidation of certain entities Other activities 18) (34) 25 TOTAL EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS $ 210 241 267Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started