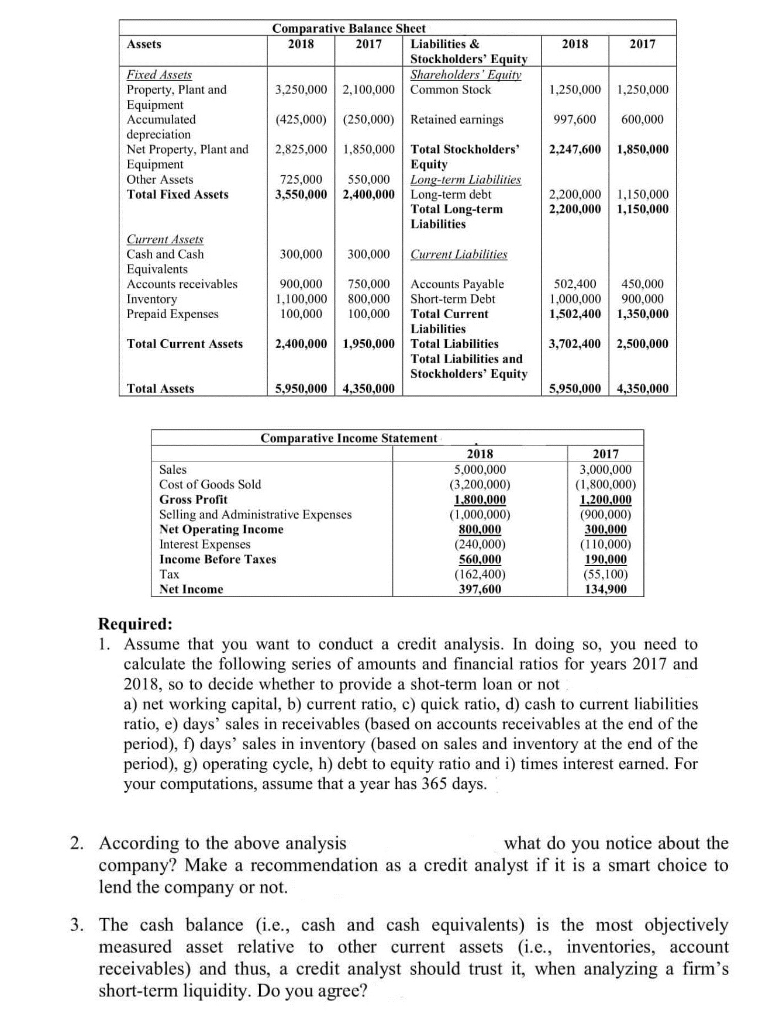

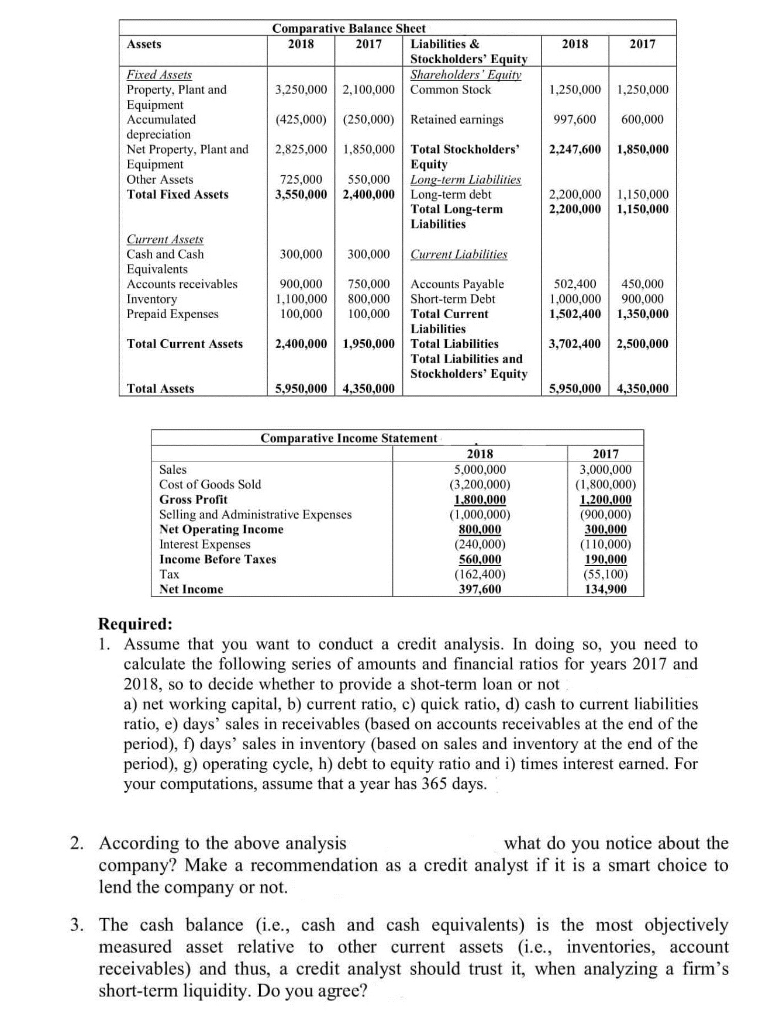

Comparative Balance Shect Assets 2018 2017 Liabilities & 2018 Stock holders' Equit sse Property, Plant and Equipment Accumulated depreciation Net Property, Plant and Equipment Other Assets Total Fixed Assets 3,250,000 2,100,000 Common Stock 1,250,0001,250,000 997,600 600,000 2,247,600,850,000 (425,000) (250,000) Retained earnings 2,825,000 1,850,000 Total Stockholders' Equity 725,000550,000 Long-term Liabilities ,550,000 2,400,000 Long-term debt 2,200,000 150,000 2,200,0001,150,000 Total Long-term Liabilities 300,000 300,000Currn Liabilities Cash and Cash Equivalents Accounts receivables Inventory Prepaid Expenses 900,000750,000 Accounts Payable ,100,000800,000 Short-term Debt 00,000 100,000 Total Current 502,400450,000 1,000,000 900,000 1,502,400 1,350,000 Liabilities Total Current Assets2,400,000 1,950,000 Total Liabilities 3,702,400 2,500,000 Total Liabilities and Stockholders' Equity Total Assets 5,950.000 4,350,000 5.950,000 4,350,000 Comparative Income Statement Sales Cost of Goods Sold Gross Profit Selling and Administrative Expenses Net Operating Income Interest Expenses Income Before Taxes 2018 5,000,000 (3,200,000) 800,000 (1,000,000) 800,000 (240.000) 560,000 (162,400) 397,600 3,000,000 (1,800,000) 200,000 (900,000) 300,000 (110,000) 190,000 (55,100) 134,900 ax Net Income Required: 1. Assume that you want to conduct a credit analysis. In doing so, you need to calculate the following series of amounts and financial ratios for years 2017 and 2018, so to decide whether to provide a shot-term loan or not a) net working capital, b) current ratio, c) quick ratio, d) cash to current liabilities ratio, e) days' sales in receivables (based on accounts receivables at the end of the period), f) days' sales in inventory (based on sales and inventory at the end of the period), g) operating cycle, h) debt to equity ratio and i) times interest earned. For your computations, assume that a year has 365 days 2. According to the above analysis what do you notice about the company? Make a recommendation as a credit analyst if it is a smart choice to lend the company or not. 3. The cash balance (i.e., cash and cash equivalents) is the most objectively measured asset relative to other current assets (i.e., inventories, account receivables) and thus, a credit analyst should trust it, when analyzing a firm's short-term liquidity. Do you agree