Answered step by step

Verified Expert Solution

Question

1 Approved Answer

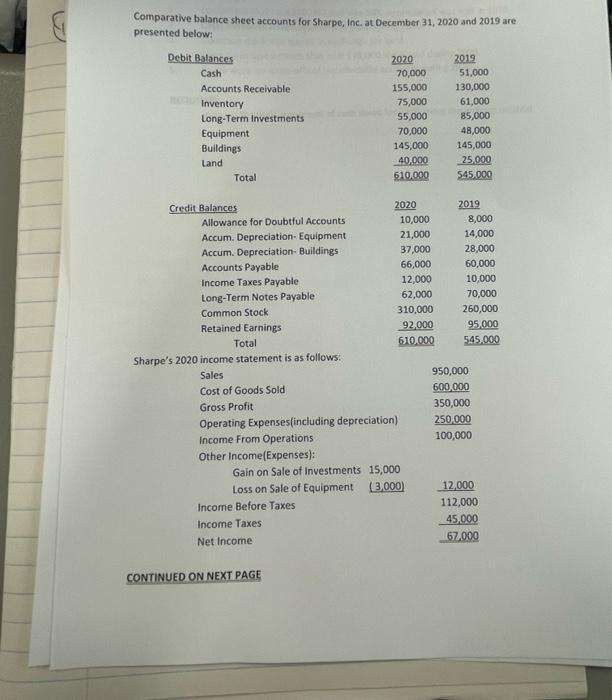

Comparative balance sheet accounts for Sharpe, Inc. at December 31, 2020 and 2019 are presented below: Debit Balances Cash 2020 2019 70,000 51,000 Accounts

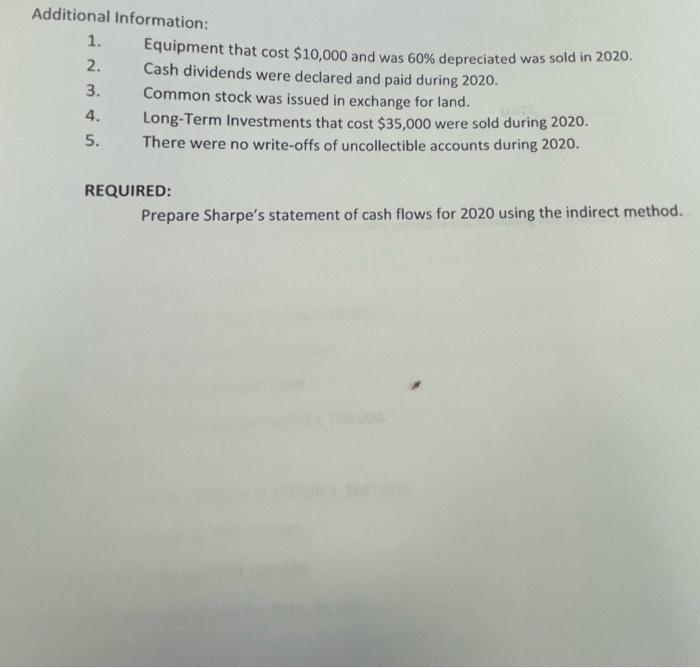

Comparative balance sheet accounts for Sharpe, Inc. at December 31, 2020 and 2019 are presented below: Debit Balances Cash 2020 2019 70,000 51,000 Accounts Receivable 155,000 130,000 Inventory 75,000 61,000 Long-Term Investments 55,000 85,000 Equipment 70,000 48,000 Buildings 145,000 145,000 Land 40,000 25,000 Total $10,000 545,000 Credit Balances 2020 2019 Allowance for Doubtful Accounts 10,000 8,000 Accum. Depreciation Equipment 21,000 14,000 Accum. Depreciation- Buildings 37,000 28,000 Accounts Payable 66,000 60,000 Income Taxes Payable 12,000 10,000 Long-Term Notes Payable: 62,000 70,000 Common Stock 310,000 260,000 Retained Earnings 92,000 95,000 Total 610,000 545,000 Sharpe's 2020 income statement is as follows: Sales 950,000 Cost of Goods Sold 600,000 Gross Profit 350,000 Operating Expenses(including depreciation) 250,000 Income From Operations 100,000 Other Income(Expenses): Gain on Sale of Investments 15,000 Loss on Sale of Equipment (3,000) 12,000 Income Before Taxes 112,000 Income Taxes 45,000 Net Income: CONTINUED ON NEXT PAGE 67,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started