Answered step by step

Verified Expert Solution

Question

1 Approved Answer

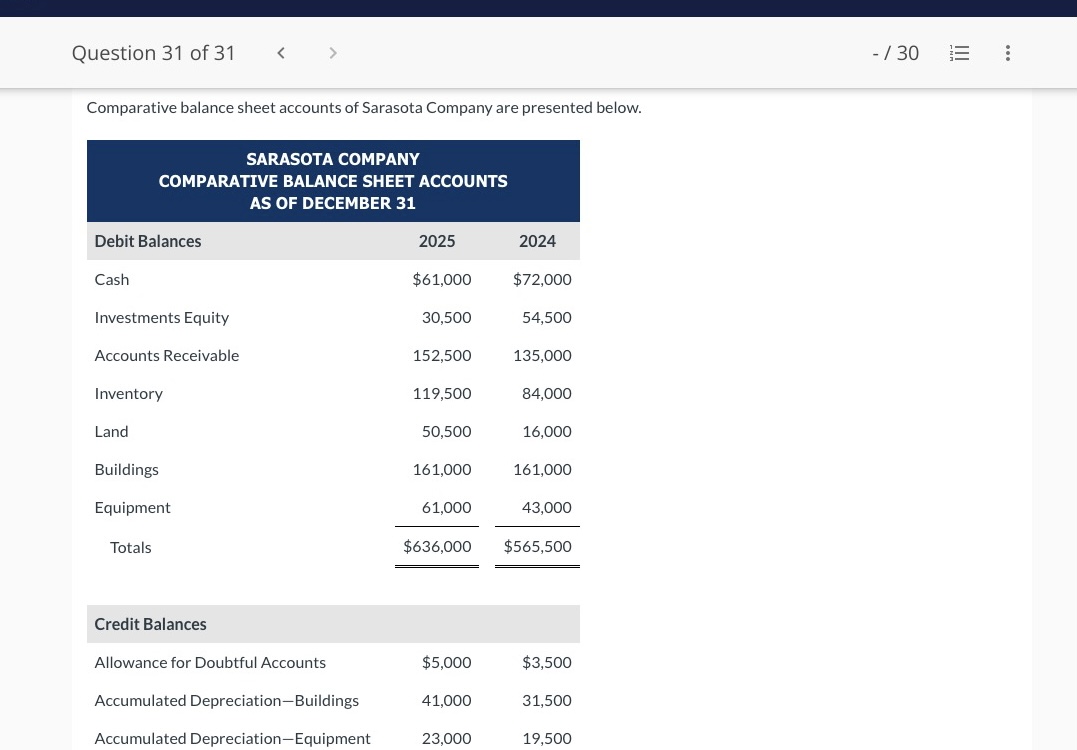

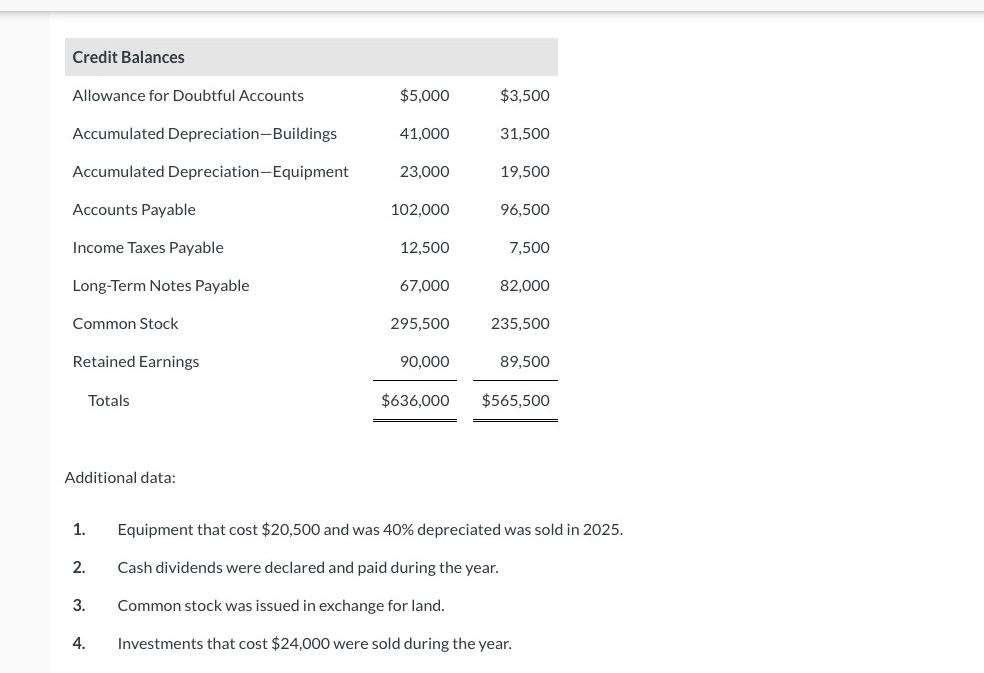

Comparative balance sheet accounts of Sarasota Company are presented below. Additional data: 1. Equipment that cost $20,500 and was 40% depreciated was sold in 2025

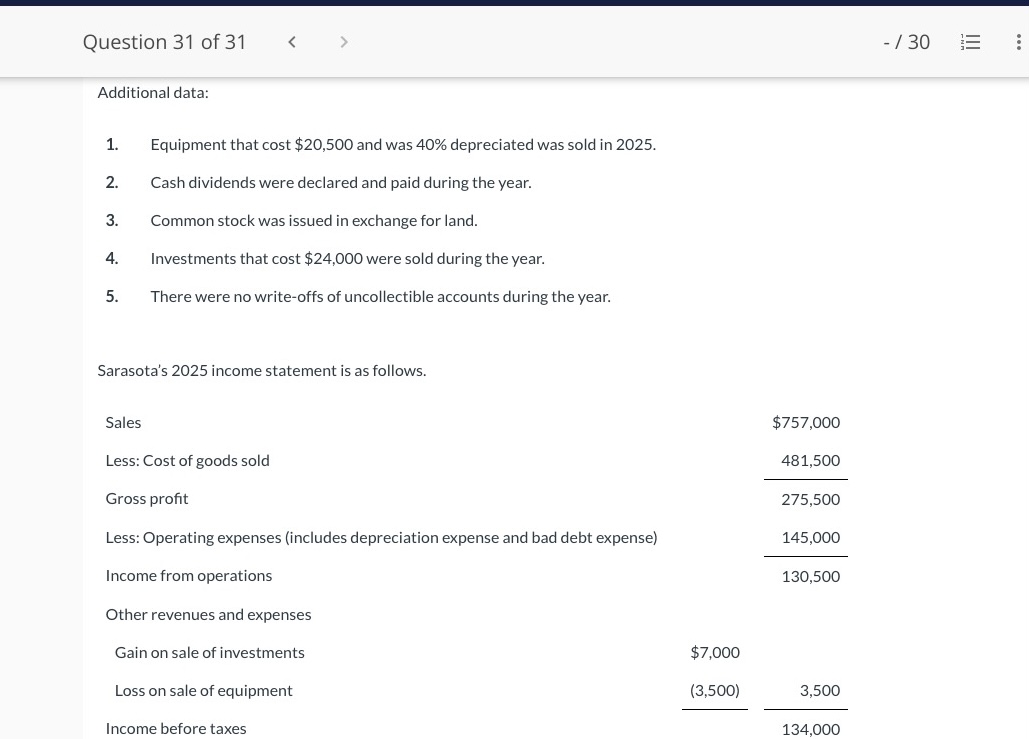

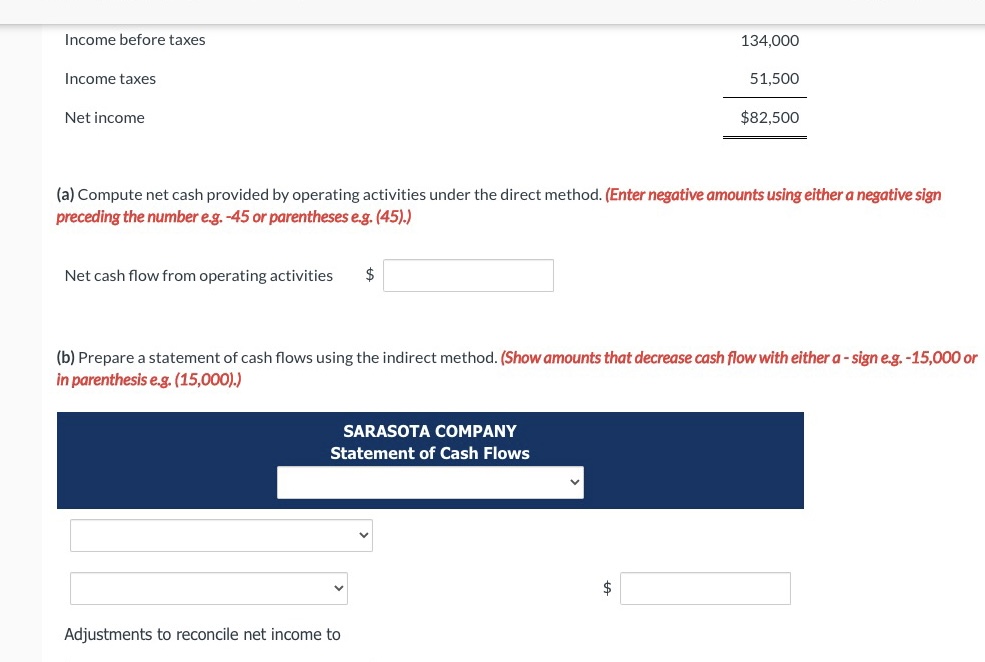

Comparative balance sheet accounts of Sarasota Company are presented below. Additional data: 1. Equipment that cost $20,500 and was 40% depreciated was sold in 2025 . 2. Cash dividends were declared and paid during the year. 3. Common stock was issued in exchange for land. 4. Investments that cost $24,000 were sold during the year. 1. Equipment that cost $20,500 and was 40% depreciated was sold in 2025 . 2. Cash dividends were declared and paid during the year. 3. Common stock was issued in exchange for land. 4. Investments that cost $24,000 were sold during the year. 5. There were no write-offs of uncollectible accounts during the year. (a) Compute net cash provided by operating activities under the direct method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net cash flow from operating activities $ (b) Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. - 15,000 or in parenthesis e.g. (15,000).)

Comparative balance sheet accounts of Sarasota Company are presented below. Additional data: 1. Equipment that cost $20,500 and was 40% depreciated was sold in 2025 . 2. Cash dividends were declared and paid during the year. 3. Common stock was issued in exchange for land. 4. Investments that cost $24,000 were sold during the year. 1. Equipment that cost $20,500 and was 40% depreciated was sold in 2025 . 2. Cash dividends were declared and paid during the year. 3. Common stock was issued in exchange for land. 4. Investments that cost $24,000 were sold during the year. 5. There were no write-offs of uncollectible accounts during the year. (a) Compute net cash provided by operating activities under the direct method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net cash flow from operating activities $ (b) Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. - 15,000 or in parenthesis e.g. (15,000).) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started