Answered step by step

Verified Expert Solution

Question

1 Approved Answer

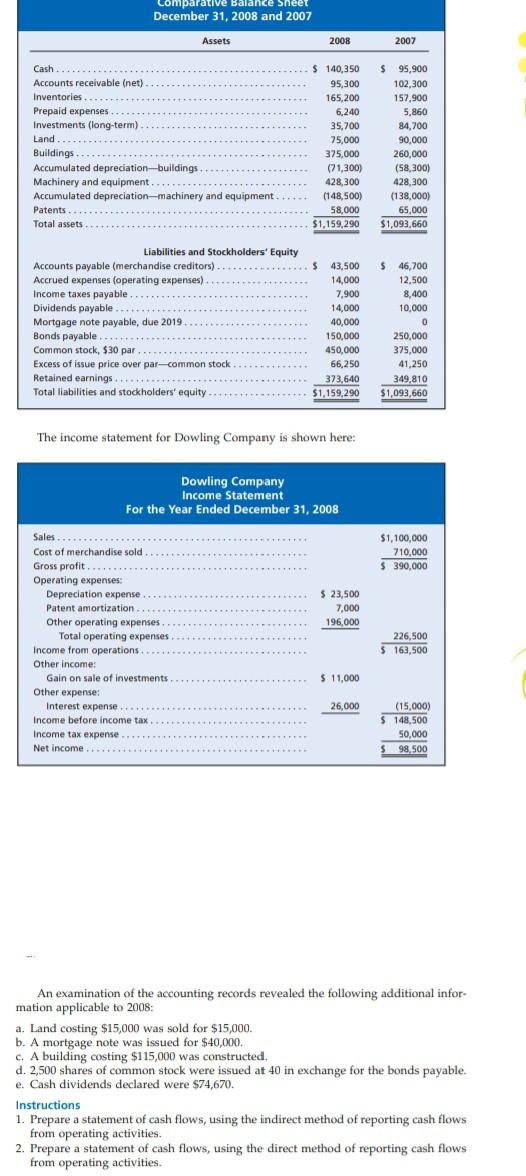

Comparative Balance Sheet December 31, 2008 and 2007 Assets 2008 2007 Cash ............ Accounts receivable (net) Inventories... Prepaid expenses Investments (long-term) Land...... Buildings Accumulated depreciation-buildings

Comparative Balance Sheet December 31, 2008 and 2007 Assets 2008 2007 Cash ............ Accounts receivable (net) Inventories... Prepaid expenses Investments (long-term) Land...... Buildings Accumulated depreciation-buildings Machinery and equipment... Accumulated depreciation-machinery and equipment Patents Total assets $ 140,350 95.300 165,200 6,240 35,700 75,000 375,000 (71,300) 428,300 (148,500) 58,000 $1.159.290 $ 95,900 102,300 157.900 5,860 84,700 90,000 260,000 (58,300) 428,300 (138,000) 65,000 $1,093,660 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Accrued expenses (operating expenses) Income taxes payable...... Dividends payable ...++++++++ Mortgage note payable, due 2019 Bonds payable... Common stock, $30 par Excess of issue price over par-common stock Retained earnings... Total liabilities and stockholders' equity $ 43,500 14,000 7.900 14,000 40,000 150,000 450.000 66,250 373,640 $1,159,290 $ 46,700 12.500 8,400 10,000 0 250,000 375.000 41,250 349,810 $1,093,660 The income statement for Dowling Company is shown here: Dowling Company Income Statement For the Year Ended December 31, 2008 $1,100,000 710,000 $ 390,000 $ 23,500 7.000 196,000 Sales... Cost of merchandise sold Gross profit. Operating expenses: Depreciation expense Patent amortization Other operating expenses Total operating expenses Income from operations Other income: Gain on sale of investments Other expense: Interest expense Income before income tax Income tax expense Net income. 226,500 $ 163,500 $ 11,000 26,000 (15,000) $ 148,500 50,000 $ 98,500 An examination of the accounting records revealed the following additional infor- mation applicable to 2008: a. Land costing $15,000 was sold for $15,000. b. A mortgage note was issued for $40,000 c. A building costing $115,000 was constructed. d. 2,500 shares of common stock were issued at 40 in exchange for the bonds payable. e. Cash dividends declared were $74,670. Instructions 1. Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities. 2. Prepare a statement of cash flows, using the direct method of reporting cash flows from operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started