Answered step by step

Verified Expert Solution

Question

1 Approved Answer

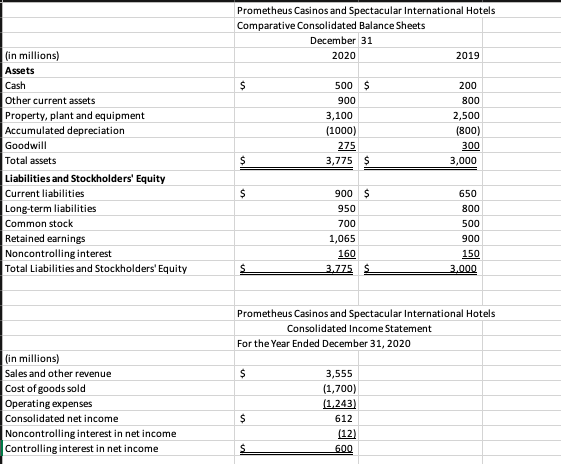

Comparative balance sheets and the income statement for Prometheus Casinos and Spectacular Internationals Hotels are shown Additional information (in millions): 1. Operating expenses include the

Comparative balance sheets and the income statement for Prometheus Casinos and Spectacular Internationals Hotels are shown

Additional information (in millions):

1. Operating expenses include the following items:

- Consolidated depreciation expense, $250

- Goodwill impairment loss, $25

- Loss on cash sale of property, plant, and equipment, $10

2. During the year, plant assets of $675 were acquired for cash.

3. Dividends of $435 were paid to Prometheus Casinos shareholders.

Required:

Prepare in good form, the consolidated statement of cash flows for the year ended December 31, 2020. Use the indirect method.

Prometheus Casinos and Spectacular International Hotels Comparative Consolidated Balance Sheets December 31 2020 2019 $ (in millions) Assets Cash Other current assets Property, plant and equipment Accumulated depreciation Goodwill Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Noncontrolling interest Total Liabilities and Stockholders' Equity 500 $ 900 3,100 (1000) 275 3,775 $ 200 800 2,500 (800) 300 3,000 $ 900 $ 950 700 1,065 160 3.775 S 650 800 500 900 150 3.000 S Prometheus Casinos and Spectacular International Hotels Consolidated Income Statement For the Year Ended December 31, 2020 $ (in millions) Sales and other revenue Cost of goods sold Operating expenses Consolidated net income Noncontrolling interest in net income Controlling interest in net income $ 3,555 (1,700) (1,243) 612 (12) 600 s

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started