Answered step by step

Verified Expert Solution

Question

1 Approved Answer

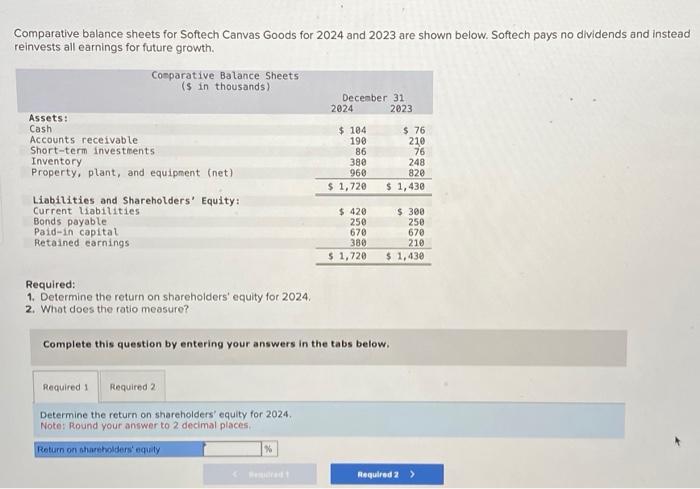

Comparative balance sheets for Softech Canvas Goods for 2024 and 2023 are shown below. Softech pays no dividends and instead reinvests all earnings for

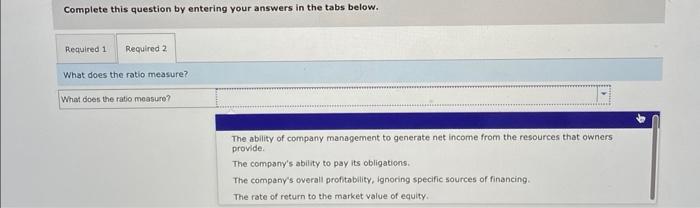

Comparative balance sheets for Softech Canvas Goods for 2024 and 2023 are shown below. Softech pays no dividends and instead reinvests all earnings for future growth. Assets: Cash Comparative Balance Sheets ($ in thousands) December 31 2024 2023 $ 104 190 $ 76 210 86 76 380 248 960 820 $ 1,430 $ 420 $ 300 250 250 670 670 380 $1,720 210 $ 1,430 Accounts receivable Short-term investments Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity: Current liabilities Bonds payable $ 1,720 Paid-in capital Retained earnings Required: 1. Determine the return on shareholders' equity for 2024. 2. What does the ratio measure? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the return on shareholders' equity for 2024. Note: Round your answer to 2 decimal places, Return on shareholders' equity % Perad Required 2 > Complete this question by entering your answers in the tabs below. Required 11 Required 2 What does the ratio measure? What does the ratio measure? The ability of company management to generate net income from the resources that owners. provide. The company's ability to pay its obligations. The company's overall profitability, ignoring specific sources of financing. The rate of return to the market value of equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started