Answered step by step

Verified Expert Solution

Question

1 Approved Answer

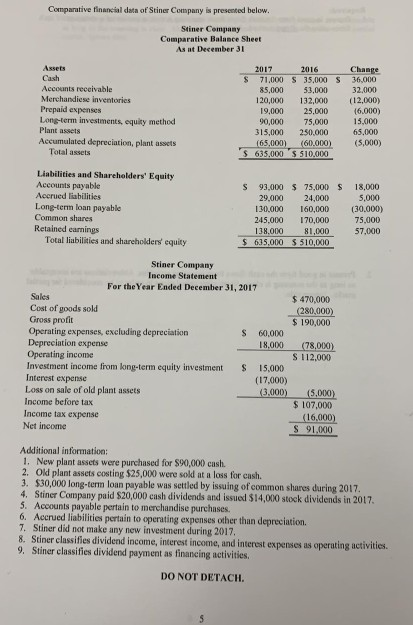

Comparative financial data of Stiner Company is presented below. Stiner Company Comparative Balance Sheet As at December 31 Assets 2017 2016 Change 36,000 Cash 71,000

Comparative financial data of Stiner Company is presented below. Stiner Company Comparative Balance Sheet As at December 31 Assets 2017 2016 Change 36,000 Cash 71,000 S 35,000 S Accounts receivable 85,000 53.000 32.000 Merchandiese inventories Prepaid expenses Long-term investments, equity method Plant assets 120,000 132,000 (12,000) 19,000 90,000 25.000 (6,000) 15.000 75,000 250.000 (60,000) 315,000 65,000 Accumulated depreciation, plant assets Total assets (5,000) (65,000) S 635,000 $ 510,000 Liabilities and Shareholders' Equity Accounts payable S 93,000 75,000 S 18,000 Accrued liabilities Long-term loan payable Common shares 5,000 (30,000) 29,000 24,000 130,000 160,000 245,000 170,000 75,000 Retained earnings Total liabilities and shareholders equity 138.000 57,000 S 635,000 $ 510,000 Stiner Company Income Statement For the Year Ended December 31, 2017 Sales $ 470,000 Cost of goods sold Gross profit Operating expenses, excluding depreciation Depreciation expense Operating income Investment income from kong-term equity investment Interest expense Loss on sale of old plant assets Income before tax (280,000) $190,000 60,000 18,000 (78,000) S 112,000 S 15,000 (17,000) (3,000) (5,000) $ 107,000 (16,000) S 91.000 Income tax expense Net income Additional information: 1. New plant assets were purchased for $90,000 cash 2. Old plant assets costing $25,000 were sold at a loss for cash. 3. $30,000 long-term loan payable was settled by issuing of common shares during 2017. 4. Stiner Company paid $20,000 cash dividends and issued $14,000 stock dividends in 2017. 5. Accounts payable pertain to merchandise purchases. 6. Accrued liabilities pertain to operating expenses other than depreciation. 7. Stiner did not make any new investment during 2017. 8. Stiner classifies dividend income, interest inccome, and interest expenses as operating activities. 9. Stiner classifies dividend payment as financing activities. DO NOT DETACH. Required: 1. Present in good form the cash flows from operating activities section of a statement of cash flows using the direct method. Ignore title. Present in good form the cash flows from investing activities. Abbreviations are acceptable as long as the meaning is clear. Show clear calculations in order to be considered for partial marks. Ignore title. 2. 3. Present in good form the cash flows from financing activities. Abbreviations are acceptable as long as the meaning is clear. Show clear calculations in order to be considered for partial marks. Ignore title

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started