Answered step by step

Verified Expert Solution

Question

1 Approved Answer

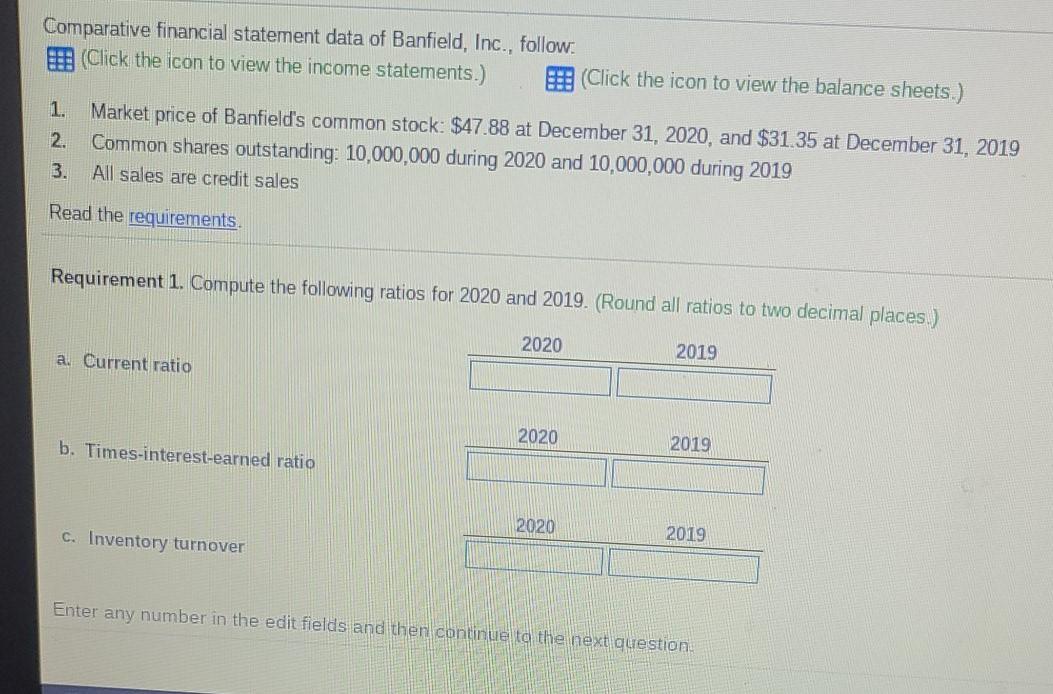

Comparative financial statement data of Banfield, Inc., follow. (Click the icon to view the income statements.) B (Click the icon to view the balance sheets.)

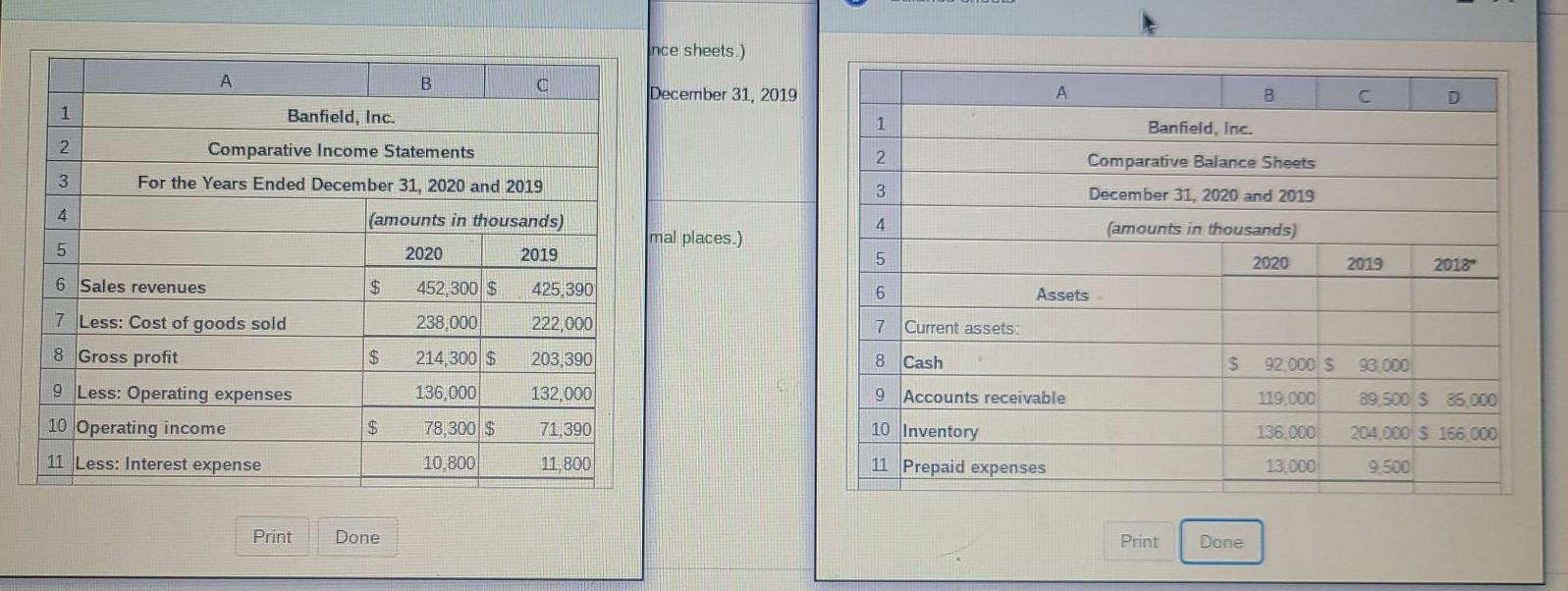

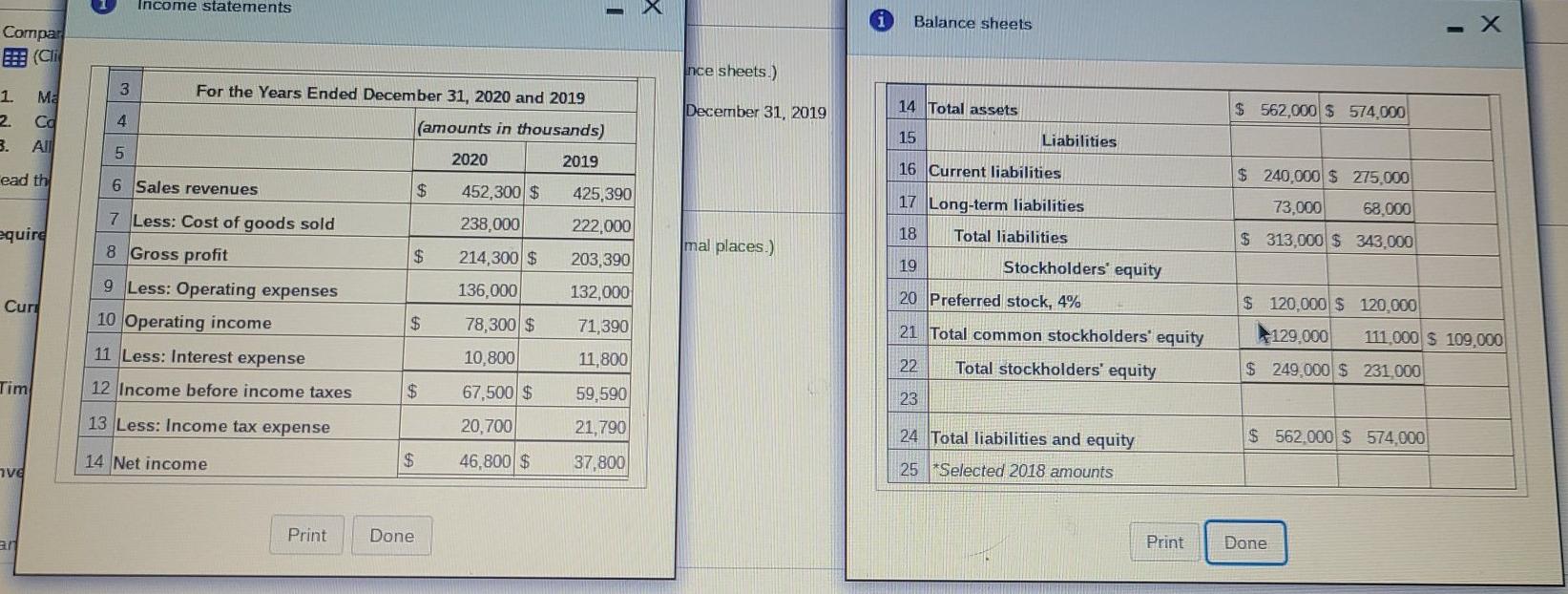

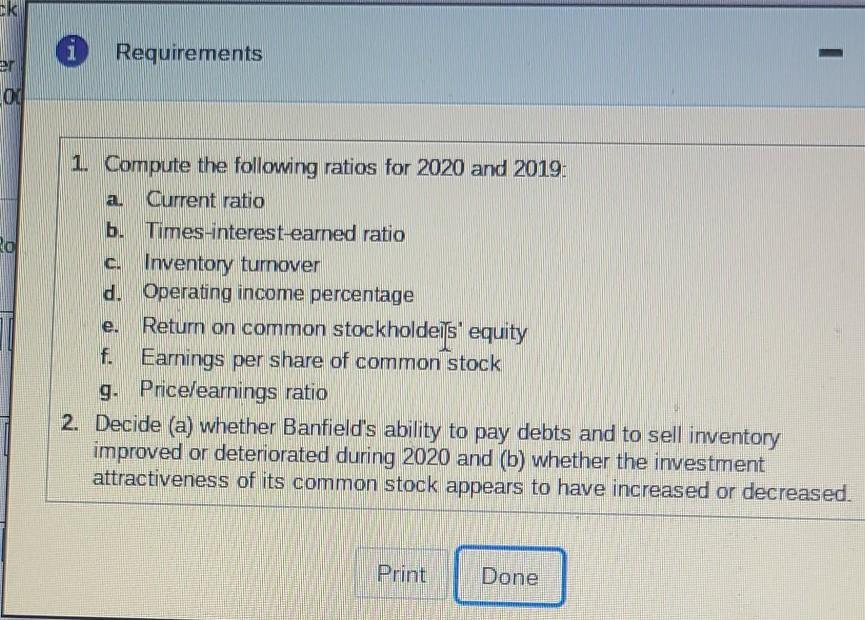

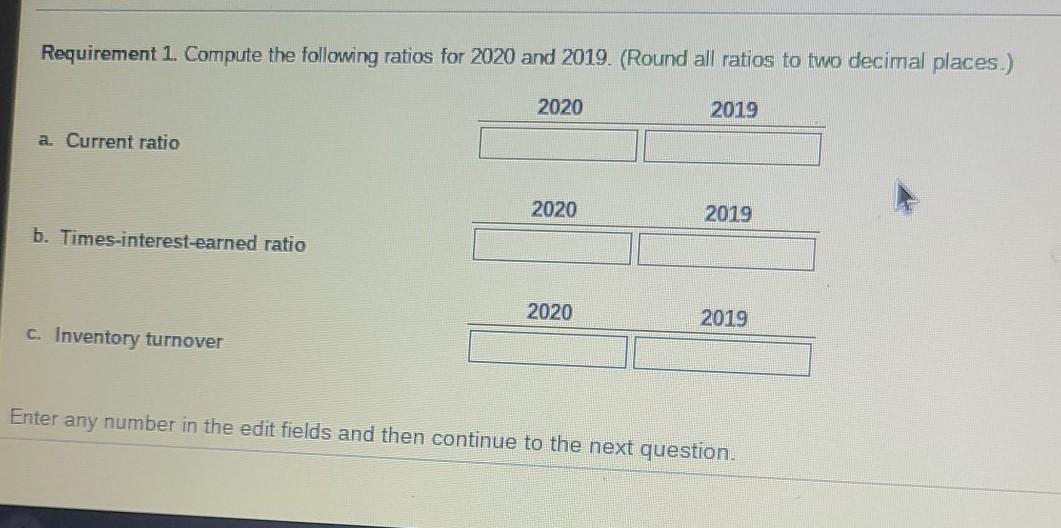

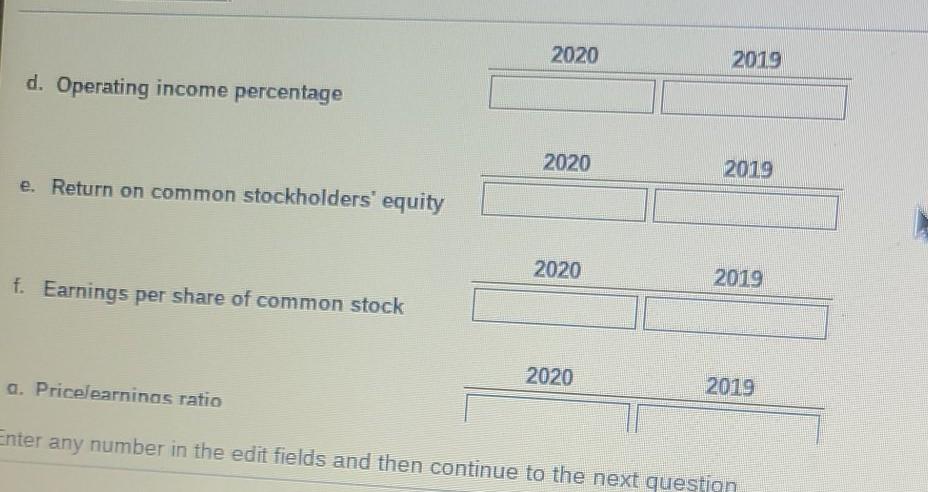

Comparative financial statement data of Banfield, Inc., follow. (Click the icon to view the income statements.) B (Click the icon to view the balance sheets.) 1. 2. Market price of Banfield's common stock: $47.88 at December 31, 2020, and $31.35 at December 31, 2019 Common shares outstanding: 10,000,000 during 2020 and 10,000,000 during 2019 All sales are credit sales 3. Read the requirements. Requirement 1. Compute the following ratios for 2020 and 2019. (Round all ratios to two decimal places.) 2020 a. Current ratio 2019 2020 b. Times-interest-earned ratio 2019 2020 C. Inventory turnover 2019 Enter any number in the edit fields and then continue to the next question, 1 nce sheets.) A B a December 31, 2019 A D 1 1 Banfield, Inc. 2 2. Banfield, Inc. Comparative Income Statements For the Years Ended December 31, 2020 and 2019 (amounts in thousands) Comparative Balance Sheets 3 3 4 December 31, 2020 and 2019 (amounts in thousands) 4 mal places.) 5 2020 2019 5 2020 2019 2018 6 Sales revenues 425,390 6 Assets 452,300 $ 238,000 222,000 7 Current assets: $ 214,300 $ 203.390 8 Cash $ 7 Less: Cost of goods sold 8 Gross profit 9 Less: Operating expenses 10 Operating income 92.000 $ 93.000 136.000 132,000 9 Accounts receivable 119.000 89 500 S 35.000 204.000 $ 166,000 $ 78,300 $ 71,390 136.000 10 Inventory 11 Prepaid expenses 11 Less: Interest expense 10.800 11.800 13.000 9 500 Print Done Print Done Done Income statements Balance sheets Compar Ince sheets.) 3 December 31, 2019 14 Total assets $ 562,000 $ 574.000 1. 2 3. ME Cd 4 For the Years Ended December 31, 2020 and 2019 amounts in thousands) 2020 2019 15 Liabilities 5 16 Current liabilities ead thi 6 Sales revenues $ 452,300 $ 425,390 $ 240,000 $ 275,000 73,000 68,000 238,000 222,000 equire mal places.) $ 313,000 $ 343,000 $ 7 Less: Cost of goods sold 8 Gross profit 9 Less: Operating expenses 10 Operating income 214,300 $ 136,000 203,390 132,000 17 Long-term liabilities 18 Total liabilities 19 Stockholders' equity 20 Preferred stock, 4% Curi $ 78,300 $ 71,390 $ 120.000 $ 120,000 129,000 111,000 $ 109,000 11 Less: Interest expense 10,800 11,800 21 Total common stockholders' equity 22 Total stockholders' equity $ 249,000 $ 231,000 Tim 12 Income before income taxes $ 67,500 $ 59,590 23 13 Less: Income tax expense 20,700 21,790 $ 562.000 $ 574,000 14 Net income $ 46,800 $ 37,800 24 Total liabilities and equity 25 *Selected 2018 amounts ve Print Done ar Print Done IK Requirements er 200 a. 20 1. Compute the following ratios for 2020 and 2019: Current ratio b. Times-interest-earned ratio c. Inventory turnover d. Operating income percentage Return on common stockholdeis' equity f. Earnings per share of common stock g. Pricelearnings ratio 2. Decide (a) whether Banfield's ability to pay debts and to sell inventory improved or deteriorated during 2020 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased. e. Print Done Requirement 1. Compute the following ratios for 2020 and 2019. (Round all ratios to two decimal places.) 2020 2019 a. Current ratio 2020 2019 b. Times-interest-earned ratio 2020 2019 C. Inventory turnover Enter any number in the edit fields and then continue to the next question. 2020 2019 d. Operating income percentage 2020 2019 e. Return on common stockholders' equity 2020 2019 f. Earnings per share of common stock 2020 a. Pricelearninas ratio 2019 Enter any number in the edit fields and then continue to the next question f. Earnings per share of common stock 2020 2019 g. Pricelearnings ratio Requirement 2. Decide (a) whether Banfield's ability to pay debts and to sell inventory improved or deteriorated during 2020 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased. a. Banfield's ability to pay its debts and to sell inventory during 2020 b. The investment attractiveness of Banfield's common stock appears to have Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started