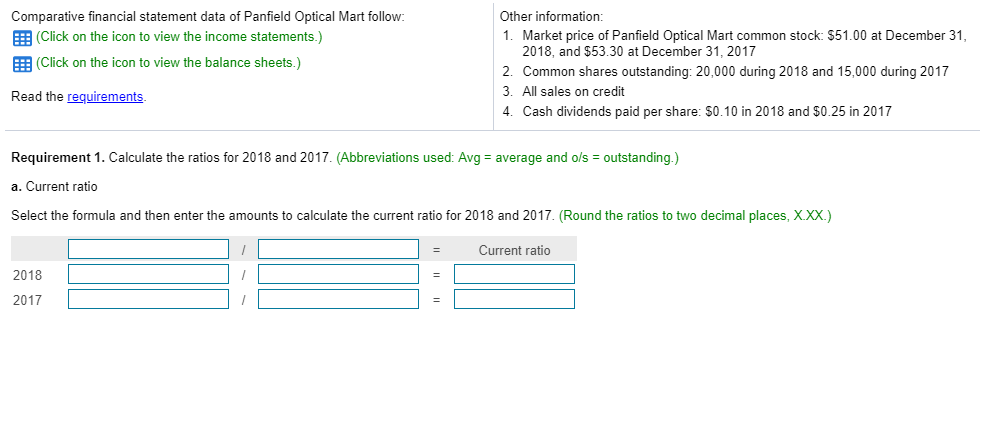

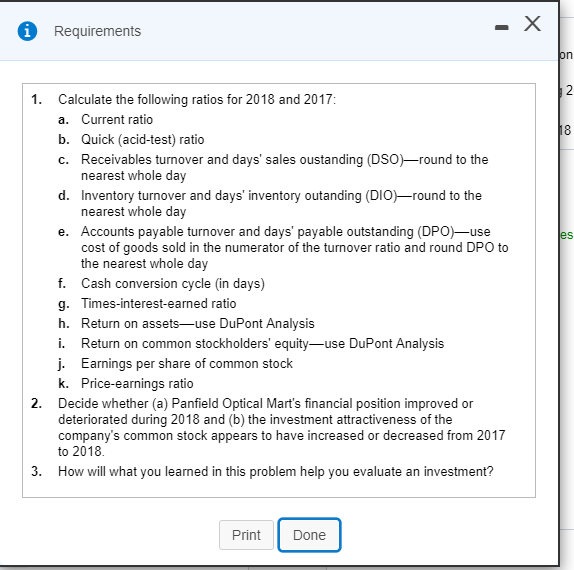

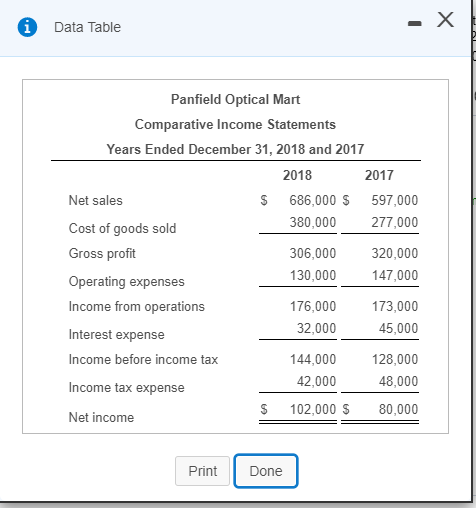

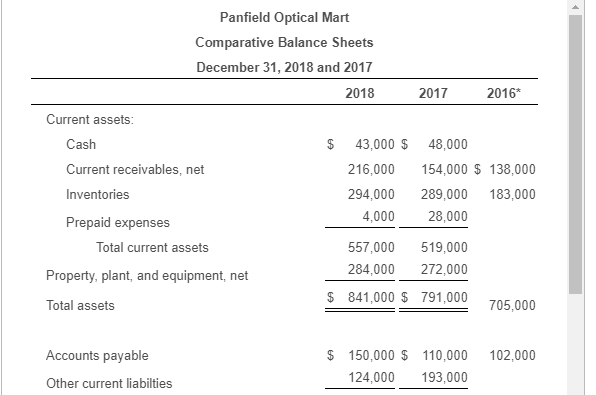

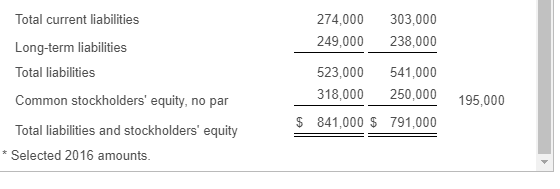

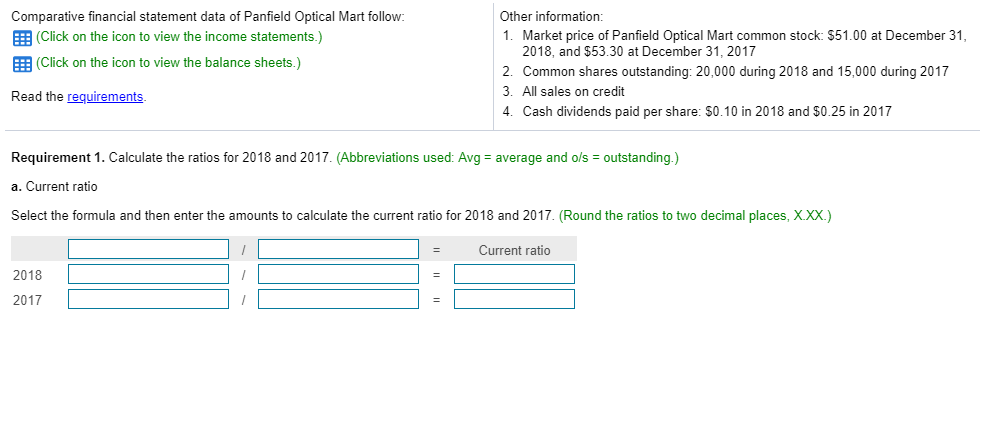

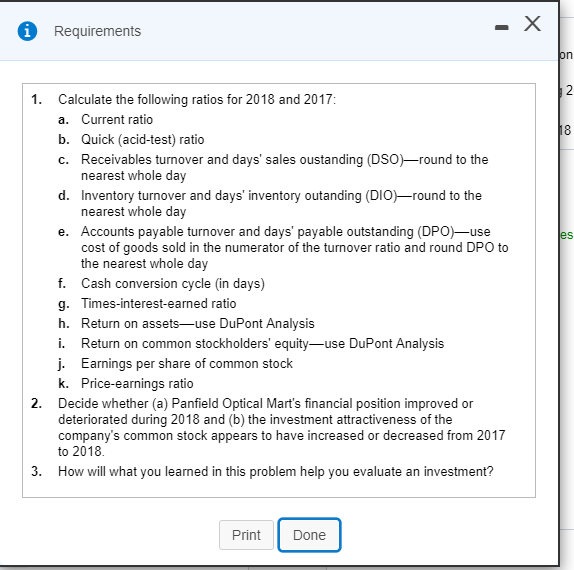

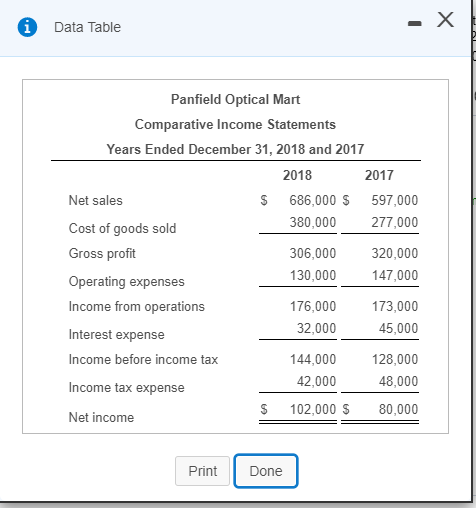

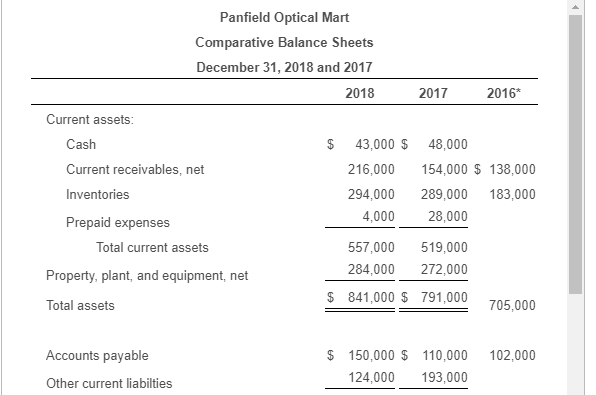

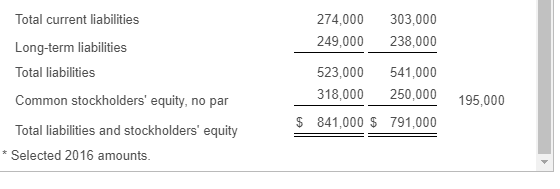

Comparative financial statement data of Panfield Optical Mart follow: EE (Click on the icon to view the income statements.) EEB (Click on the icon to view the balance sheets.) Read the requirements. Other information: 1. Market price of Panfield Optical Mart common stock: $51.00 at December 31, 2018, and $53.30 at December 31, 2017 2. Common shares 3. All sales on credit outstanding 20,000 during 2018 and 15,000 during 2017 4. Cash dividends paid per share: $0.10 in 2018 and $0.25 in 2017 Requirement 1. Calculate the ratios for 2018 and 2017. (Abbreviations used: Avg average and o/s outstanding.) a. Current ratio Select the formula and then enter the amounts to calculate the current ratio for 2018 and 2017. (Round the ratios to two decimal places, X.XX.;) Current ratio 2018 2017 Requirements 1. Calculate the following ratios for 2018 and 2017 a. Current ratio b. Quick (acid-test) ratio c. Receivables turnover and days' sales oustanding (DSO-round to the nearest whole day Inventory turnover and days' inventory outanding (DIO-round to the nearest whole day Accounts payable turnover and days' payable outstanding (DPO-use cost of goods sold in the numerator of the turnover ratio and round DPO to the nearest whole dav d. e. ash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assets-use DuPont Analysis i. Return on common stockholders' equity-use DuPont Analysis j. Earnings per share of common stock k. Price-earnings ratio Decide whether (a) Panfield Optical Mart's financial position improved or deteriorated during 2018 and (b) the investment attractiveness of the company's common stock appears to have increased or decreased from 2017 to 2018 2. 3. How will what you learned in this problem help you evaluate an investment? Print Done Data Table Panfield Optical Mart Comparative Income Statements Years Ended December 31, 2018 and 2017 2018 2017 Net sales Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income tax Income tax expense Net income S 686,000 $ 597,000 277,000 306,000 320,000 147,000 173,000 45,000 128,000 48,000 S 102,000 80,000 380,000 130,000 176,000 32,000 144,000 42,000 Print Done Panfield Optical Mart Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 2016* Current assets: Cash Current receivables, net Inventories Prepaid expenses $ 43,000 $ 48,000 216,000 154,000 $ 138,000 294,000 289,000 183,000 4,000 28,000 557,000 519,000 284,000 272,000 $ 841,000 $ 791,000 Total current assets Property, plant, and equipment, net Total assets 791:000705,000 Accounts payable $ 150,000 $ 110,000 102,000 24,000 193,000 Other current liabilties Total current liabilities Long-term liabilities Total liabilities Common stockholders' equity, no par Total liabilities and stockholders' equity 274,000 303,000 249,000 238,000 523,000 541,000 800 250,000 195,000 $ 841,000 $ 791,000 * Selected 2016 amounts