Question

Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not issue any new common or preferred

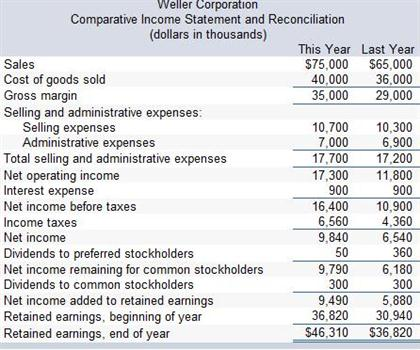

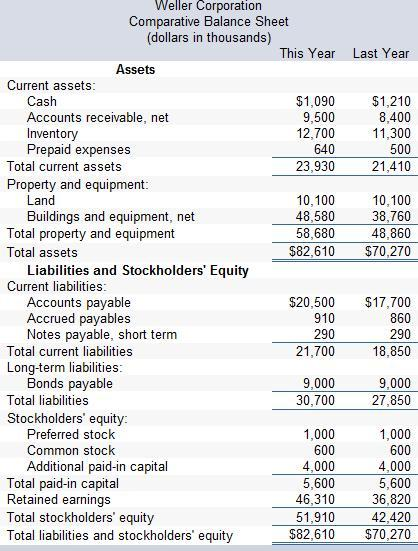

Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not issue any new common or preferred stock during the year. A total of 600,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $.50. The market value of the company's common stock at the end of the year was $25. All of the company's sales are on account. |

I need help finding: a) Earnings per share b) Price-earnings ratio c) Dividend payout ratio d) Dividend yield ratio e) Return on common stockholder's equity f) Book value per share

Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not issue any new common or preferred stock during the year. A total of 600,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $.50. The market value of the company's common stock at the end of the year was $25. All of the company's sales are on account. I need help finding: a) Earnings per share b) Price-earnings ratio c) Dividend payout ratio d) Dividend yield ratio e) Return on common stockholder's equity f) Book value per share Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not issue any new common or preferred stock during the year. A total of 600,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $.50. The market value of the company's common stock at the end of the year was $25. All of the company's sales are on account. I need help finding: a) Earnings per share b) Price-earnings ratio c) Dividend payout ratio d) Dividend yield ratio e) Return on common stockholder's equity f) Book value per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started