Answered step by step

Verified Expert Solution

Question

1 Approved Answer

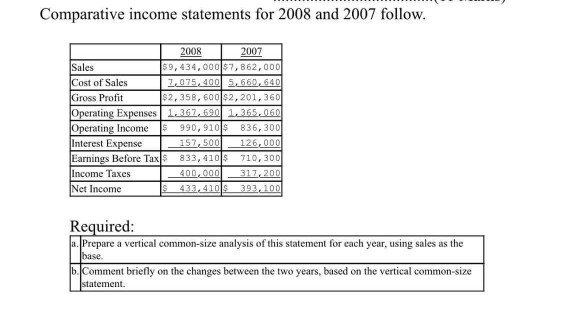

Comparative income statements for 2008 and 2007 follow. 2008 2007 Sales $9, 434,000 $7,862,000 Cost of Sales 7,075,400 5,660,640 Gross Profit $2,358, 600 $2,201, 360

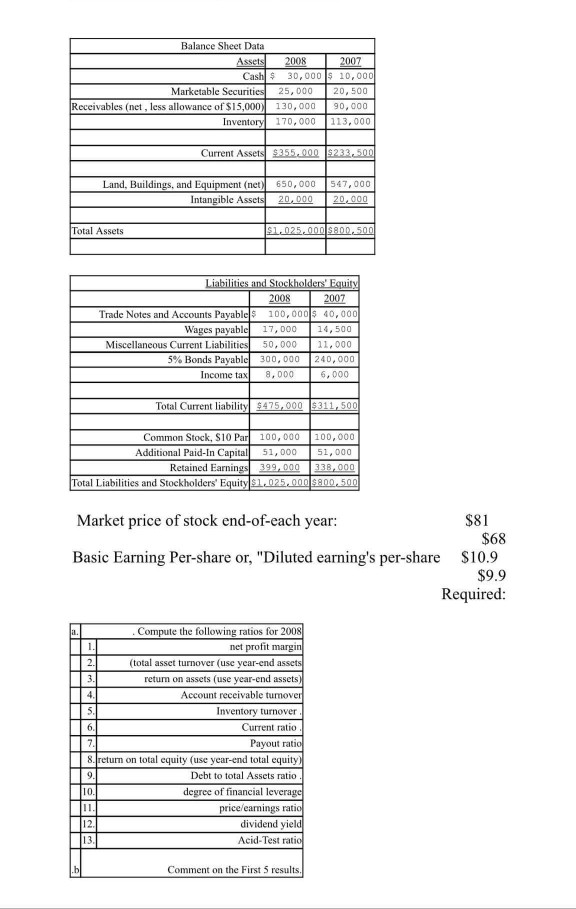

Comparative income statements for 2008 and 2007 follow. 2008 2007 Sales $9, 434,000 $7,862,000 Cost of Sales 7,075,400 5,660,640 Gross Profit $2,358, 600 $2,201, 360 Operating Expenses 1.367, 690 1.365.060 Operating Income $ 990, 910 $ 836,300 Interest Expense 157,500 126,000 Earnings Before Taxs833, 4105 710,300 Income Taxes 400,000 317, 200 Net Income 433,410$ 393, 100 Required: a. Prepare a vertical common-size analysis of this statement for each year, using sales as the base. b. Comment briefly on the changes between the two years, based on the vertical common-size statement. Balance Sheet Data Assets 2008 2007 Cash $ 30,000 $ 10,000 Marketable Securities 25,000 20,500 Receivables (net , less allowance of $15,000) 130,000 90,000 Inventory 170,000 113,000 Current Assets $255.900 $233,500 Land, Buildings, and Equipment (net) Intangible Assets 650,000 20.000 547,000 20,000 Total Assets $1,025,000 SADD.500 Liabilities and Stockholders' Equity 2008 2007 Trade Notes and Accounts Payable$ 100,000 $ 40,000 Wages payable 17,000 14,500 Miscellaneous Current Liabilities 50,000 11,000 5% Bonds Payable 300,000 240,000 Income taxl 8,000 6,000 Total Current liability $475,000 $311,500 Stock, Par 100,000 100,000 Additional Paid-In Capital 51,000 51,000 Retained Earnings 399,000 338,000 Total Liabilities and Stockholders' Equity$1,025,000 $800.500 Market price of stock end-of-each year: $81 $68 Basic Earning Per-share or, "Diluted earning's per-share $10.9 $9.9 Required: 6. ja. Compute the following ratios for 2008 1. net profit margin 2 (total asset turnover (use year-end assets 3. retum on assets (use year-end assets) 4. Account receivable tumover 5. Inventory turnover. Current ratio 7. Payout ratio 8.return on total equity (use year-end total equity) Debt to total Assets ratio 10. degree of financial leverage 11. price/earings ratio 12. dividend yield 13 Acid-Test ratio 9 .b Comment on the First 5 results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started