Answered step by step

Verified Expert Solution

Question

1 Approved Answer

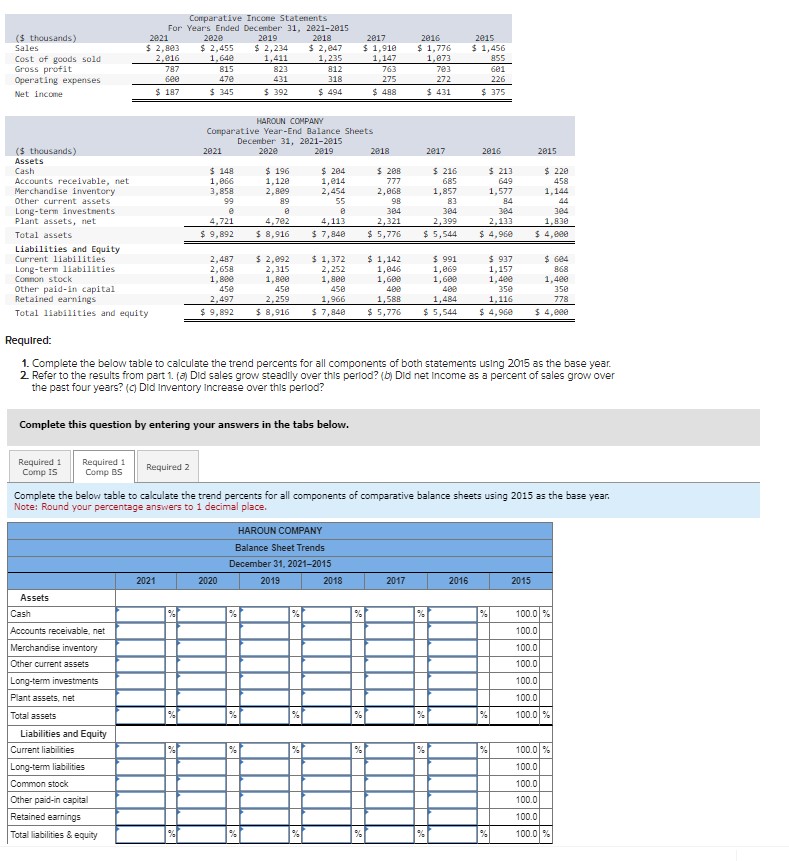

Comparative Income Statements For Years Ended December 31, 2021-2015 ($ thousands) Sales 2021 $ 2,803 2020 $ 2,455 2019 2018 2017 2016 2015 $

Comparative Income Statements For Years Ended December 31, 2021-2015 ($ thousands) Sales 2021 $ 2,803 2020 $ 2,455 2019 2018 2017 2016 2015 $ 2,234 $ 2,047 $ 1,910 $ 1,776 $ 1,456 Cost of goods sold Gross profit 2,016 787 1,640 815 1,411 823 Operating expenses 600 470 431 1,235 812 318 1,147 763 1,073 855 703 601 275 272 226 Net income $ 187 $ 345 $ 392 $ 494 $ 488 $ 431 $ 375 HAROUN COMPANY Comparative Year-End Balance Sheets December 31, 2021-2015 Long-term liabilities. ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock 2021 $ 148 1,066 3,858 4,721 2020 2019 2018 2017 2016 2015 $ 196 $ 204 $ 208 1,120 1,014 777 2,809 2,454 2,068 $ 216 685 1,857 $ 213 649 $ 220 458 1,577 1,144 99 e 89 55 98 83 0 8 304 4,702 4,113 2,321 2,133 $ 9,892 $ 8,916 $ 7,840 2,487 $ 2,092 2,658 2,315 Other paid-in capital Retained earnings 1,800 450 2,497 1,800 450 2,259 $ 1,372 2,252 1,800 450 1,966 $ 5,776 $ 5,544 304 2,399 $ 4,960 44 304 1,830 $ 4,000 84 384 $ 1,142 1,046 $ 991 1,069 $ 937 1,157 $ 604 1,600 400 1,588 1,600 400 1,484 1,400 350 1,116 868 1,400 350 778 Total liabilities and equity $ 9,892 $ 8,916 $ 7,840 $ 5,776 $ 5,544 $ 4,960 $ 4,000 Required: 1. Complete the below table to calculate the trend percents for all components of both statements using 2015 as the base year. 2. Refer to the results from part 1. (a) Did sales grow steadily over this period? (b) Did net income as a percent of sales grow over the past four years? (c) Did Inventory Increase over this period? Complete this question by entering your answers in the tabs below. Required 1 Comp IS Required 1 Comp BS Required 2 Complete the below table to calculate the trend percents for all components of comparative balance sheets using 2015 as the base year. Note: Round your percentage answers to 1 decimal place. 2021 2020 HAROUN COMPANY Balance Sheet Trends December 31, 2021-2015 2019 2018 2017 2016 2015 Assets Cash % Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets % % % 100.0 % 100.0 100.0 100.0 100.0 100.0 % % 100.0 % Liabilities and Equity Current liabilities % % % % 100.0 % Long-term liabilities 100.0 Common stock Other paid-in capital Retained earnings Total liabilities & equity 100.0 100.0 100.0 % 100.0 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started