Answered step by step

Verified Expert Solution

Question

1 Approved Answer

rn Comparative statement of financial position accounts of Traduce Inc., (based on IFRS), follow: December 31 Debit accounts 2018 2017 $ 37,000 67,500 30,000 $

rn

rn

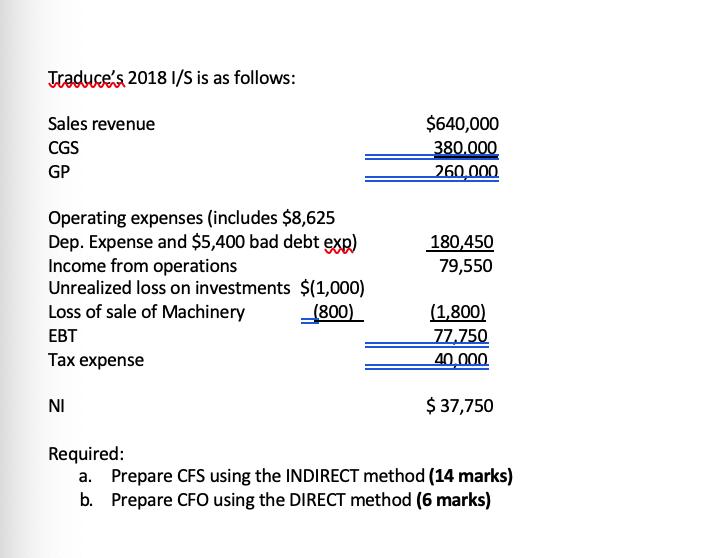

Comparative statement of financial position accounts of Traduce Inc., (based on IFRS), follow: December 31 Debit accounts 2018 2017 $ 37,000 67,500 30,000 $ 33,750 60,000 24,000 Cash AR Inventory Long-term investments Buildings 23,250 67,500 30,000 7,500 $262,750 40,500 56,250 18,750 7,500 $240,750 Machinery Land Credit accounts Allowance for Bad debts (AFBD) Acc. Dep- Buildings c. Dep - Machinery $ 2,250 13,500 5,625 $ 1,500 9,000 2,250 Accrued payables ax/P 30,000 2,375 1,000 24,750 1,125 1,500 Long-term NP (financial) C/S 26,000 150,000 32,000 $262,750 31,000 125,000 44,625 $240,750 RE Additional information%3B Cash dividends were declared and paid during the year. A 20% stock dividend was declared during the year and $25,000 of R/E was capitalized. Investments that cost $20,000 and had a fair value at December 31, 2017, of $24,750 were sold during the year for $23,750. Machinery that cost $3,750 and had $750 of depreciation accumulated was sold for $2,200.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Traduce Inc Statement of Cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started