Answered step by step

Verified Expert Solution

Question

1 Approved Answer

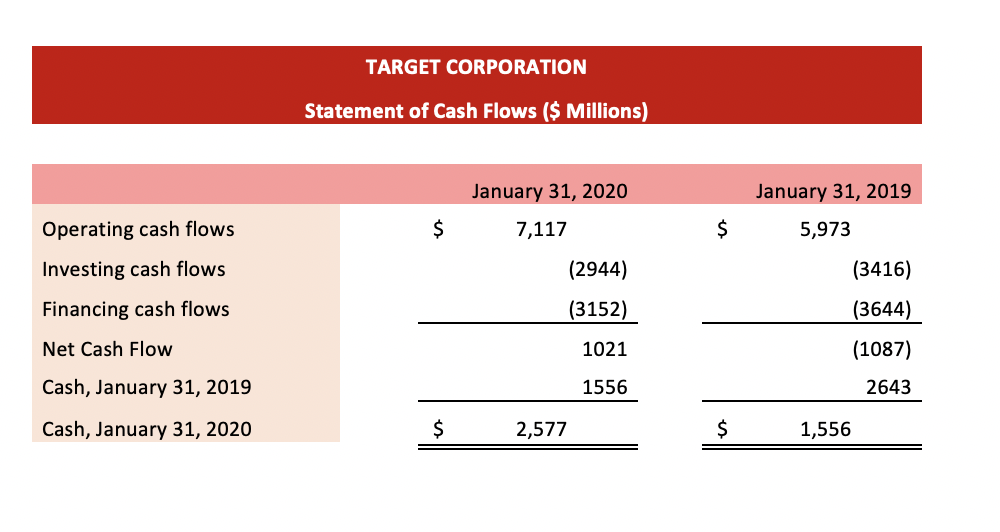

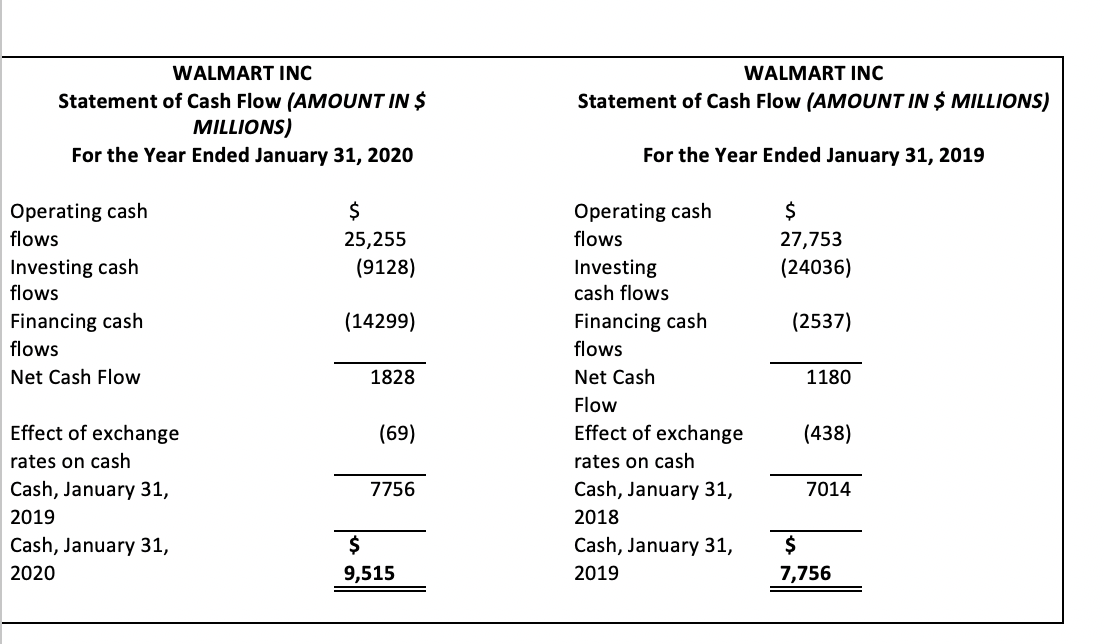

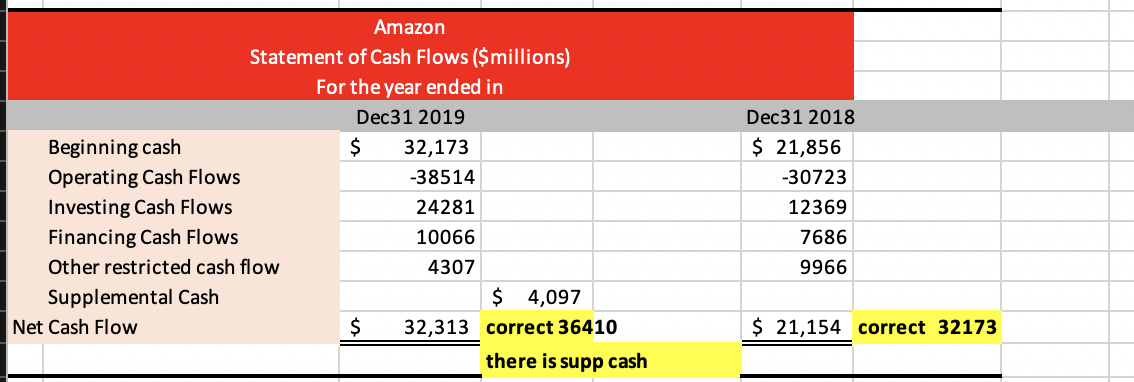

Compare and contrast the statements of cash flows of these three companies.This is an analysis question. Required to analyze the cash flows statements of these

Compare and contrast the statements of cash flows of these three companies.This is an analysis question. Required to analyze the cash flows statements of these companies and explain the similarities and differences in a business perspective. At least a half or full page explanation.

TARGET CORPORATION Statement of Cash Flows ($ Millions) January 31, 2020 January 31, 2019 5,973 Operating cash flows $ 7,117 $ Investing cash flows (2944) (3416) Financing cash flows (3152) (3644) Net Cash Flow 1021 (1087) Cash, January 31, 2019 1556 2643 Cash, January 31, 2020 $ 2,577 $ 1,556 WALMART INC Statement of Cash Flow (AMOUNT IN $ MILLIONS) WALMART INC Statement of Cash Flow (AMOUNT IN $ MILLIONS) For the Year Ended January 31, 2020 For the Year Ended January 31, 2019 $ 25,255 (9128) $ 27,753 (24036) Operating cash flows Investing cash flows Financing cash flows Net Cash Flow (14299) (2537) 1828 1180 Operating cash flows Investing cash flows Financing cash flows Net Cash Flow Effect of exchange rates on cash Cash, January 31, 2018 Cash, January 31, 2019 (69) (438) 7756 7014 Effect of exchange rates on cash Cash, January 31, 2019 Cash, January 31, 2020 $ 9,515 $ 7,756 Amazon Statement of Cash Flows ($millions) For the year ended in Dec31 2019 Beginning cash $ 32,173 Operating Cash Flows -38514 Investing Cash Flows 24281 Financing Cash Flows 10066 Other restricted cash flow 4307 Supplemental Cash $ 4,097 Net Cash Flow $ 32,313 correct 36410 there is supp cash Dec31 2018 $ 21,856 -30723 12369 7686 9966 $ 21,154 correct 32173Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started