Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compare Telus's cash flow statement with Shaw's cash flow statement. Choose several items from their cash flow statements and analyze them. For example, choose some

Compare Telus's cash flow statement with Shaw's cash flow statement. Choose several items from their cash flow statements and analyze them. For example, choose some items from their cash flow from operating activities, choose several items from their cash flow from investing activities to analyze, and choose several items from their cash flow from their financing activites to analyze.

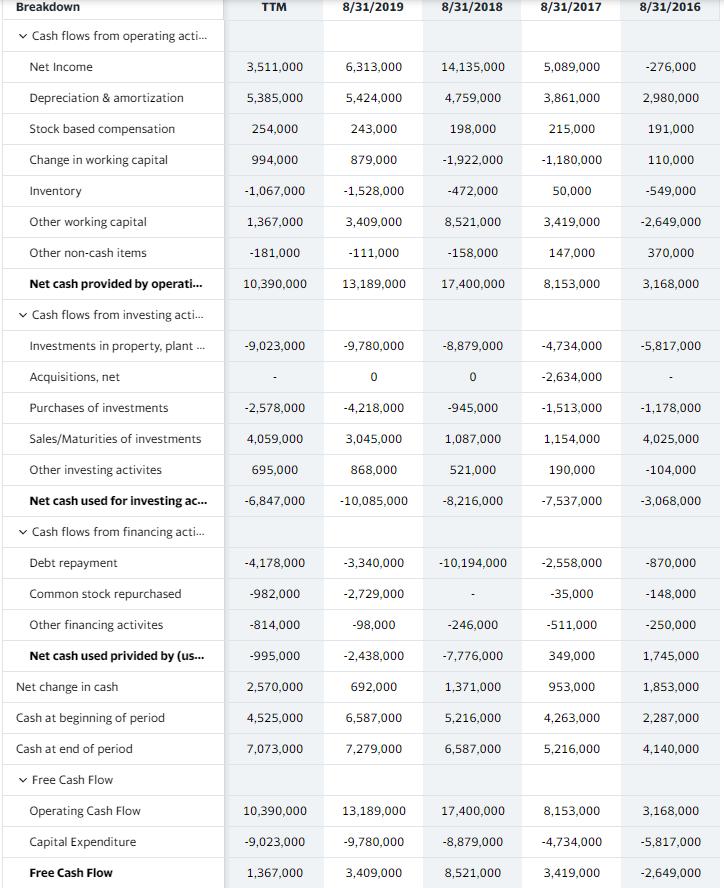

Telus Cash Flow:

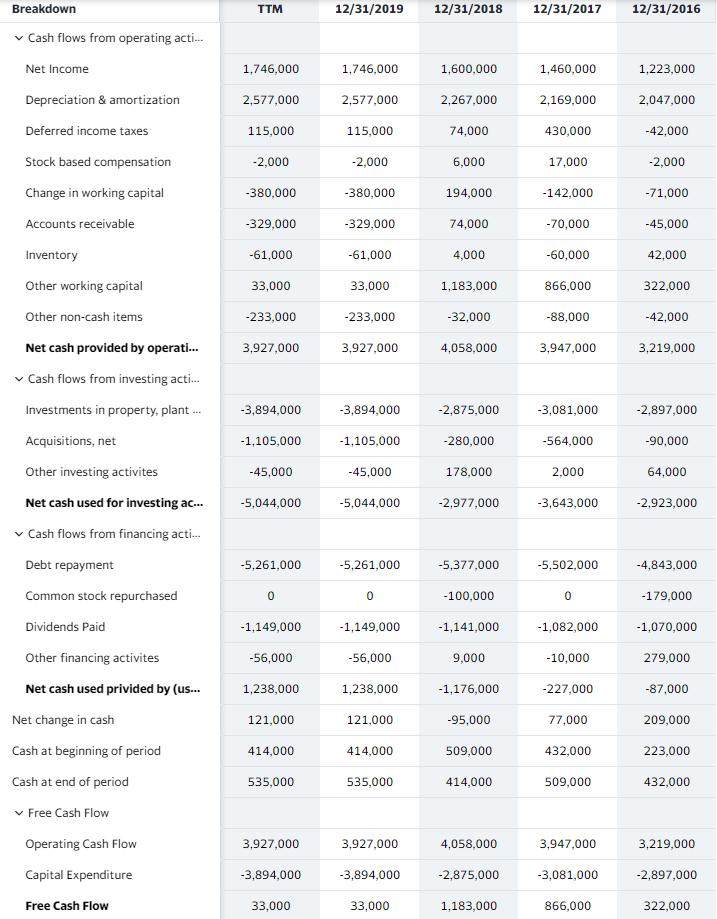

Shaw cash flow:

Breakdown TTM 12/31/2019 12/31/2018 12/31/2017 12/31/2016 v Cash flows from operating acti. Net Income 1,746,000 1,746,000 1,600,000 1,460,000 1,223,000 Depreciation & amortization 2,577,000 2,577,000 2,267,000 2,169,000 2,047,000 Deferred income taxes 115,000 115,000 74,000 430,000 -42,000 Stock based compensation -2,000 -2,000 6,000 17,000 -2,000 Change in working capital -380,000 -380,000 194,000 -142,000 -71,000 Accounts receivable -329,000 -329,000 74,000 -70,000 -45,000 Inventory -61,000 -61,000 4,000 -60,000 42,000 Other working capital 33,000 33,000 1,183,000 866,000 322,000 Other non-cash items -233,000 -233,000 -32,000 -88,000 -42,000 Net cash provided by operati. 3,927,000 3,927,000 4,058,000 3,947,000 3,219,000 v Cash flows from investing acti. Investments in property, plant . -3,894,000 -3,894,000 -2,875,000 -3,081,000 -2,897,000 Acquisitions, net -1,105,000 -1,105,000 -280,000 -564,000 -90,000 Other investing activites -45,000 -45,000 178,000 2,000 64,000 Net cash used for investing ac. -5,044,000 -5,044,000 -2,977,000 -3,643,000 -2,923,000 v Cash flows from financing acti. Debt repayment -5,261,000 -5,261,000 -5,377,000 -5,502,000 -4,843,000 Common stock repurchased -100,000 -179,000 Dividends Paid -1,149,000 -1,149,000 -1,141,000 -1,082,000 -1,070,000 Other financing activites -56,000 -56,000 9,000 -10,000 279,000 Net cash used privided by (us. 1,238,000 1,238,000 -1,176,000 -227,000 -87,000 Net change in cash 121,000 121,000 -95,000 77,000 209,000 Cash at beginning of period 414,000 414,000 509,000 432,000 223,000 Cash at end of period 535,000 535,000 414,000 509,000 432,000 v Free Cash Flow Operating Cash Flow 3,927,000 3,927,000 4,058,000 3,947,000 3,219,000 Capital Expenditure -3,894,000 -3,894,000 -2,875,000 -3,081,000 -2,897,000 Free Cash Flow 33,000 33,000 1,183,000 866,000 322,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cash flow from Operating Activity 1 Depreciation and amortisation In both the companies the depreciation and amortisation expenses are increasing over ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started