Question

Comment on the validity of the uncovered interest rate parity (UIRP) in this case. Assume that you have the capacity to borrow 100 million yen

Comment on the validity of the uncovered interest rate parity (UIRP) in this case. Assume that you have the capacity to borrow 100 million yen at the beginning of each year to conduct currency carry trade by investing in New Zealand dollar for one year. Calculate the total profits from the carry trade for each year over the period 2000 to 2019. Discuss the validity of uncovered interest rate parity based on your findings for the profitability of the carry trade strategy applied to the NZD-JPY currency pair. Provide an introduction to the concept of currency carry trade and explain the rationale of currency traders pursuing this strategy. Provide possible explanations for the validity or violation of the uncovered interest rate parity. You may take the perspective of a currency trader targeting at an audience of clients who are interested in speculating on the foreign exchange market.

• Prepare a chart plotting past annual change of cross exchange rate between NZD and JAP against the differential interest rates.

• Conduct an ordinary least squares (OLS) regression analysis: regress the annual rate of exchange rate changes on the annual interest rate differential. Interpret your regression results.

• Assess the profitability of the carry trade strategy based on your calculation results of the profits/losses from the carry trades.

• Does the uncovered IRP hold for the NZD-JAP exchange rate in your opinion?

• What is your recommendation for your clients?

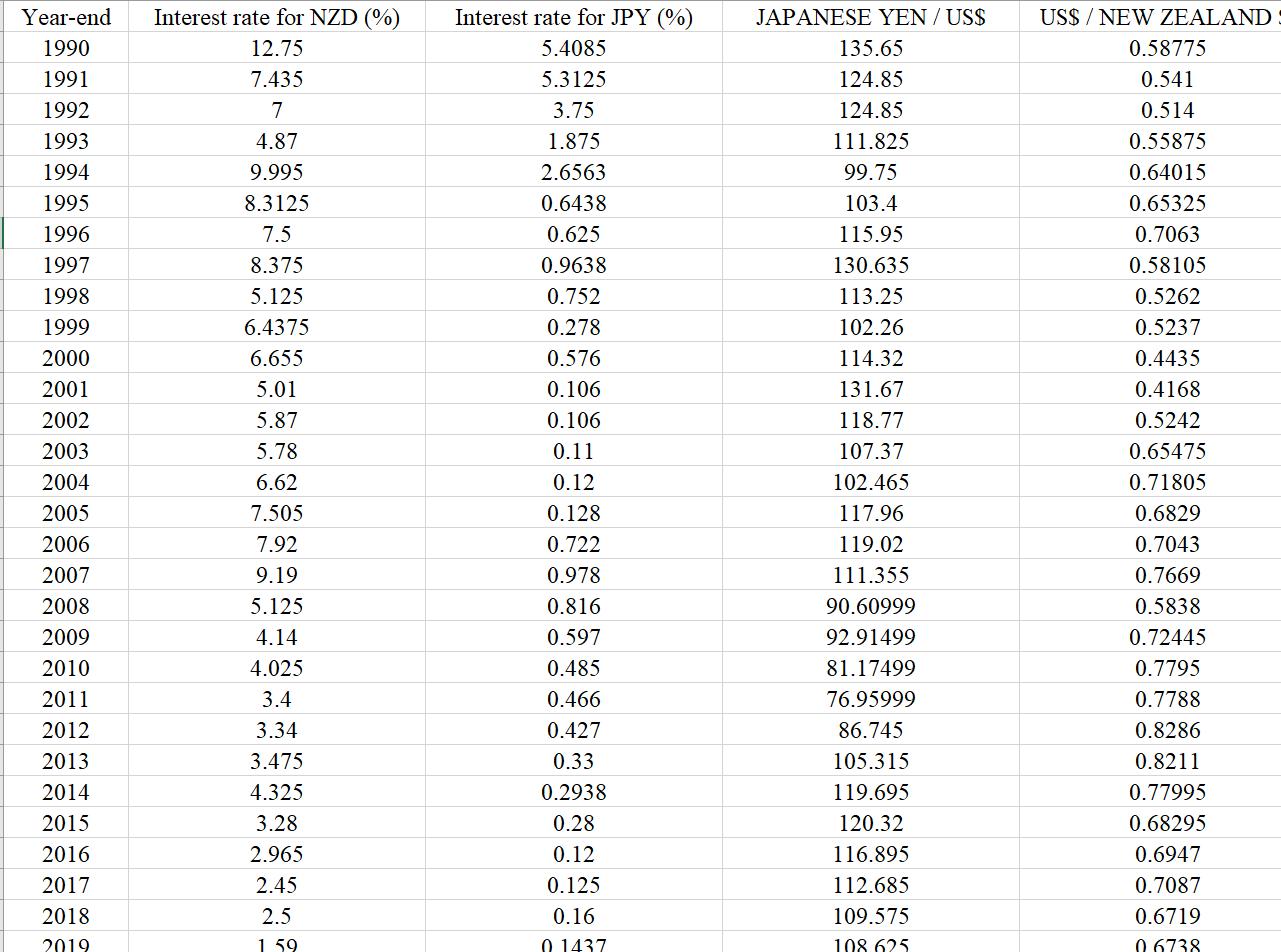

Year-end Interest rate for NZD (%) 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 12.75 7.435 7 4.87 9.995 8.3125 7.5 8.375 5.125 6.4375 6.655 5.01 5.87 5.78 6.62 7.505 7.92 9.19 5.125 4.14 4.025 3.4 3.34 3.475 4.325 3.28 2.965 2.45 2.5 1 59 Interest rate for JPY (%) 5.4085 5.3125 3.75 1.875 2.6563 0.6438 0.625 0.9638 0.752 0.278 0.576 0.106 0.106 0.11 0.12 0.128 0.722 0.978 0.816 0.597 0.485 0.466 0.427 0.33 0.2938 0.28 0.12 0.125 0.16 0 1437 JAPANESE YEN/ US$ 135.65 124.85 124.85 111.825 99.75 103.4 115.95 130.635 113.25 102.26 114.32 131.67 118.77 107.37 102.465 117.96 119.02 111.355 90.60999 92.91499 81.17499 76.95999 86.745 105.315 119.695 120.32 116.895 112.685 109.575 108.625 US$ / NEW ZEALAND 0.58775 0.541 0.514 0.55875 0.64015 0.65325 0.7063 0.58105 0.5262 0.5237 0.4435 0.4168 0.5242 0.65475 0.71805 0.6829 0.7043 0.7669 0.5838 0.72445 0.7795 0.7788 0.8286 0.8211 0.77995 0.68295 0.6947 0.7087 0.6719 06738

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Introduction Currency carry trade is a popular investment strategy used by forex traders where they borrow a lowyielding currency and invest in a higheryielding currency to earn the interest rate diff...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started