Answered step by step

Verified Expert Solution

Question

1 Approved Answer

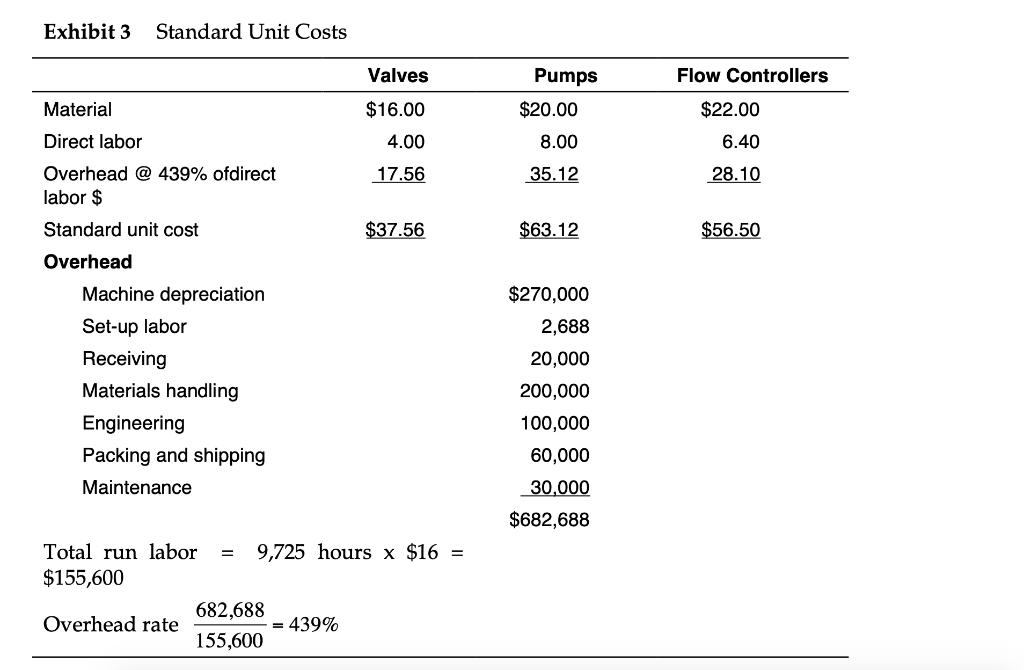

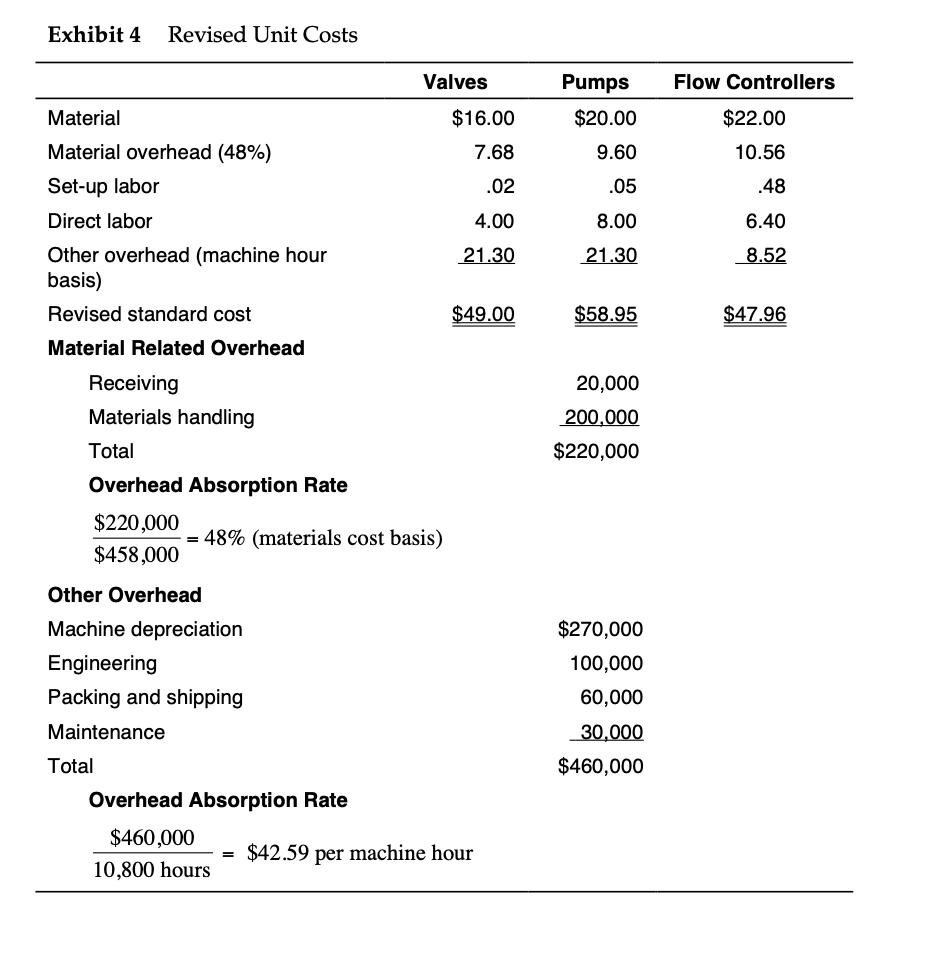

Compare the estimated costs you calculate to existing standard unit costs (Exhibit 3) and the revised unit costs (Exhibit 4). What causes the different product

Compare the estimated costs you calculate to existing standard unit costs (Exhibit 3) and the revised unit costs (Exhibit 4). What causes the different product costing methods to produce such different results?

Exhibit 3 Standard Unit Costs Valves Pumps Flow Controllers Material $16.00 $20.00 $22.00 Direct labor 4.00 8.00 6.40 Overhead @ 439% ofdirect 17.56 35.12 28.10 labor $ Standard unit cost $37.56 $63.12 $56.50 Overhead Machine depreciation $270,000 Set-up labor 2,688 Receiving 20,000 Materials handling 200,000 Engineering 100,000 Packing and shipping 60,000 Maintenance 30,000 $682,688 Total run labor 9,725 hours x $16 = $155,600 682,688 Overhead rate 439% %3D 155,600

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Exhibit 3 uses a single cost driver allocation method to allocate the overheads to the products It u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started