Answered step by step

Verified Expert Solution

Question

1 Approved Answer

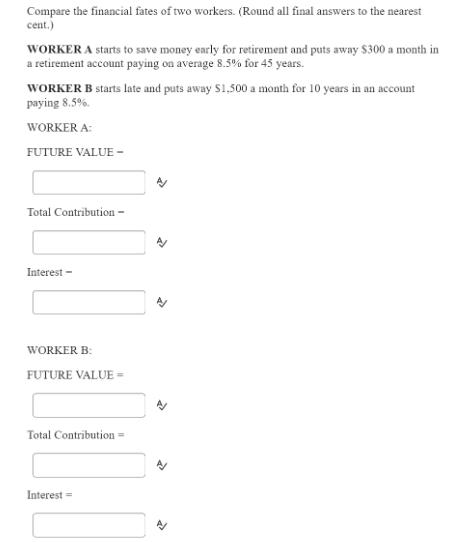

Compare the financial fates of two workers. (Round all final answers to the nearest cent.) WORKER A starts to save money early for retirement

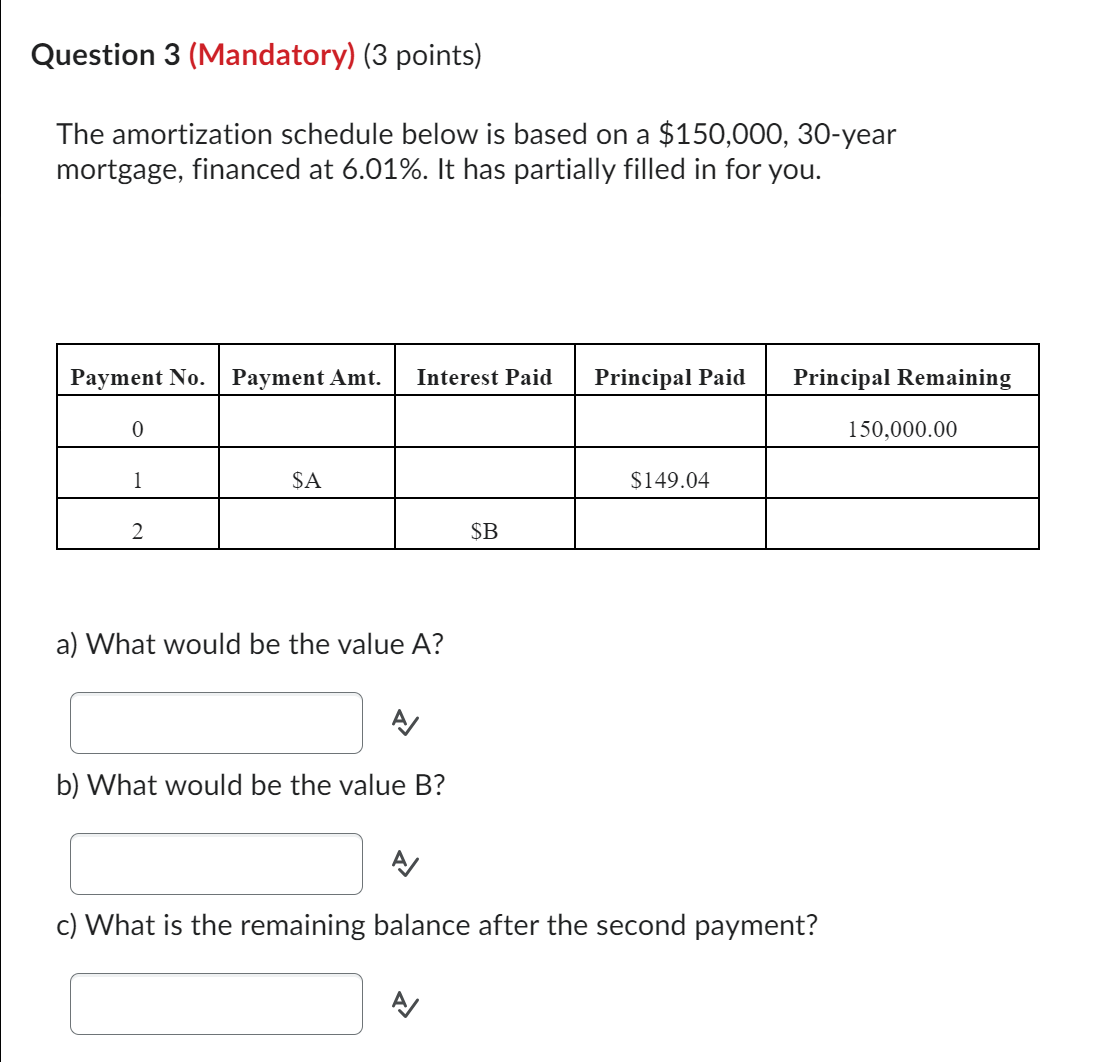

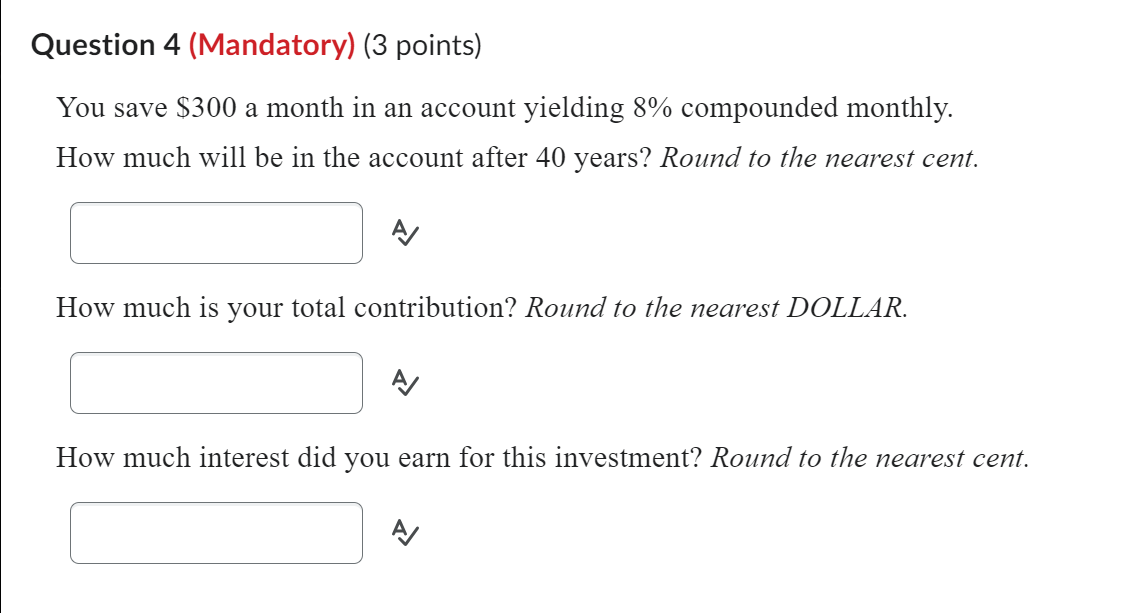

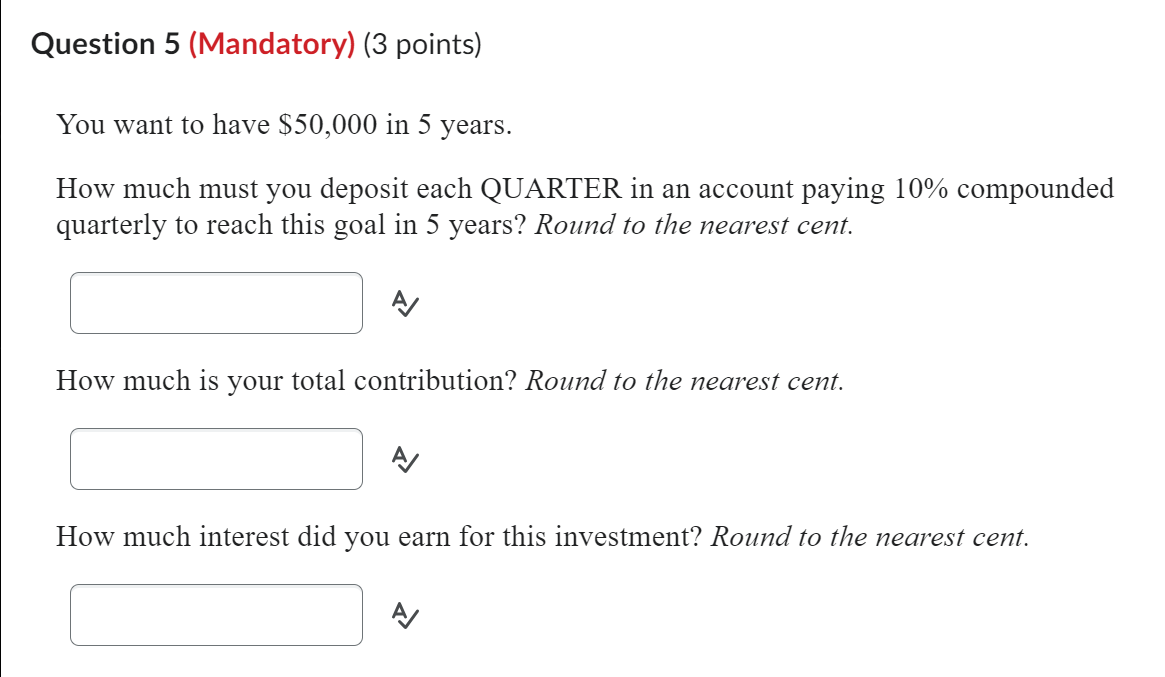

Compare the financial fates of two workers. (Round all final answers to the nearest cent.) WORKER A starts to save money early for retirement and puts away $300 a month in a retirement account paying on average 8.5% for 45 years. WORKER B starts late and puts away 51,500 a month for 10 years in an account paying 8.5%. WORKER A: FUTURE VALUE- Total Contribution- Interest- WORKER B: FUTURE VALUE = Total Contribution = Interest Question 3 (Mandatory) (3 points) The amortization schedule below is based on a $150,000, 30-year mortgage, financed at 6.01%. It has partially filled in for you. Payment No. Payment Amt. Interest Paid Principal Paid Principal Remaining 0 150,000.00 1 $A $149.04 2 $B a) What would be the value A? A/ b) What would be the value B? c) What is the remaining balance after the second payment? Question 4 (Mandatory) (3 points) You save $300 a month in an account yielding 8% compounded monthly. How much will be in the account after 40 years? Round to the nearest cent. How much is your total contribution? Round to the nearest DOLLAR. How much interest did you earn for this investment? Round to the nearest cent. A/ Question 5 (Mandatory) (3 points) You want to have $50,000 in 5 years. How much must you deposit each QUARTER in an account paying 10% compounded quarterly to reach this goal in 5 years? Round to the nearest cent. How much is your total contribution? Round to the nearest cent. How much interest did you earn for this investment? Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started