Question

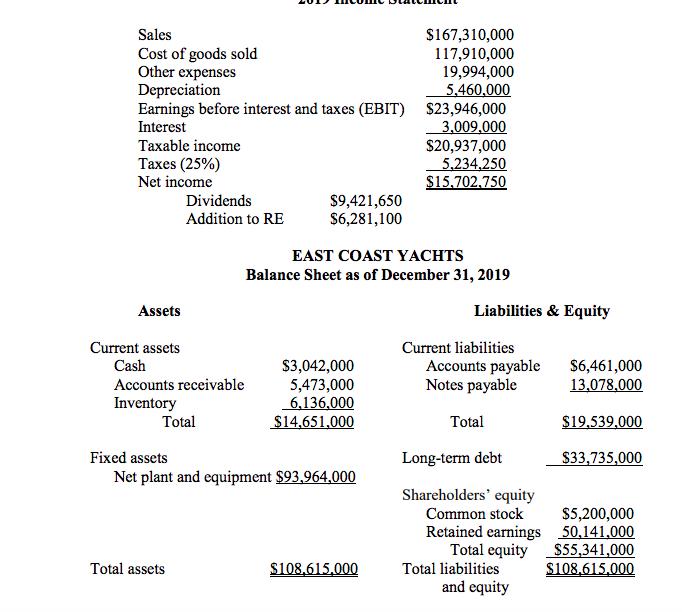

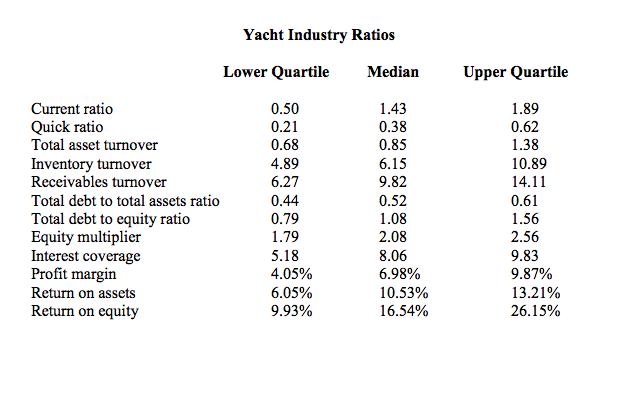

Compare the financial ratios of East Coast Yachts to the industry as a whole by the following categories. a) Short-term solvency or liquidity measures b)

Compare the financial ratios of East Coast Yachts to the industry as a whole by the following categories.

a) Short-term solvency or liquidity measures

b) Long-term solvency measures

c) Asset management or turnover measures

d) Profitability measures

Also comment on the performance of each category (a) to (d) above and overall performance of East Coast Yachts based on your analyses.

Calculate the sustainable growth rate of East Coast Yachts. Prepare pro forma income statement and balance sheet. Assume that sales, cost of goods sold, other expenses, current assets (cash, accounts receivable, and inventory), fixed assets, and current liabilities (accounts payable and notes payable) grow at precisely this rate. Also assume that depreciation, interest, long-term debt, and common stock remain the same. The firm’s tax rate is 25%. Compute external fund needed (EFN). (Note that the total equity used to compute the return on equity (ROE) is taken from an ending balance sheet. When you compute the sustainable growth rate, you need to use the following formula: Sustainable growth rate = ROExb 1−(ROExb) , where b is the retention or plowback ratio.)

$167,310,000 117,910,000 19,994,000 5,460,000 Earnings before interest and taxes (EBIT) $23,946,000 3,009,000 $20,937,000 5.234.250 $15.702.750 Sales Cost of goods sold Other expenses Depreciation Interest Taxable income Taxes (25%) Net income Dividends $9,421,650 $6,281,100 Addition to RE EAST COAST YACHTS Balance Sheet as of December 31, 2019 Assets Liabilities & Equity Current assets Current liabilities Cash $3,042,000 5,473,000 6,136,000 $14.651.000 Accounts payable Notes payable $6,461,000 Accounts receivable 13,078.000 Inventory Total Total $19.539,000 Fixed assets Long-term debt $33,735,000 Net plant and equipment $93,964.000 Shareholders' equity $5,200,000 Retained earnings 50,141.000 $55,341,000 $108,615,000 Common stock Total equity Total liabilities Total assets $108,615,000 and equity

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started