Question

Compare the performance of these 3 companies mentioned and analyze which company is in better financial standing in terms of Profitability, Liquidity, Efficiency, and leverage,

Compare the performance of these 3 companies mentioned and analyze which company is in better financial standing in terms of Profitability, Liquidity, Efficiency, and leverage, Market value and provide your recommendations on what can they improve on to have a better financial standing.

The question is related to financial management

Here is the required Data

Walmart

The market Capitalization was 337.17 Billion at the end of 2019

Microsoft

| Liquidity | |

| Year | Current Ratio |

| 2019 | 2.53 |

| 2018 | 2.9 |

| 2017 | 2.92 |

| Year | Quick Ratio |

| 2019 | 2.35 |

| 2018 | 2.74 |

| 2017 | 2.37 |

| Year | Cash Ratio |

| 2019 | 1.93 |

| 2018 | 2.29 |

| 2017 | 2.06 |

| Dupont Analysis | |

| 2019 | |

| ROE | 0.383 |

| Profitable | 2.154 |

| Efficiency | 0.063 |

| Leverage | 2.8 |

| 2018 | |

| ROE | 0.2 |

| Profitability | 0.94 |

| Efficiency | 0.057 |

| Leverage | 3.129 |

| 2017 | |

| ROE | 0.29 |

| Profitable | 1.648 |

| Efficiency | 0.061 |

| leverage | 2.85 |

Market capitalization was 1.2 Trillion at the end of 2019

DowDupont

| Liquidity | |

| Year | Current Ratio |

| 2019 | 2.3 |

| 2018 | 2.01 |

| 2017 | 1.91 |

| Year | Quick ratio |

| 2019 | 2.21 |

| 2018 | 1.94 |

| 2017 | 1.86 |

| Dupont analysis | |

| 2019 | |

| ROE | (-) 0.030 |

| Profitability | 0.13% |

| Efficiency | 0.36 |

| Leverage | 0.38 |

| 2018 | |

| ROE | 0.041 |

| Profitability | 0.12% |

| Efficiency | 0.26 |

| Leverage | 0.23 |

| 2017 | |

| ROE | 0.016 |

| Profitability | 0.16% |

| Efficiency | 0.33 |

| Leverage | 0.13 |

The market capitalization was 151.1 billion at the end of 2018

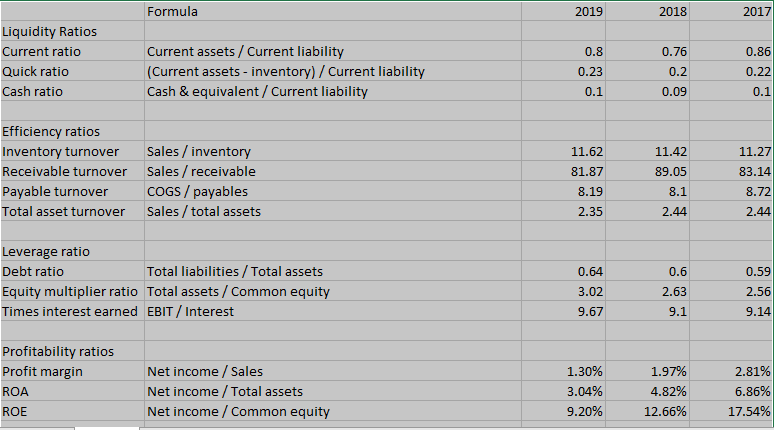

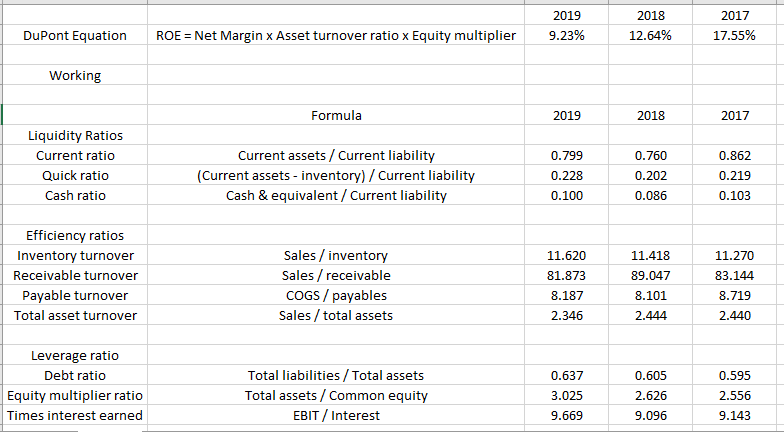

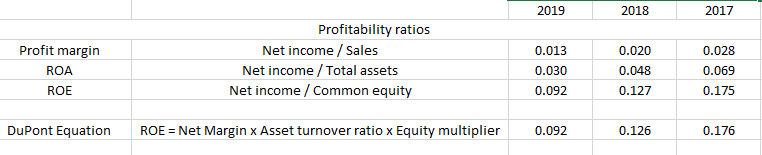

Formula 2019 2018 2017 0.86 Liquidity Ratios Current ratio Quick ratio Cash ratio Current assets / Current liability (Current assets - inventory) / Current liability Cash & equivalent / Current liability 0.8 0.23 0.1 0.76 0.2 0.09 0.22 0.1 11.27 Efficiency ratios Inventory turnover Receivable turnover Payable turnover Total asset turnover 83.14 Sales / inventory Sales / receivable COGS / payables Sales / total assets 11.62 81.87 8.19 2.35 11.42 89.05 8.1 2.44 8.72 2.44 - Leverage ratio Debt ratio Total liabilities/Total assets Equity multiplier ratio Total assets / Common equity Times interest earned EBIT/ Interest 0.64 3.02 9.67 0.6 2.63 9.1 0.59 2.56 9.14 Profitability ratios Profit margin ROA ROE Net income / Sales Net income / Total assets Net income / Common equity 1.30% 3.04% 9.20% 1.97% 4.82% 12.66% 2.81% 6.86% 17.54% 2019 9.23% 2018 12.64% 2017 17.55% DuPont Equation ROE = Net Margin x Asset turnover ratio x Equity multiplier Working Formula 2019 2018 2017 Liquidity Ratios Current ratio Quick ratio Cash ratio Current assets / Current liability (Current assets - inventory) / Current liability Cash & equivalent / Current liability 0.799 0.228 0.100 0.760 0.202 0.086 0.862 0.219 0.103 Efficiency ratios Inventory turnover Receivable turnover Payable turnover Total asset turnover Sales / inventory Sales / receivable COGS/ payables Sales / total assets 11.620 81.873 8.187 2.346 11.418 89.047 8.101 2.444 11.270 83.144 8.719 2.440 0.595 Leverage ratio Debt ratio Equity multiplier ratio Times interest earned Total liabilities/ Total assets Total assets / Common equity EBIT / Interest 0.637 3.025 9.669 0.605 2.626 9.096 2.556 9.143 2019 2018 2017 0.013 Profit margin ROA ROE Profitability ratios Net income / Sales Net income / Total assets Net income / Common equity 0.030 0.092 0.020 0.048 0.127 0.028 0.069 0.175 DuPont Equation ROE = Net Margin x Asset turnover ratio x Equity multiplier 0.092 0.126 0.176Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started