Compare the returns of a diversified and non-diversified portfolio of assets.

Portfolio distribution

pls ans as on this page

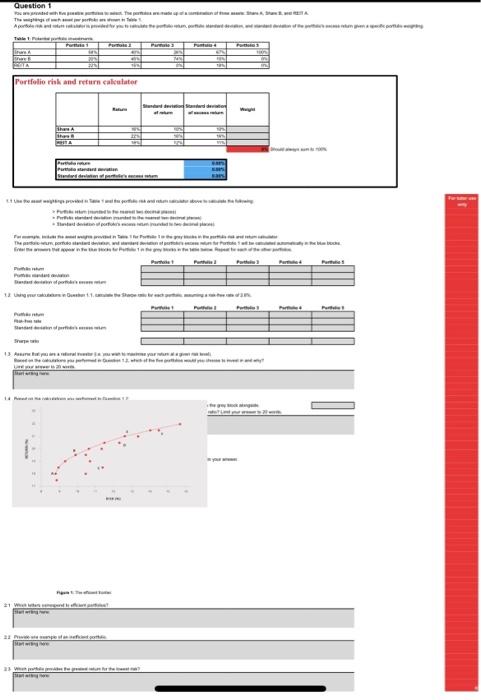

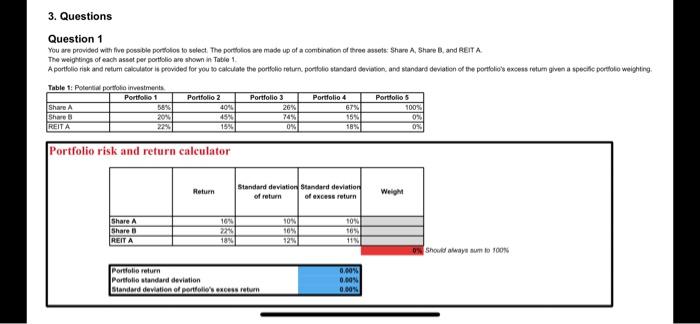

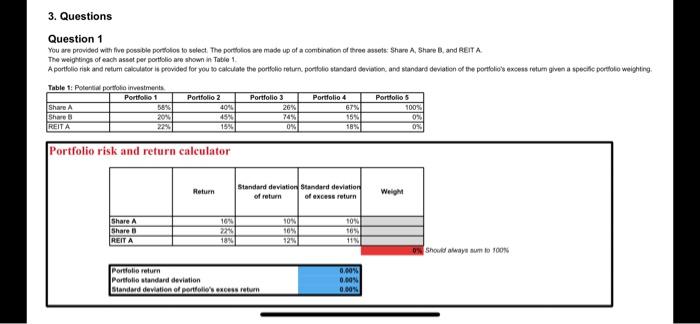

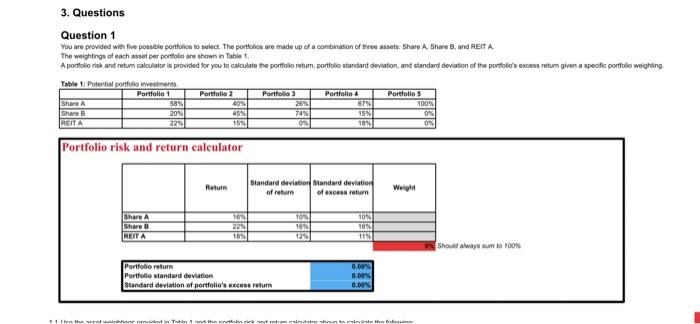

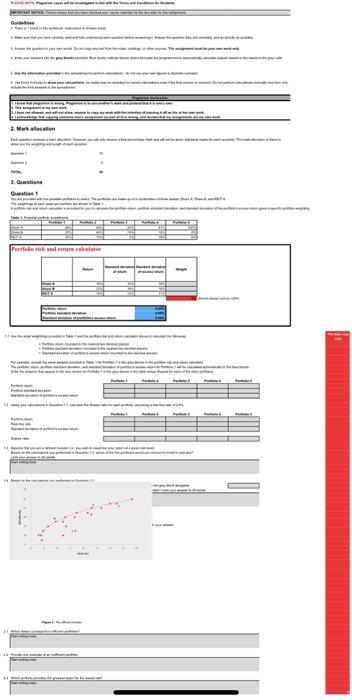

Question 1

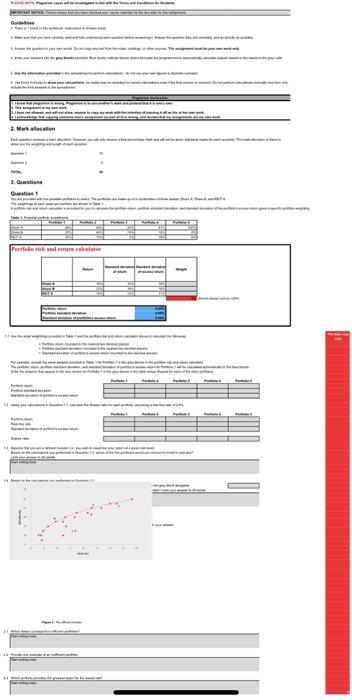

You are provided with five possible portfolios to select. The portfolios are made up of a combination of three assets: Share A, Share B, and REIT A The weiantinas or each asset ver portfolio are shown in able 1.

A portfolio risk and retum calculator is orovided for vou to calculate the portfolio return. portfolio standard deviation. and standard deviation of the portfolio's excess return aiven specific portfolio weighting.

could you drop me an email than i cwn sent you an pdf file which will see more clearly

i hope this will find you well

pls pls ASAP

portfolio distribution

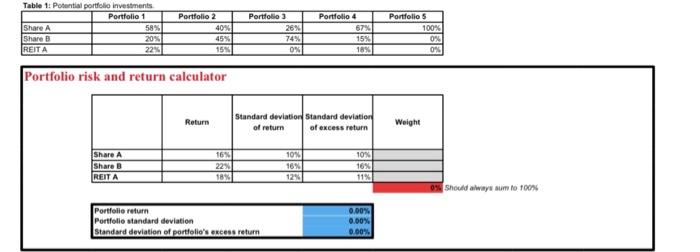

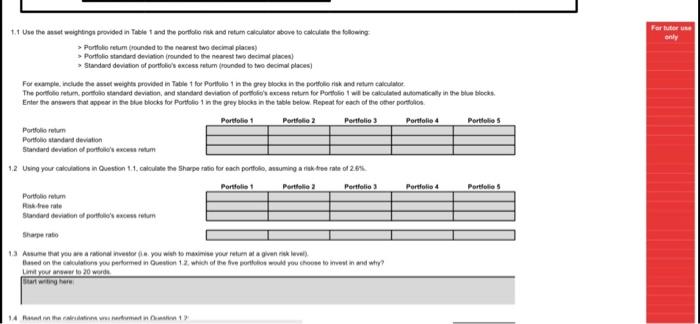

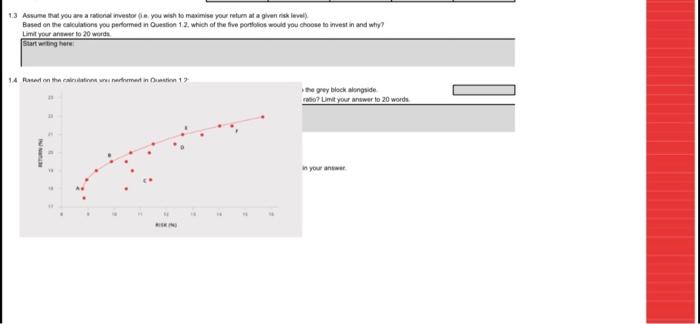

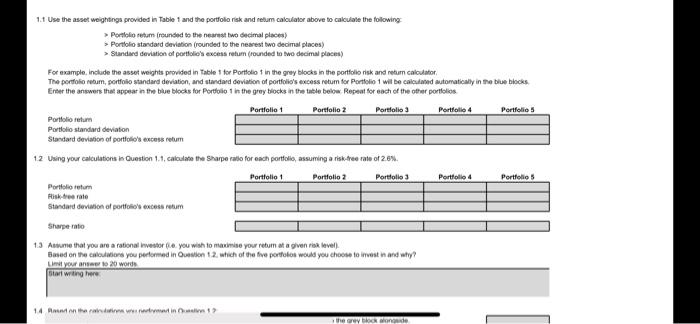

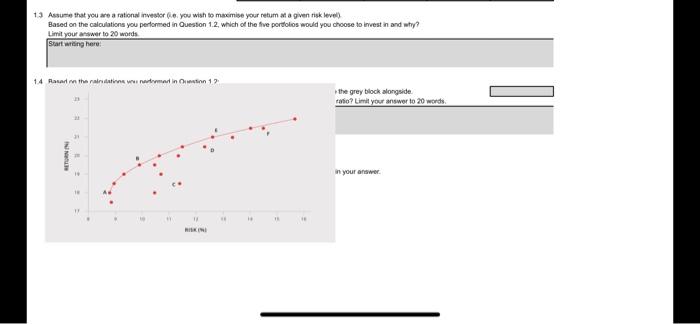

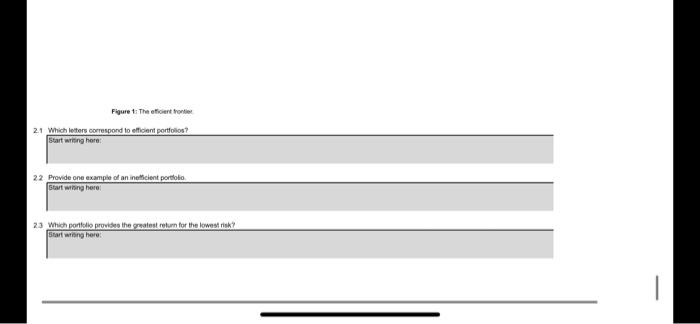

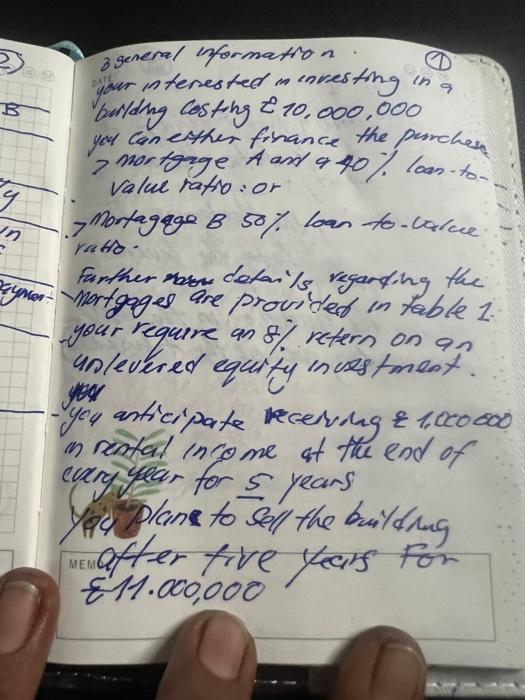

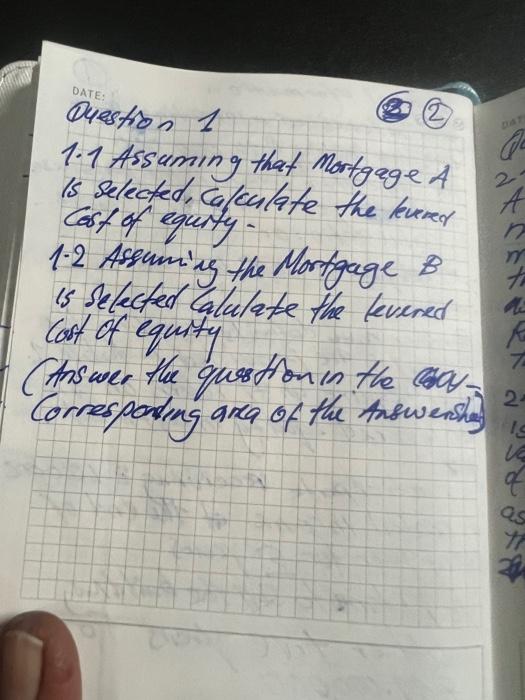

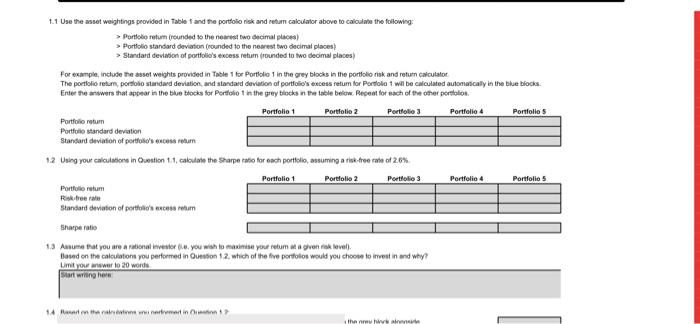

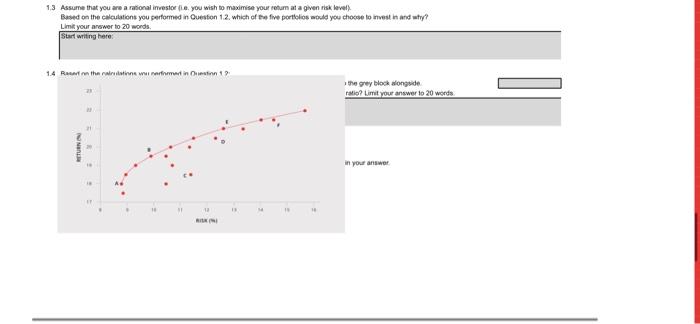

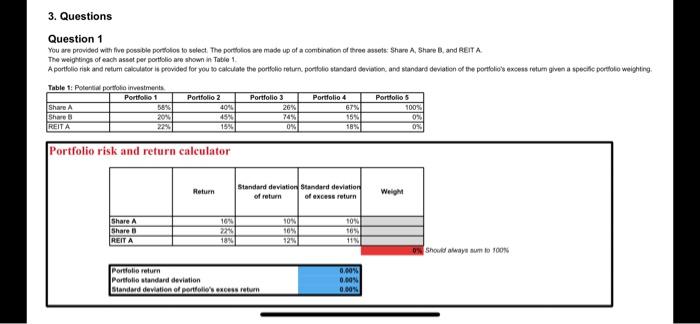

Portfolio risk and return calculator > Porthele refum (rounded bo the neabest two decima places) - Portiolo standard deviation (rounded to the nearest teo decimal piaces) ; Standerd devation of portolioh encess rehum (pounded to two decimal places) Enter the answers that appear in fie tiue blocks for Portholio 1 is the grey blocks in the table below. Aepeat for each of the othar portholos Pertililis return Portobe atandard devation Standard tevation of portfobis axcesi retum Portfolio rehum Pasulese rate Shandayd devaben of portfules's asess tehar Sharpe nato Lint patar anser to 20 worda. itart inding hare Based on the ealculations you pertormed in Question 1.2, which of the frre ponfolios would you choose to invest in and why? Limit vour anteser lo 20 werda. Start wering hare Questicn f Portfolio risk and return calkulater Diman riam Pumbe arias aninan Aishernen Ae her un Metast diekn a perheri ansen mim Share ana Question 1 You are provided with five possble porfolos to select. The portolos are mase up of a comination of three assets: Share A, Share B, and RerT A. The weightings of each asset per portlolis are shown in Table 1 . Portfolio risk and return calculator 1.t Use the asset weightngs provided in Tabie 1 and the portfolo risk and resum caboulator above fo calculale the following: - Perelislio retum (reunded to the nearest bwe decimal places) - Portolio standard deviabion (rounded to the nearest bwo decimal places) > Standard deviation of portfolo's eveess retum (rounded to Awo decimal places) For example. include the asset weights propided in Table 1 for Portlolio t in the grey blocks in the portfolio risk and nebum caloulator: The pertholo rebum, portfolio standard deriation, and atardacd dervation of portfolig's excess retum for portiolio 1 wit be calesiabed automatically in the blue biocks. Eneer the answers that appear in the blue blocks for Pertfolo in the grey blocks in the tusle beloe. Repeat for each of the ofter portolss Portslio iehara Portolo standard deviation Standard deviabion of portfolobs excess retum 1.2. Using your caiculations is Question 1.1, caloulabe the shame rabio for each portiolig, assuming a risk-tree rate of 2.6%. Partiolo ieturn Hink-iree rate Standard deviabon of portfossit excess retum Sharpe rato 1.3 Askime that yos are a rational invesor (i.e. you wish to maimise yosr retum at a given ribk level). Based on the calodabord you pertorined in Ousion 1 . which of the fye portolos woud you choose to invest in and why? Lienit your ansep is 20 words. Dtail wring here 1.3 Assutie that you are a rational investor (i.e. you wish to maximise yoer retum at a given risk level. Based on the caloulations you pertonsed in Queston 1.2, which of the five pordolos would you choose to irrest in and why? Limit your anwer to 20 worts. Start inating here: 1.4 Pasad on the rainidations wer: nutromed in Oiestion 1.2 Figure 1: The efioient fronties. your in tersested in investing in 9 butlding costing r 10,000,000 you con exther finance the purches > mortgage A and 940% loan - to. value ratio: or . Montagege B 50\% Loan to-calce rato. Further bes details vegarding the Wortgages are provided in table 1. your require an 8\% retern on an unlevered equity in uestment. - You anticipate lrecering z 1,0c0000 in rental inco me at the end of cury year for 5 years yid plan to ell the baild ung meMuter tive tects fon 11.000,000 Question 1 (2) 11 Assuming that mortgage A 1s selected, Galeulate the leverer cosf of equity. 12 Assuming the Mortgage B is selected Galulate the leverned cost of equity Answer the question in the Corresponting area of the Answenshe Question 2 21. Assuming thed the mortorge A is selected, ca kulate the net present value of the invest. ment. Cise the cosf of equity that alculate in question 1 pound your Calculatide towen to 2'2. Asumming thot the mostgage B is selected, Calcutate the net present velue of the investnin t. use the cost of equity that Calaifate in question 212 as the approp ate drococint rat e Question 1 rou are provided wih five possibie portfolios bo seiect. The portiolios are made up of a combinaton of three assets: Share A. Share B, and REIT A. the weightings of each asset per portolo are shown in fable t. Portfolio risk and return ealeulator 1.1 Use the asset weightings peovided in Table ff and the porttolio risk and resam cakculabor above to caloulabe the following: > Pertiolig return (reunded so the nearest bwo secimal places) > Portlolo standard devation (counded to the nesrest two decimal places) > Standard deviabon of portfolio's excess retion (rounded to two decimal places) For example, include the asset weights probided in Table 1 for Portiolo 1 in the grey blocks in the portlolio risk and return caiculator. Entee the answers that appear in the blue blocks for Portfolio 1 in the grey blocks in the tabie below. Respeat for each of the oher porthlion. Portfolio return Portfolo standard deviation Stansard deviafon of pertoloks eucess reaim 1.2 Using your calcuiabions in Ginstion 1.1, caboulabe the Shape rabo for each portiolio, assuming a risk-tree tabe of 2.6%. Portfole retum Risk.free rave Standard deviaton of pertololos encess rehum Sharpe ratis 1.3 Aasume that you are a retional ievesber (i.e. you wish to masimise yose retum at a gren rak keved.. Dased on the calculatons you performed in Ouesson 12 . which of the five portolos would you choose to irrest in and why? Limit yove answar to 20 wordi Start winne here 1,3 Assume that you are a rafonal inresior (i.e. you wish to mavimise your cohum at a given risk levely. Based on the calculations you performed in Queston 1.2. which of the five portolios abcla you chocoe to invest in and wity? Limit your arswer to 20 aonds. Start witing hare: 1.4 Rasert ra the nairidatinne wui nerfinmed in Deiestonn 19 Figure 1: The efficient frontier. Portfolio risk and return calculator > Porthele refum (rounded bo the neabest two decima places) - Portiolo standard deviation (rounded to the nearest teo decimal piaces) ; Standerd devation of portolioh encess rehum (pounded to two decimal places) Enter the answers that appear in fie tiue blocks for Portholio 1 is the grey blocks in the table below. Aepeat for each of the othar portholos Pertililis return Portobe atandard devation Standard tevation of portfobis axcesi retum Portfolio rehum Pasulese rate Shandayd devaben of portfules's asess tehar Sharpe nato Lint patar anser to 20 worda. itart inding hare Based on the ealculations you pertormed in Question 1.2, which of the frre ponfolios would you choose to invest in and why? Limit vour anteser lo 20 werda. Start wering hare Questicn f Portfolio risk and return calkulater Diman riam Pumbe arias aninan Aishernen Ae her un Metast diekn a perheri ansen mim Share ana Question 1 You are provided with five possble porfolos to select. The portolos are mase up of a comination of three assets: Share A, Share B, and RerT A. The weightings of each asset per portlolis are shown in Table 1 . Portfolio risk and return calculator 1.t Use the asset weightngs provided in Tabie 1 and the portfolo risk and resum caboulator above fo calculale the following: - Perelislio retum (reunded to the nearest bwe decimal places) - Portolio standard deviabion (rounded to the nearest bwo decimal places) > Standard deviation of portfolo's eveess retum (rounded to Awo decimal places) For example. include the asset weights propided in Table 1 for Portlolio t in the grey blocks in the portfolio risk and nebum caloulator: The pertholo rebum, portfolio standard deriation, and atardacd dervation of portfolig's excess retum for portiolio 1 wit be calesiabed automatically in the blue biocks. Eneer the answers that appear in the blue blocks for Pertfolo in the grey blocks in the tusle beloe. Repeat for each of the ofter portolss Portslio iehara Portolo standard deviation Standard deviabion of portfolobs excess retum 1.2. Using your caiculations is Question 1.1, caloulabe the shame rabio for each portiolig, assuming a risk-tree rate of 2.6%. Partiolo ieturn Hink-iree rate Standard deviabon of portfossit excess retum Sharpe rato 1.3 Askime that yos are a rational invesor (i.e. you wish to maimise yosr retum at a given ribk level). Based on the calodabord you pertorined in Ousion 1 . which of the fye portolos woud you choose to invest in and why? Lienit your ansep is 20 words. Dtail wring here 1.3 Assutie that you are a rational investor (i.e. you wish to maximise yoer retum at a given risk level. Based on the caloulations you pertonsed in Queston 1.2, which of the five pordolos would you choose to irrest in and why? Limit your anwer to 20 worts. Start inating here: 1.4 Pasad on the rainidations wer: nutromed in Oiestion 1.2 Figure 1: The efioient fronties. your in tersested in investing in 9 butlding costing r 10,000,000 you con exther finance the purches > mortgage A and 940% loan - to. value ratio: or . Montagege B 50\% Loan to-calce rato. Further bes details vegarding the Wortgages are provided in table 1. your require an 8\% retern on an unlevered equity in uestment. - You anticipate lrecering z 1,0c0000 in rental inco me at the end of cury year for 5 years yid plan to ell the baild ung meMuter tive tects fon 11.000,000 Question 1 (2) 11 Assuming that mortgage A 1s selected, Galeulate the leverer cosf of equity. 12 Assuming the Mortgage B is selected Galulate the leverned cost of equity Answer the question in the Corresponting area of the Answenshe Question 2 21. Assuming thed the mortorge A is selected, ca kulate the net present value of the invest. ment. Cise the cosf of equity that alculate in question 1 pound your Calculatide towen to 2'2. Asumming thot the mostgage B is selected, Calcutate the net present velue of the investnin t. use the cost of equity that Calaifate in question 212 as the approp ate drococint rat e Question 1 rou are provided wih five possibie portfolios bo seiect. The portiolios are made up of a combinaton of three assets: Share A. Share B, and REIT A. the weightings of each asset per portolo are shown in fable t. Portfolio risk and return ealeulator 1.1 Use the asset weightings peovided in Table ff and the porttolio risk and resam cakculabor above to caloulabe the following: > Pertiolig return (reunded so the nearest bwo secimal places) > Portlolo standard devation (counded to the nesrest two decimal places) > Standard deviabon of portfolio's excess retion (rounded to two decimal places) For example, include the asset weights probided in Table 1 for Portiolo 1 in the grey blocks in the portlolio risk and return caiculator. Entee the answers that appear in the blue blocks for Portfolio 1 in the grey blocks in the tabie below. Respeat for each of the oher porthlion. Portfolio return Portfolo standard deviation Stansard deviafon of pertoloks eucess reaim 1.2 Using your calcuiabions in Ginstion 1.1, caboulabe the Shape rabo for each portiolio, assuming a risk-tree tabe of 2.6%. Portfole retum Risk.free rave Standard deviaton of pertololos encess rehum Sharpe ratis 1.3 Aasume that you are a retional ievesber (i.e. you wish to masimise yose retum at a gren rak keved.. Dased on the calculatons you performed in Ouesson 12 . which of the five portolos would you choose to irrest in and why? Limit yove answar to 20 wordi Start winne here 1,3 Assume that you are a rafonal inresior (i.e. you wish to mavimise your cohum at a given risk levely. Based on the calculations you performed in Queston 1.2. which of the five portolios abcla you chocoe to invest in and wity? Limit your arswer to 20 aonds. Start witing hare: 1.4 Rasert ra the nairidatinne wui nerfinmed in Deiestonn 19 Figure 1: The efficient frontier