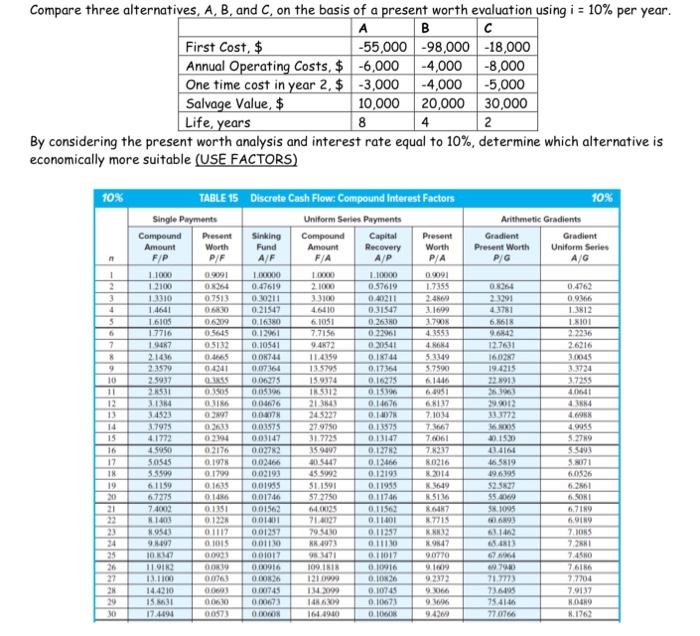

Compare three alternatives, A, B, and C, on the basis of a present worth evaluation using i = 10% per year. A B First Cost, $ -55,000 -98,000 -18,000 Annual Operating costs, $ -6,000 -4,000 -8,000 One time cost in year 2, $ -3,000 -4,000 -5,000 Salvage Value, $ 10,000 20,000 30,000 Life, years 8 4 2 By considering the present worth analysis and interest rate equal to 10%, determine which alternative is economically more suitable (USE FACTORS) 10% 10% Arithmetic Gradients Gradient Gradient Present Worth Uniform Series PG AG 1 2 3 4 0.8064 2.3291 43781 6.1618 0642 127611 5 7 9 194215 22911 TABLE 15 Discrete Cash Flow: Compound Interest Factors Single Payments Uniform Series Payments Compound Present Sinking Compound Capital Present Amount Worth Fund Amount Recovery Worth F/P P/F AF FA A/P P/A 11000 0991 1. LO 1.10000 09091 1.2100 0X064 0.47619 2. 1000 0.57619 1.7355 1.3310 0.7513 0.30211 3.3100 0.40211 2.4669 1.4641 0.21547 4.6410 0.31547 3.1699 1.6105 0629 0.160 61051 0.26.30 1.7008 1.7716 05615 0.12061 7.7156 0.22961 4.3553 1947 05132 0.10541 9.4672 030941 4. MON 2.1416 0.4665 0.07.14 11 4159 0.1144 51149 23579 04M 0.07164 135795 0.17164 5.750 25937 006225 15 9174 0.16275 61446 2531 03503 0056 15312 0.15 6.3951 14 004676 21 0.14676 68117 3:4523 07 0.00 243227 0.1007 7.1034 3.7975 0233 0.03575 27.9750 0.13375 7 107 4.1772 0219 0.03147 31.7725 0.13147 7.0061 4.5950 0.2176 0.0272 35.9097 01272 71217 SOSES 0.1973 0.02466 20.5447 0.12466 80216 5.5599 01790 0.02193 45 5992 0.12193 2014 61159 0.1615 0.0194 $1.1591 0.1 1953 3619 67275 14 0.01746 57.2750 0.11746 5116 7.400 01151 0.01562 6425 0.1156 7 1403 0.122 001001 0.11.401 7715 N0543 01112 001357 79 SENO 0 11257 NNNN2 9.097 0.1015 0.01130 1973 01111 9847 10 0.0001 001017 9191 011017 10770 11 93 019 0916 109 1818 16 1649 11100 0.0745 0.0026 1210 0.02 9 2372 14.4210 0.0693 0.00745 IN 2009 0.10745 1066 15 31 00630 0.00673 14 0107 96 17.4694 00573 DODON 161190 942 10 11 12 13 14 15 W 29, 2012 16 17 18 19 20 21 NOS 30.150 04160 155819 196395 $2.57 550 SONS 0.4762 0.916 1.3812 1.8101 2.216 2.6216 3.0045 3.3724 3.7255 MAI 44 4.69 4.9955 5.2719 5.53 5.071 6.0526 6.261 SONI 6719 6.9189 ZAIOKS 7.21 7.45NO 7616 77704 7.9137 R.NO 8.1762 C CIR 23 24 25 26 27 ILI 6 W . 71.777) 7349 75 416 770766 20 MO PARO