Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Salmon for the weights in the weighted

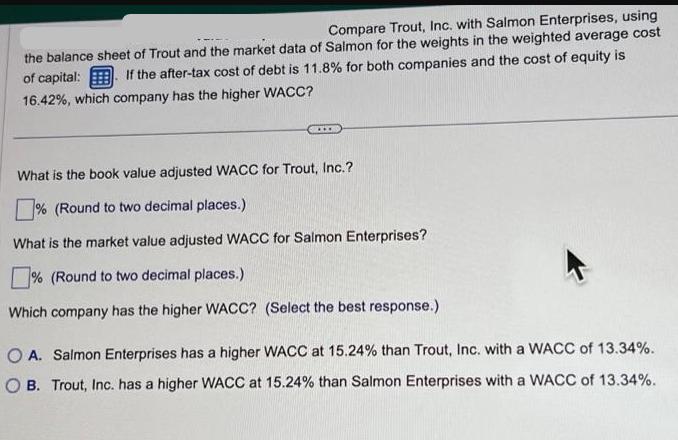

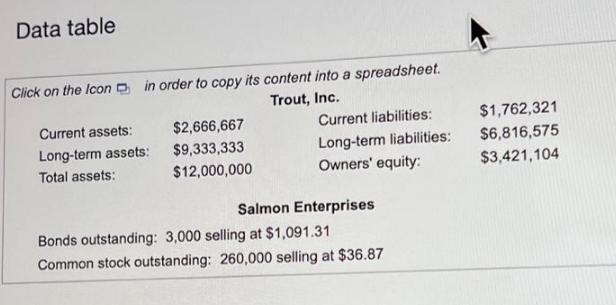

Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Salmon for the weights in the weighted average cost of capital: If the after-tax cost of debt is 11.8% for both companies and the cost of equity is 16.42%, which company has the higher WACC? ... What is the book value adjusted WACC for Trout, Inc.? % (Round to two decimal places.) What is the market value adjusted WACC for Salmon Enterprises? % (Round to two decimal places.) Which company has the higher WACC? (Select the best response.) O A. Salmon Enterprises has a higher WACC at 15.24% than Trout, Inc. with a WACC of 13.34%. B. Trout, Inc. has a higher WACC at 15.24% than Salmon Enterprises with a WACC of 13.34%. Data table Click on the Icon in order to copy its content into a spreadsheet. Trout, Inc. Current assets: Long-term assets: Total assets: $2,666,667 $9,333,333 $12,000,000 Current liabilities: Long-term liabilities: Owners' equity: Salmon Enterprises Bonds outstanding: 3,000 selling at $1,091.31 Common stock outstanding: 260,000 selling at $36.87 $1,762,321 $6,816,575 $3,421,104

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Book Value adjusted WACC for Trout Inc Trout Inc Debt will be 6816575 and Equity will be 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started