Answered step by step

Verified Expert Solution

Question

1 Approved Answer

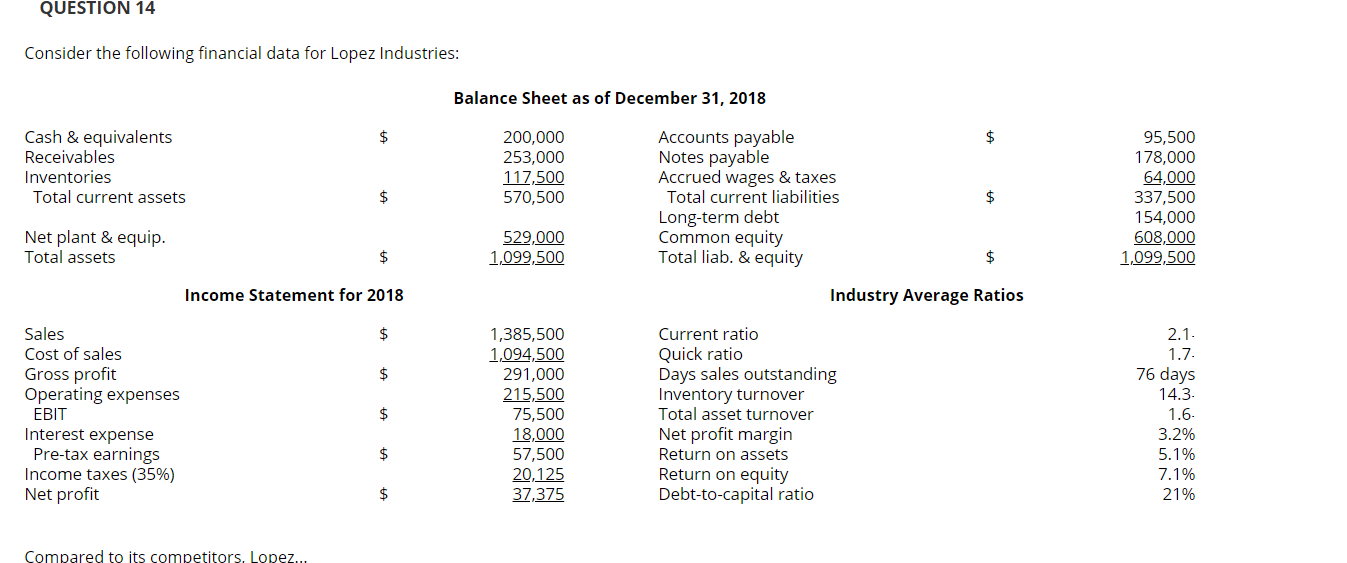

Compared to its competitors, Lopez... a. obtains more of its capital from equity financing. b. is in a stronger short-term liquidity position. c. generates less

Compared to its competitors, Lopez...

| a. | obtains more of its capital from equity financing. | |

| b. | is in a stronger short-term liquidity position. | |

| c. | generates less profit per dollar of shareholders' equity. | |

| d. | has a higher profit margin. | |

| e. | has a higher inventory turnover ratio. |

can you please show how you solved for each answer choice, even the wrong ones because it will pop up in the final, but have different answers. Thank you.

QUESTION 14 Consider the following financial data for Lopez Industries: Balance Sheet as of December 31, 2018 $ $ Cash & equivalents Receivables Inventories Total current assets 200,000 253,000 117,500 570,500 $ Accounts payable Notes payable Accrued wages & taxes Total current liabilities Long-term debt Common equity Total liab. & equity $ 95,500 178,000 64,000 337,500 154,000 608,000 1,099,500 Net plant & equip. Total assets 529,000 1,099.500 Income Statement for 2018 Industry Average Ratios $ $ Sales Cost of sales Gross profit Operating expenses EBIT Interest expense Pre-tax earnings Income taxes (35%) Net profit $ 1,385,500 1,094,500 291,000 215,500 75,500 18,000 57,500 20,125 37,375 Current ratio Quick ratio Days sales outstanding Inventory turnover Total asset turnover Net profit margin Return on assets Return on equity Debt-to-capital ratio 2.1. 1.7. 76 days 14.3. 1.6 3.2% 5.1% 7.1% 21% $ $ Compared to its competitors, LopezStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started