Answered step by step

Verified Expert Solution

Question

1 Approved Answer

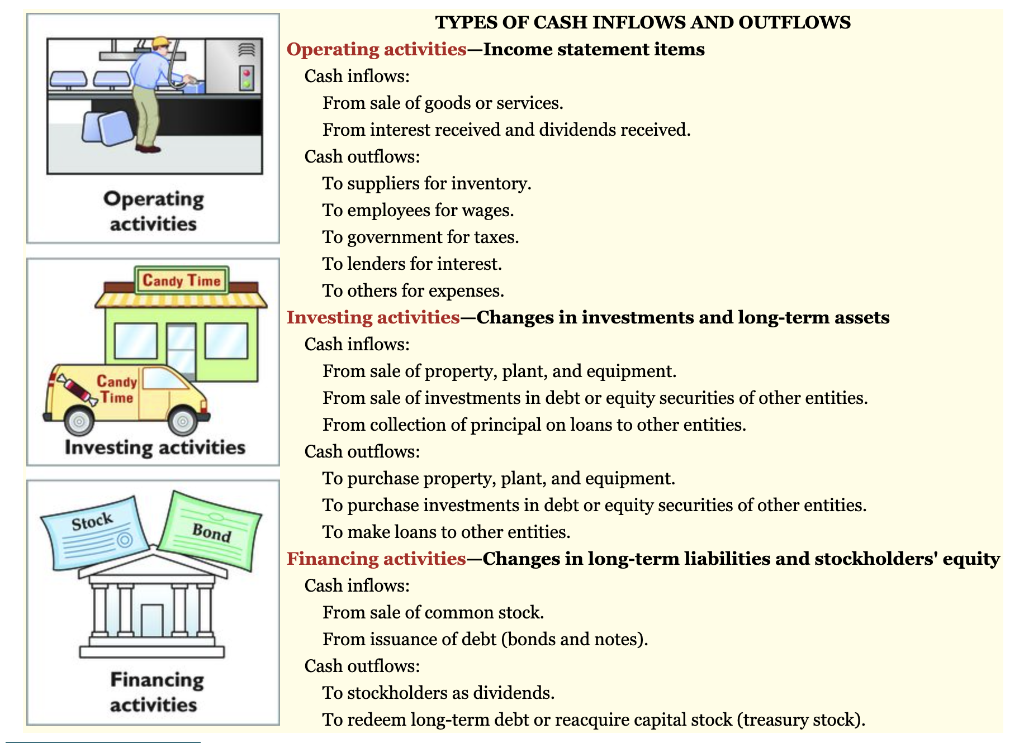

Compared to the statement of cash flows discussed in chapter 12 in accordance to U.S. GAAP (Figure 12.1): Make one initial post to identify and

Compared to the statement of cash flows discussed in chapter 12 in accordance to U.S. GAAP (Figure 12.1):

- Make one initial post to identify and explain (1) one similarity and (2) one difference in the classification of cash flow activities. (Hint: Look in the investing activities section or the financing activities section because the operating activities are prepared using the "indirect method" that you don't need to know. Don't waste time trying to understand the items that you are not familiar. Focus on those discussed in chapter 12. For example, for similarity: "Purchase of property, plant and equipment" is classified as an investing activity under GAAP and it is also classified as an investing activity under IFRS. This is because property, plant, and equipment are long-term assets. Do NOT use this example in your post. Also, do not search Internet, this is NOT a discussion on the differences between IFRS and GAAP in general.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started