Answered step by step

Verified Expert Solution

Question

1 Approved Answer

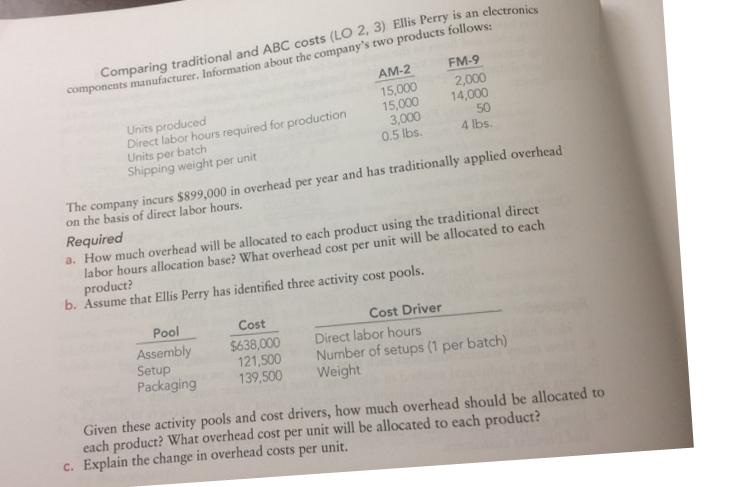

Comparing traditional and ABC costs (LO 2, 3) Ellis Perry is an electronics components manufacturer. Information abour the company's two products follows: AM-2 FM-9

Comparing traditional and ABC costs (LO 2, 3) Ellis Perry is an electronics components manufacturer. Information abour the company's two products follows: AM-2 FM-9 15,000 15,000 3,000 0.5 lbs. 2,000 14,000 50 4 lbs. Units produced Direct labor hours required for production Units per batch Shipping weight per unit The company incurs $899,000 in overhead per year and has traditionally applied overhead on the basis of direct labor hours. Required a. How much overhead will be allocated to each product using the traditional direct labor hours allocation base? What overhead cost per unit will be allocated to each product? b. Assume that Ellis Perry has identified three activity cost pools. Pool Assembly Setup Packaging Cost Cost Driver $638,000 121,500 139,500 Direct labor hours Number of setups (1 per batch) Weight Given these activity pools and cost drivers, how much overhead should be allocated to each product? What overhead cost per unit will be allocated to each product? c. Explain the change in overhead costs per unit.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Payment rate Number of headers Total number of hours 89900015000 14000 31 per hour More than AM2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started