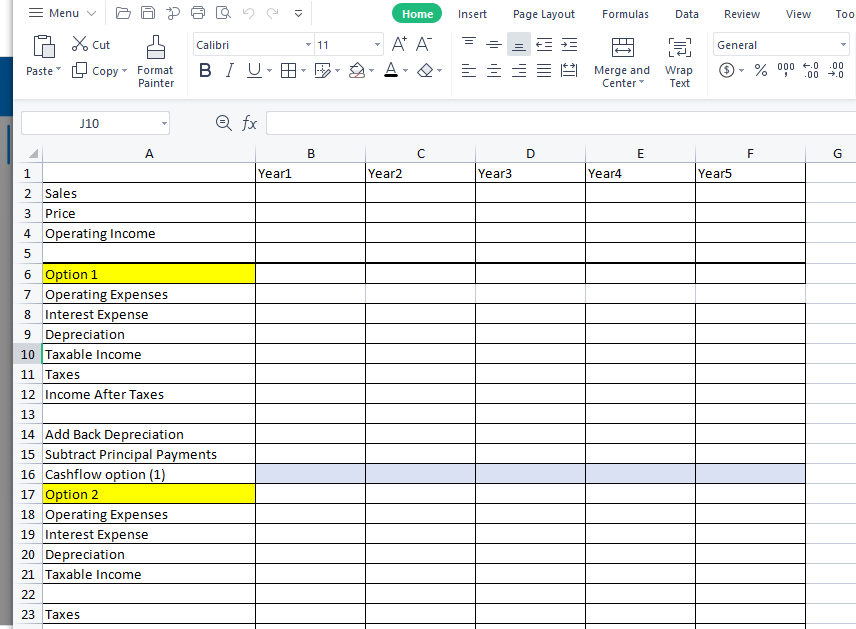

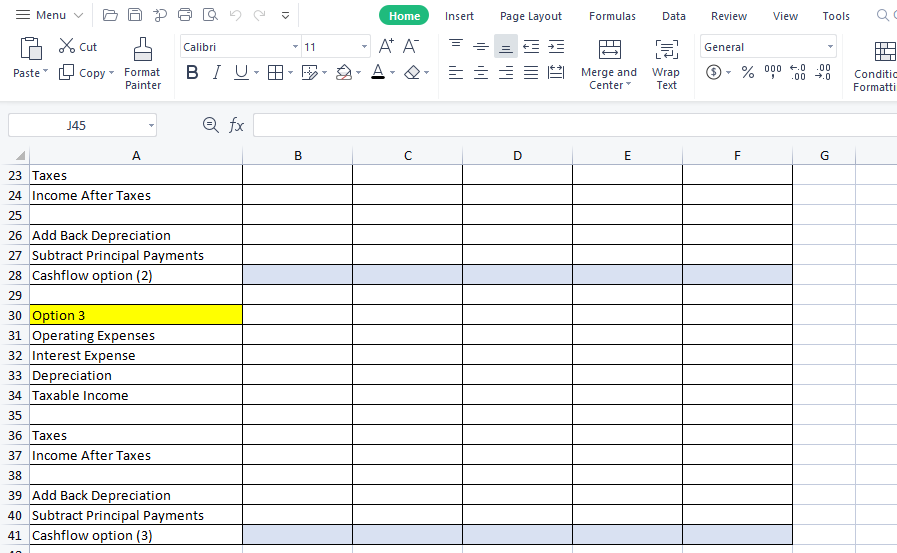

Comparison ofCashflow for three different options A manufacturerhasdecided to expand its business. They need 15vehicles forthe logistic operationline. They areconsidering three different options for thetransportationsand logistics lines in operations (1) Outsourcing transportation manufacturing groupp ay $6,000,000 annuallyin transportation vehiclesfees foryear. These costs areexpectadto rise atananmalrateof5%. So,in yearl, the costis expected to be 56 millionplus anadditional 5%. Allcosts areconsideradas operatingexpenses, whichcanbe used to reducein come forpurposes ofcalculating taxes. (2) Purchasing transportation vehicles The costofpurchasingeachtransportation vehicles is $1,000,000which should be spentin year 0.Indoing so, themanufacturer should get a loan. HSBCB ankhas approved the loan and offered 5% annual interestratecompounded quarterly overthe next fiveyears. Thepaymentsare being processedat theendo feachperiod. Purchased vehicleswouldbedepreciatedusing straightlinedepreciation over thefullfive-yearperiod, assuminga salvagevaheof 10%ofthe original purchaseprice. (3) Leasing transportation vehicles The manufacturerleasesvehicles with a flatfeeof$ 350,000 pervehiclefor eachofthenextfive years. The costofleaseis corsidered as operatingex perses. The selldata is givenas bellow: Year1 Year 2 Year3 Yeard Years Sales Volume 87,000 82,000 95,000 97,000 101,000 Selling Price 2400 2400 2400 2400 2400 Taxis 35%andisnotchanging overtheperiods. - Open thecashflowexcelfileandcalculated thecashflows foreach option over theperiod ofyearl toyears. Highlighttheoption with highest cashflows. - Allvalues should bein accounting formatwithnodecimal. Use definingnamestod in excelfortaxandelements ofdepreciations Financialfunction leamtin chapter 6 shouldbeusewhereapplicable Operating Income=Sales volume Selling Price Taxable incomz=0perating Income- (Operating expenses-interestexpenses-depreciations) 7 = Menu P 0.) 2 Home Insert Page Layout Formulas Data Review View Too X Cut Calibri 11 * = a General Paste copy - Format Painter BI U - lil 9 Merge and Center Wrap Text - % 0000 .00 .00 0 J10 Q fx A B C D E F G 1 Year1 Year2 Year3 Year4 Year5 2 Sales 3 Price 4 Operating Income 5 6 Option 1 7 Operating Expenses 8 Interest Expense 9 Depreciation 10 Taxable income 11 Taxes 12 Income After Taxes 13 14 Add Back Depreciation 15 Subtract Principal Payments 16 Cashflow option (1) 17 Option 2 18 Operating Expenses 19 Interest Expense 20 Depreciation 21 Taxable income 22 23 Taxes = Menu 0 5 KI Home Insert Page Layout Formulas Data Review View Tools o Q Cut = Calibri 11 AA General I Pastecopy - Format Painter + 1 Merge and Center BI U 2 Wrap Text - % 000 .00 .00 0 Conditic Formatti J45 Q fx A B C D E F G 23 Taxes 24 Income After Taxes 25 26 Add Back Depreciation 27 Subtract Principal Payments 28 Cashflow option (2) 29 30 Option 3 31 Operating Expenses 32 Interest Expense 33 Depreciation 34 Taxable income 35 36 Taxes 37 Income After Taxes 38 39 Add Back Depreciation 40 Subtract Principal Payments 41 Cashflow option (3) Comparison ofCashflow for three different options A manufacturerhasdecided to expand its business. They need 15vehicles forthe logistic operationline. They areconsidering three different options for thetransportationsand logistics lines in operations (1) Outsourcing transportation manufacturing groupp ay $6,000,000 annuallyin transportation vehiclesfees foryear. These costs areexpectadto rise atananmalrateof5%. So,in yearl, the costis expected to be 56 millionplus anadditional 5%. Allcosts areconsideradas operatingexpenses, whichcanbe used to reducein come forpurposes ofcalculating taxes. (2) Purchasing transportation vehicles The costofpurchasingeachtransportation vehicles is $1,000,000which should be spentin year 0.Indoing so, themanufacturer should get a loan. HSBCB ankhas approved the loan and offered 5% annual interestratecompounded quarterly overthe next fiveyears. Thepaymentsare being processedat theendo feachperiod. Purchased vehicleswouldbedepreciatedusing straightlinedepreciation over thefullfive-yearperiod, assuminga salvagevaheof 10%ofthe original purchaseprice. (3) Leasing transportation vehicles The manufacturerleasesvehicles with a flatfeeof$ 350,000 pervehiclefor eachofthenextfive years. The costofleaseis corsidered as operatingex perses. The selldata is givenas bellow: Year1 Year 2 Year3 Yeard Years Sales Volume 87,000 82,000 95,000 97,000 101,000 Selling Price 2400 2400 2400 2400 2400 Taxis 35%andisnotchanging overtheperiods. - Open thecashflowexcelfileandcalculated thecashflows foreach option over theperiod ofyearl toyears. Highlighttheoption with highest cashflows. - Allvalues should bein accounting formatwithnodecimal. Use definingnamestod in excelfortaxandelements ofdepreciations Financialfunction leamtin chapter 6 shouldbeusewhereapplicable Operating Income=Sales volume Selling Price Taxable incomz=0perating Income- (Operating expenses-interestexpenses-depreciations) 7 = Menu P 0.) 2 Home Insert Page Layout Formulas Data Review View Too X Cut Calibri 11 * = a General Paste copy - Format Painter BI U - lil 9 Merge and Center Wrap Text - % 0000 .00 .00 0 J10 Q fx A B C D E F G 1 Year1 Year2 Year3 Year4 Year5 2 Sales 3 Price 4 Operating Income 5 6 Option 1 7 Operating Expenses 8 Interest Expense 9 Depreciation 10 Taxable income 11 Taxes 12 Income After Taxes 13 14 Add Back Depreciation 15 Subtract Principal Payments 16 Cashflow option (1) 17 Option 2 18 Operating Expenses 19 Interest Expense 20 Depreciation 21 Taxable income 22 23 Taxes = Menu 0 5 KI Home Insert Page Layout Formulas Data Review View Tools o Q Cut = Calibri 11 AA General I Pastecopy - Format Painter + 1 Merge and Center BI U 2 Wrap Text - % 000 .00 .00 0 Conditic Formatti J45 Q fx A B C D E F G 23 Taxes 24 Income After Taxes 25 26 Add Back Depreciation 27 Subtract Principal Payments 28 Cashflow option (2) 29 30 Option 3 31 Operating Expenses 32 Interest Expense 33 Depreciation 34 Taxable income 35 36 Taxes 37 Income After Taxes 38 39 Add Back Depreciation 40 Subtract Principal Payments 41 Cashflow option (3)