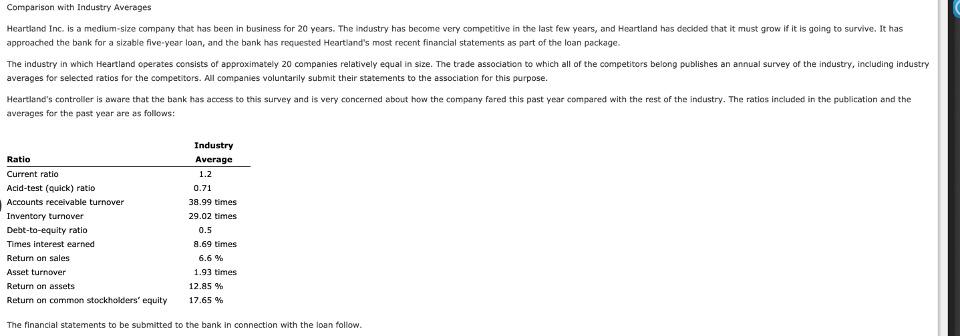

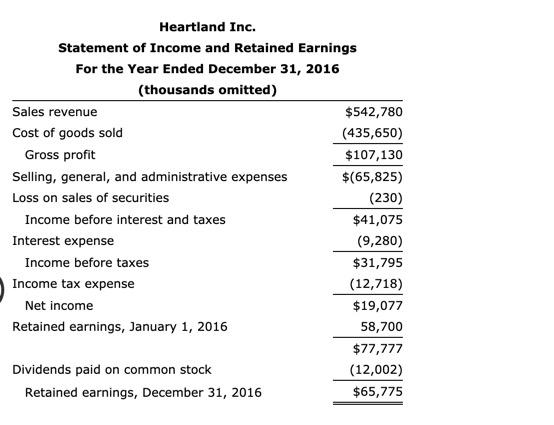

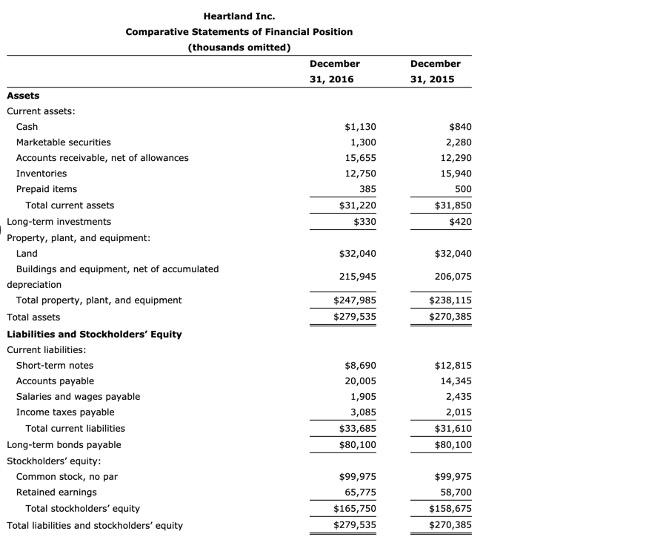

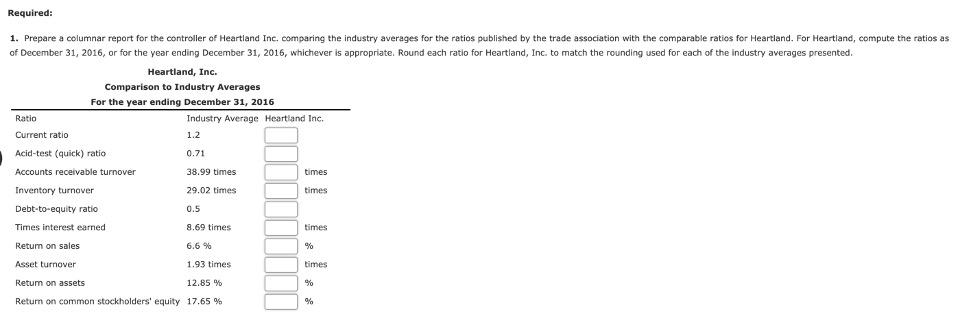

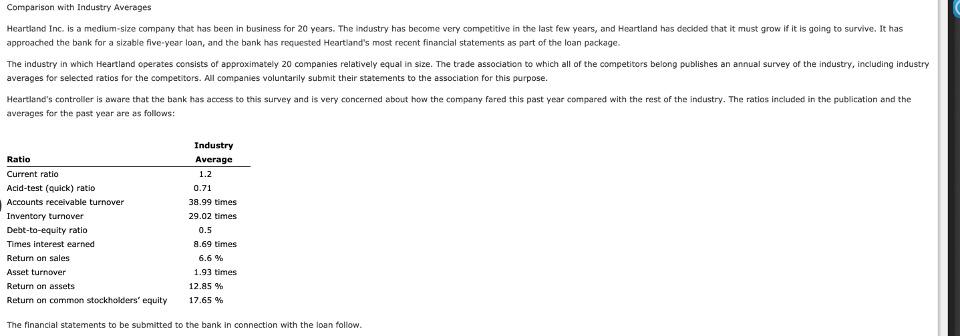

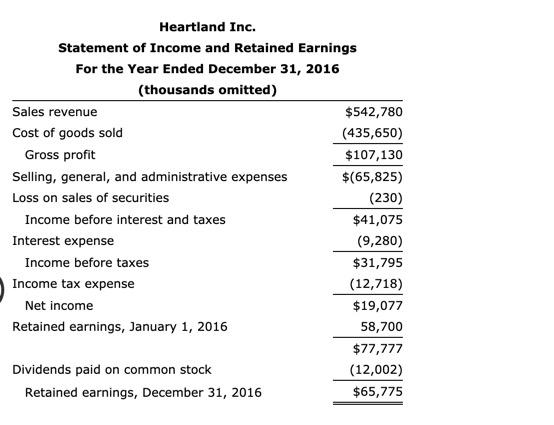

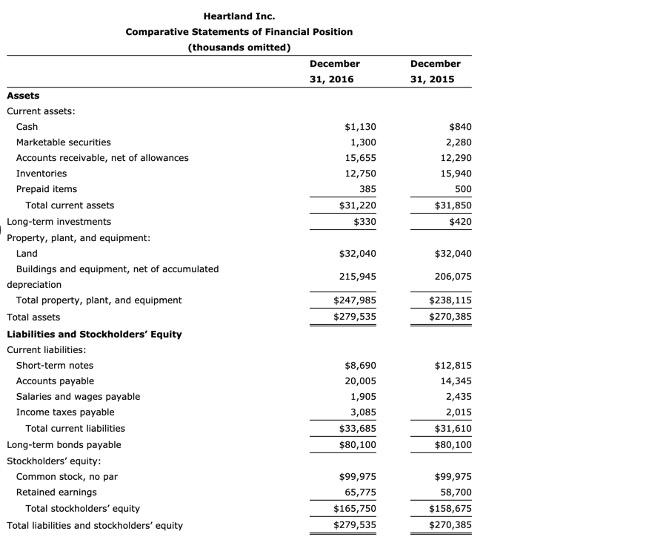

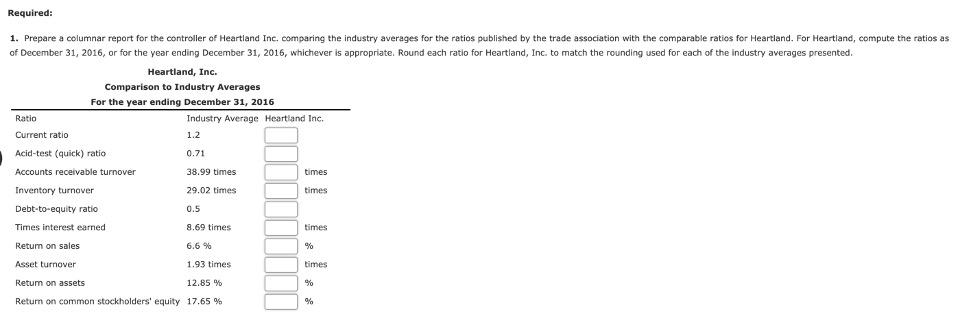

Comparison with Industry Averages Heartland Inc. is a medium-size company that has been in business for 20 years. The industry has become very competitive in the last few years, and Heartland has decided that it must grow if it is going to survive. It has approached the bank for a sizable five-year loan, and the bank has requested Heartland's most recent financial statements as part of the loan package. The industry in which Heartland operates consists of approximately 20 companies relatively equal in size. The trade association to which all of the competitors belong publishes an annual survey of the industry, including industry averages for selected ratios for the competitors. All companies voluntarily submit their statements to the association for this purpose. Heartland's controller is aware that the bank has access to this survey and is very concerned about how the company fared this past year compared with the rest of the industry. The ratios included in the publication and the averages for the past year are as follows: Ratio Current ratio Acid-test (quick) ratio Accounts receivable turnover Inventory turnover Debt-to-equity ratio Times interest earned Return on sales Asset turnover Return on assets Return on common stockholders' equity Industry Average 1.2 0.71 38.99 times 29.02 times 0.5 2.69 times 6.6% 1.93 times 12.85 % 17.65 % The financial statements to be submitted to the bank in connection with the loan follow Heartland Inc. Statement of Income and Retained Earnings For the Year Ended December 31, 2016 (thousands omitted) Sales revenue $542,780 Cost of goods sold (435,650) Gross profit $107,130 Selling, general, and administrative expenses $(65,825) Loss on sales of securities (230) Income before interest and taxes $41,075 Interest expense (9,280) Income before taxes $31,795 Income tax expense (12,718) Net income $19,077 Retained earnings, January 1, 2016 58,700 $77,777 Dividends paid on common stock (12,002) Retained earnings, December 31, 2016 $65,775 Heartland Inc. Comparative Statements of Financial Position (thousands omitted) December 31, 2016 December 31, 2015 Assets $1,130 1,300 15,655 12,750 385 $31,220 $330 $840 2,280 12,290 15,940 500 $31,850 $420 $32,040 $32,040 215,945 206,075 Current assets: Cash Marketable securities Accounts receivable, net of allowances Inventories Prepaid items Total current assets Long-term investments Property, plant, and equipment: Land Buildings and equipment, net of accumulated depreciation Total property, plant, and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Short-term notes Accounts payable Salaries and wages payable Income taxes payable Total current liabilities Long-term bonds payable Stockholders' equity: Common stock, no par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $247,985 $279,535 $238,115 $270,385 $8,690 20,005 1,905 3,085 $33,685 $80,100 $12,815 14,345 2,435 2,015 $31,610 $80,100 $99,975 65,775 $165,750 $279,535 $99,975 58,700 $158,675 $270,385 Required: 1. Prepare a columnar report for the controller of Heartland Inc. comparing the industry averages for the ratios published by the trade association with the comparable ratios for Heartland. For Heartland, compute the ratios as of December 31, 2016, or for the year ending December 31, 2016, whichever is appropriate. Round each ratio for Heartland, Inc. to match the rounding used for each of the industry averages presented. Heartland, Inc. Comparison to Industry Averages For the year ending December 31, 2016 Ratio Industry Average Heartland Inc. Current ratio 1.2 Acid-test (quick) ratio 0.71 Accounts receivable turnover 38.99 times times Inventory turnover 29.02 times times Debt-to-equity ratio 0.5 Times interest earned 8.69 times times Return on sales 6.6% % Asset turnover 1.93 times times Retum on assets 12.85% Return on common stockholders' equity 17.65% %