Answered step by step

Verified Expert Solution

Question

1 Approved Answer

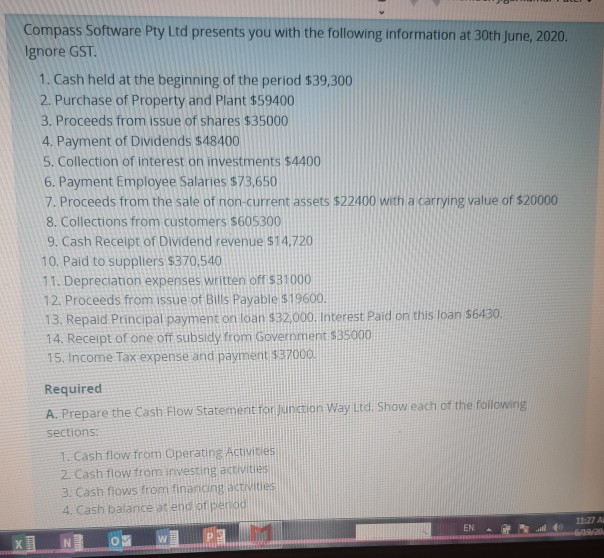

Compass Software Pty Ltd presents you with the following information at 30th June, 2020. Ignore GST. 1. Cash held at the beginning of the period

Compass Software Pty Ltd presents you with the following information at 30th June, 2020. Ignore GST. 1. Cash held at the beginning of the period $39,300 2. Purchase of Property and Plant $59400 3. Proceeds from issue of shares $35000 4. Payment of Dividends $48400 5. Collection of interest on investments $4400 6. Payment Employee Salaries $73,650 7. Proceeds from the sale of non-current assets $22400 with a carrying value of $20000 8. Collections from customers $605300 9. Cash Receipt of Dividend revenue $14,720 10. Paid to suppliers $370,540 11. Depreciation expenses written off $31000 12. Proceeds from issue of Bills Payable $19600. 13. Repaid Principal payment on loan $32,000. Interest Paid on this loan $6430. 14. Receipt of one off subsidy from Government S35000 15. Income Tax expense and payment 37000 Required A. Prepare the Cash Flow Statement Tonjunction Way itd. Show each of the following sections: 1. cash flow from Operating Activities 2. Cash flow from investing activities 3. Cash flows from financing activities 4. Cash balance at end of end EN . 11:27 A G/19/20 O w

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started