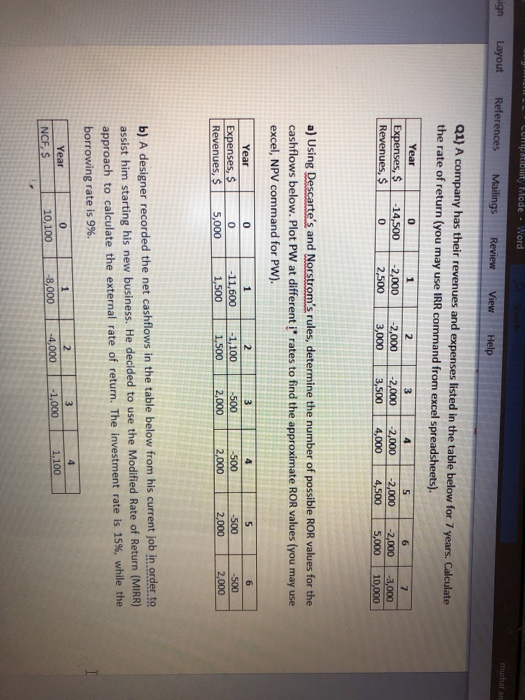

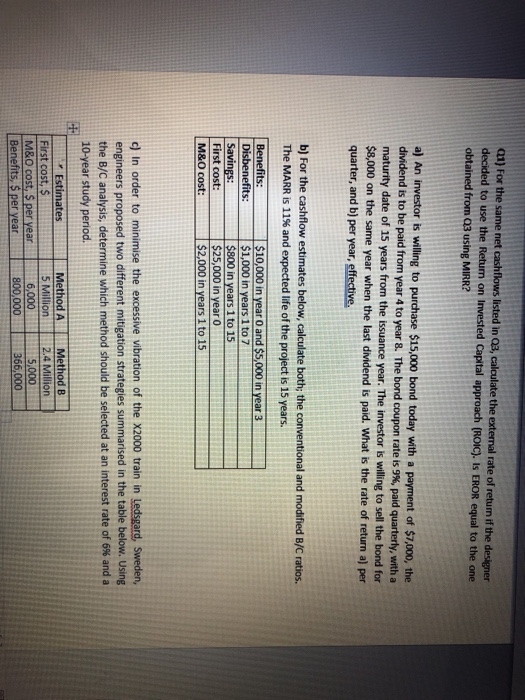

compatibility Mode - Word ign Layout References Mailings Review View Help Q1) A company has their revenues and expenses listed in the table below for 7 years. Calculate the rate of return (you may use IRR command from excel spreadsheets). 4 Year Expenses, $ Revenues, $ 0 -14,500 0 2,000 00 2 2,000 3,000 -2,000 3,500 2,000 4,000 2,000 4,500 -2,000 5,000 3,000 10,000 a) Using Descarte's and Norstrom's rules, determine the number of possible ROR values for the cashflows below. Plot PW at different i* rates to find the approximate ROR values (you may use excel, NPV command for PW). Year Expenses, $ Revenues, $ 0 0 5,000 -SUO -11,600 1.500 -1,100 1,500 -500 2,000 S -500 2,000 2,0 2,000 -500 2,000 1 b) A designer recorded the net cashflows in the table below from his current job in order to assist him starting his new business. He decided to use the Modified Rate of Return (MIRR) approach to calculate the external rate of return. The investment rate is 15%, while the borrowing rate is 9%. 1 2 0 Year NCF, S 1.100 10,100 -8,000 -4,000 -1,000 1,100 a) For the same net cashflows listed in Q3, calculate the external rate of return if the designer decided to use the Return on invested Capital approach (ROIC). IS EROR equal to the one obtained from 03 using MIRR? a) An investor is willing to purchase $15,000 bond today with a payment of $7,000, the dividend is to be paid from year 4 to year 8. The bond coupon rate is 9%, paid quarterly, with a maturity date of 15 years from the issuance year. The investor is willing to sell the bond for $8,000 on the same year when the last dividend is paid. What is the rate of return a) per quarter, and b) per year, effective. b) For the cashflow estimates below, calculate both; the conventional and modified B/C ratios. The MARR is 11% and expected life of the project is 15 years. Benefits: Disbenefits: Savings: First cost: M&O cost: $10,000 in year 0 and $5,000 in year 3 $1,000 in years 1 to 7 $800 in years 1 to 15 $25,000 in year 0 $2,000 in years 1 to 15 c) In order to minimise the excessive vibration of the X2000 train in Ledsgard, Sweden, engineers proposed two different mitigation strategies summarised in the table below. Using the B/C analysis, determine which method should be selected at an interest rate of 6% and a 10-year study period. Estimates First cost, $ M&O cost, $ per year Benefits, $ per year Method A 5 Million 6,000 800,000 Method B 2.4 Million 5,000 366,000