Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compensatory stock options were granted to executives on January 1, year 1, for services to be rendered during year 1, year 2, and year 3.

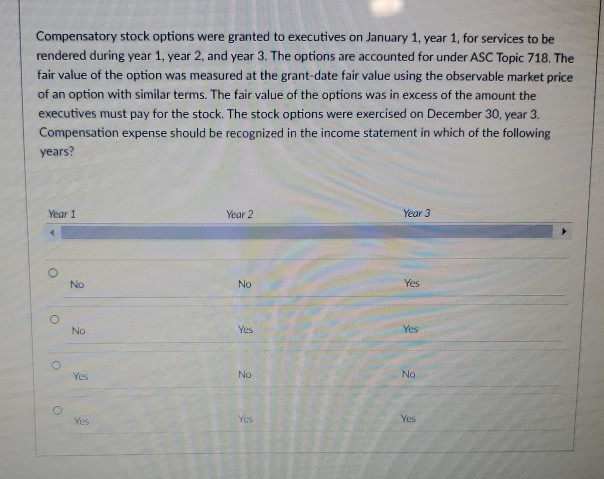

Compensatory stock options were granted to executives on January 1, year 1, for services to be rendered during year 1, year 2, and year 3. The options are accounted for under ASC Topic 718. The fair value of the option was measured at the grant-date fair value using the observable market price of an option with similar terms. The fair value of the options was in excess of the amount the executives must pay for the stock. The stock options were exercised on December 30, year 3. Compensation expense should be recognized in the income statement in which of the following years? Year 1 Year 2 Year 3 No No Yes No Yes Yes Yes No No Ves Yes Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started