Competency In this project, you will demonstrate your mastery of the following competency: Apply accounting principles and methods to a variety of financial reporting situations

Competency

In this project, you will demonstrate your mastery of the following competency:

- Apply accounting principles and methods to a variety of financial reporting situations

Overview

It is important for a company to disclose the quantitative information as well as the qualitative information. Transactions often occur over the period that may not have a direct financial impact, however, are still important to disclose to stakeholders.

Directions

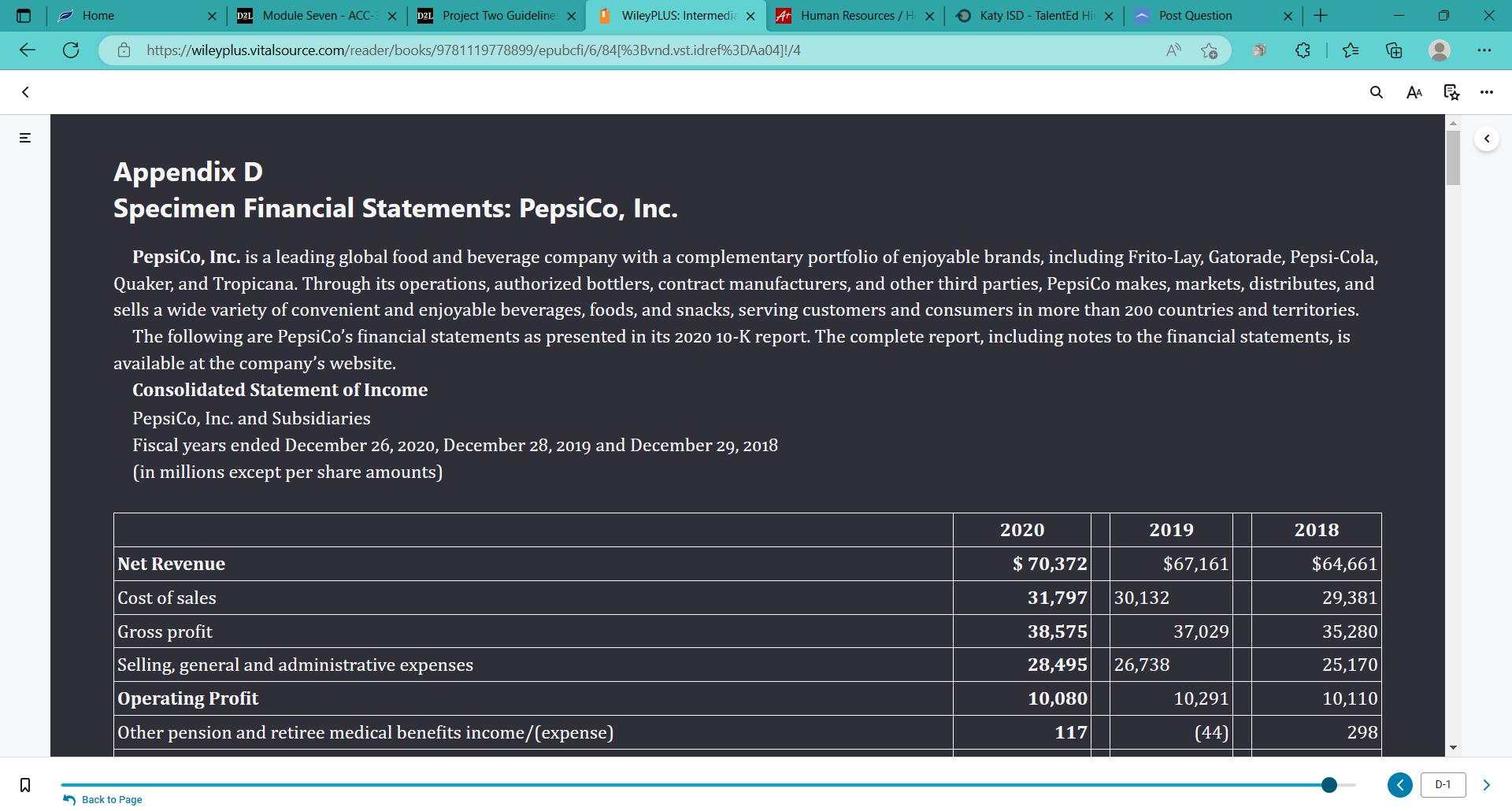

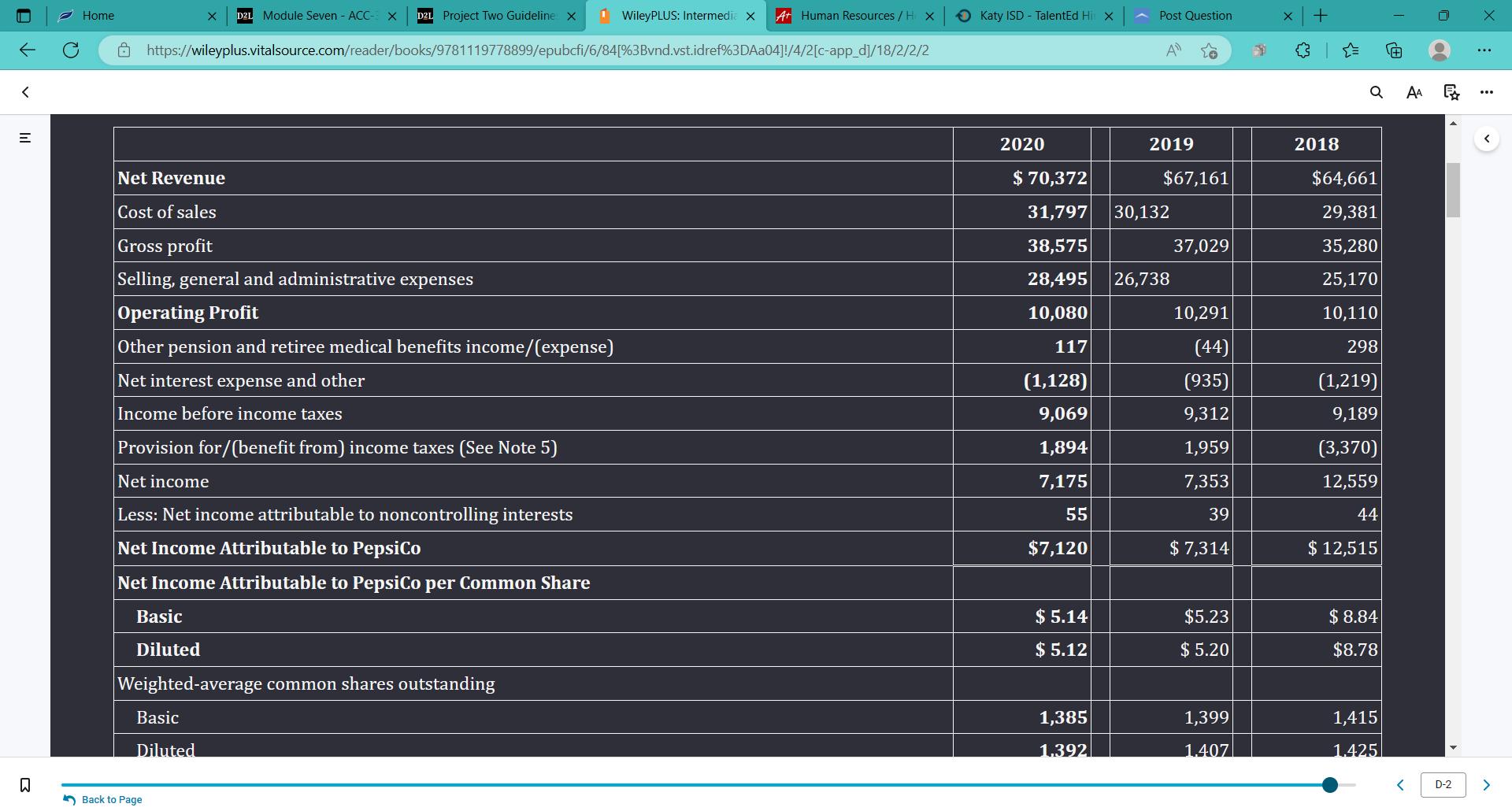

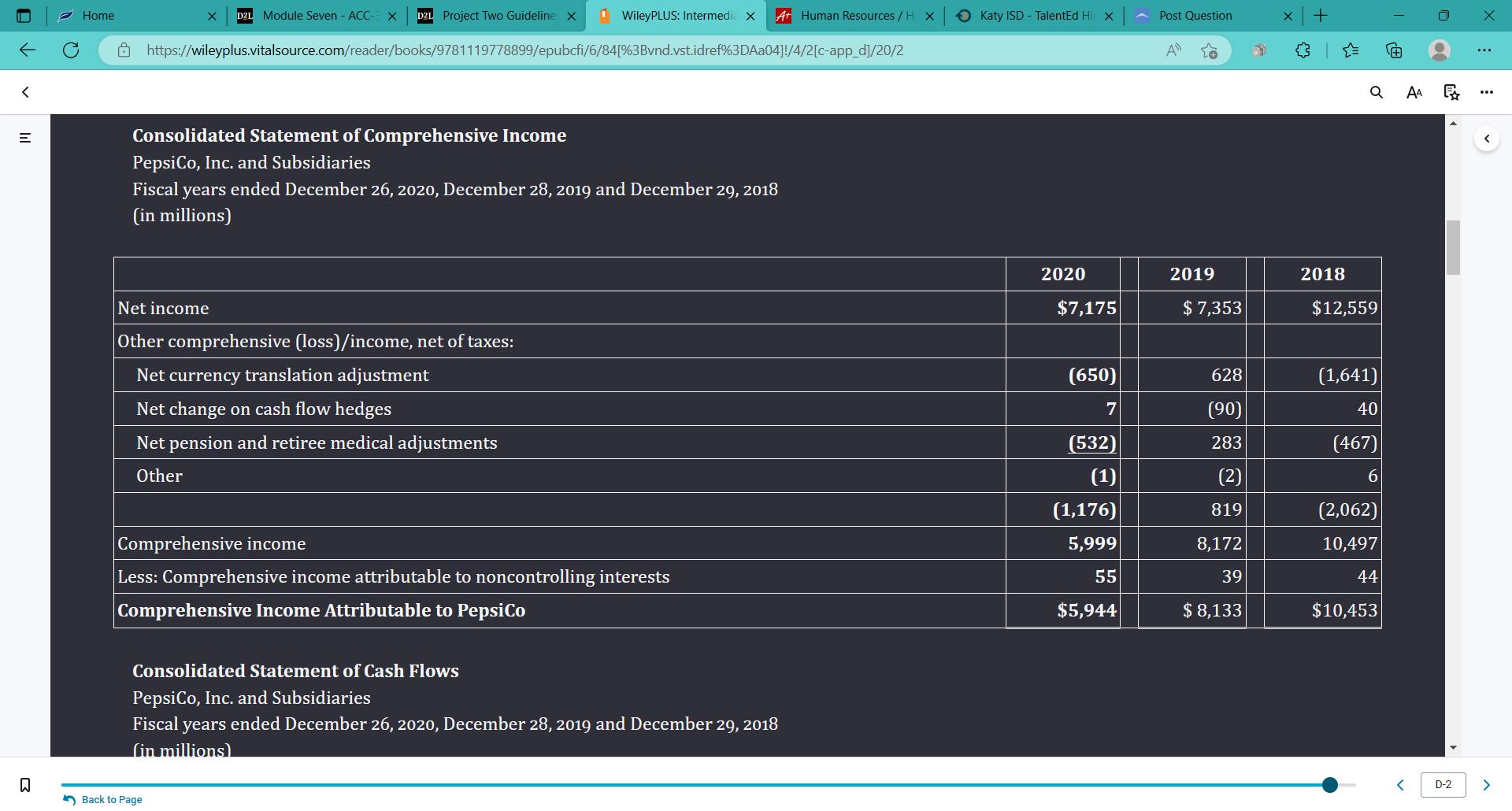

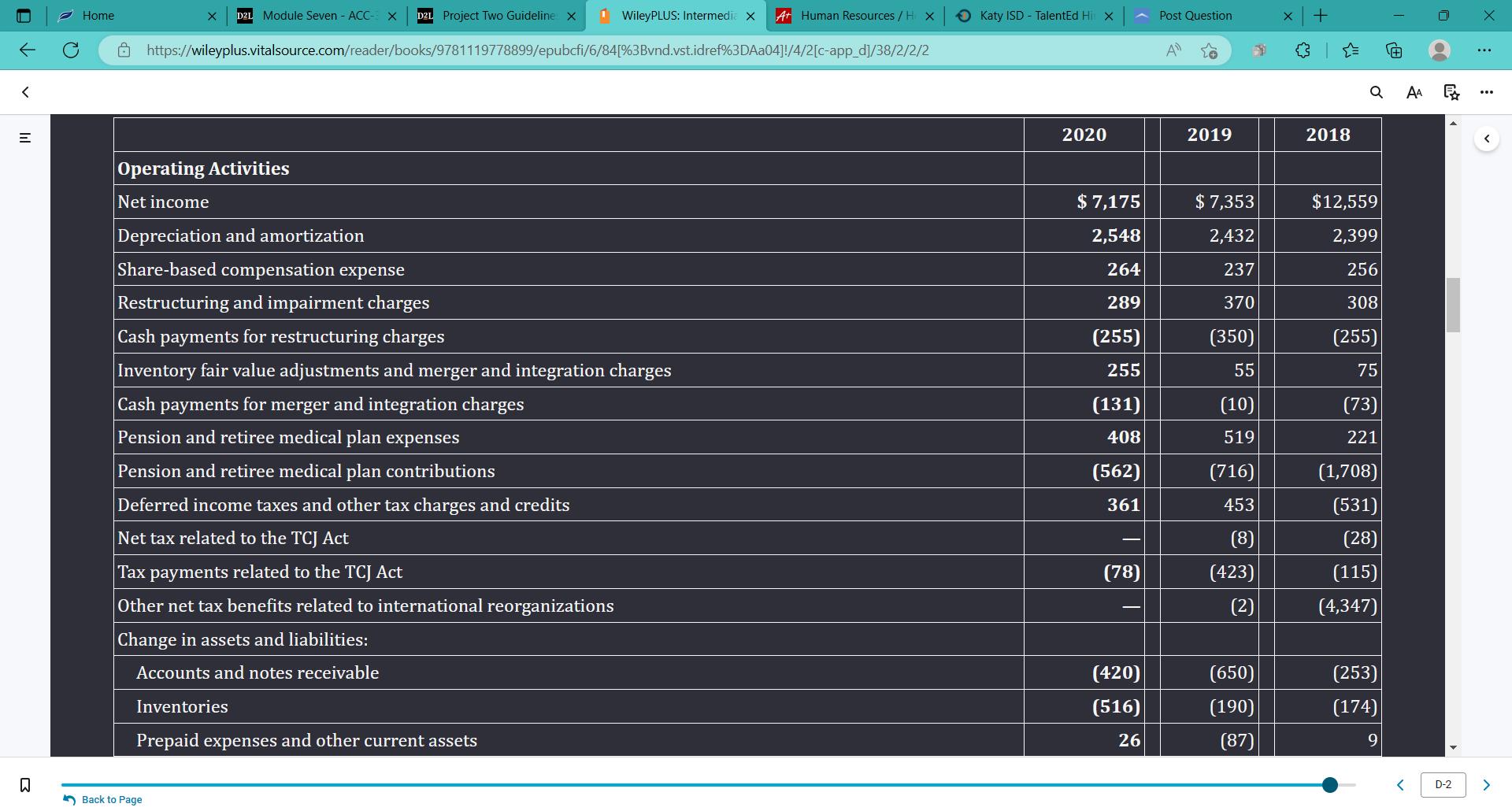

For this assignment, you will choose to review the 10-K for either The Coca-Cola Company or PepsiCo, Inc., and use that company for this entire project. As you work through this project, you will be considering the necessity of full disclosures.

Specifically, you must address the following rubric criteria:

Disclosure

Explain the importance of the full disclosure principle.

Provide a rationale for disclosing financial information to stakeholders in a variety of financial reporting situations.

Specific Financials of a Given Company

Use the financials of either The Coca-Cola Company or PepsiCo, Inc. The company you choose should be used to address the following:

Explain the disclosure requirements for related-party transactions. Include the following details in your response:

Cite the codification section applicable in your answer.

Identify the type of information that is required or important to disclose for these types of common transactions.

Explain the disclosure requirements for contingent liabilities. Include the following details in your response:

Cite the codification section applicable in your answer.

Identify the type of information that is required or important to disclose for these types of common transactions.

Explain the disclosure requirements for subsequent events. Include the following details in your response:

Cite the codification section applicable in your answer.

Identify the type of information that is required or important to disclose for these types of common transactions.

Explain the disclosure requirements for major business segments. Include the following details in your response:

Cite the codification section applicable in your answer.

Identify the type of information that is required or important to disclose for these types of common transactions.

Explain the disclosure requirements for interim reporting. Include the following details in your response:

Cite the codification section applicable in your answer.

Identify the type of information that is required or important to disclose for these types of common transactions.

Accounting Change and Error Correction

Use the financials of either The Coca-Cola Company or Pepsi Co, Inc. The company you choose should be to address the following:

Determine the impact on a company for an accounting change. Consider the following question to guide your response:

How do companies account for accounting changes? For example, if the company changed from one GAAP method to another (e.g., LIFO to FIFO for inventory valuation).

Determine the impact that an error correction can have on a company. Consider the following questions to guide your response:

What are the effects of errors on the financial statements?

If there was an Excel calculation error in a spreadsheet calculating the depreciation expense for all the property, plant and equipment that resulted in $3 million less expense, how would this be corrected?

What to Submit

Submit your project as a 3- to 5-page Microsoft Word document with double spacing, 12-point Times New Roman font, and one-inch margins. Sources should be cited according to APA style.

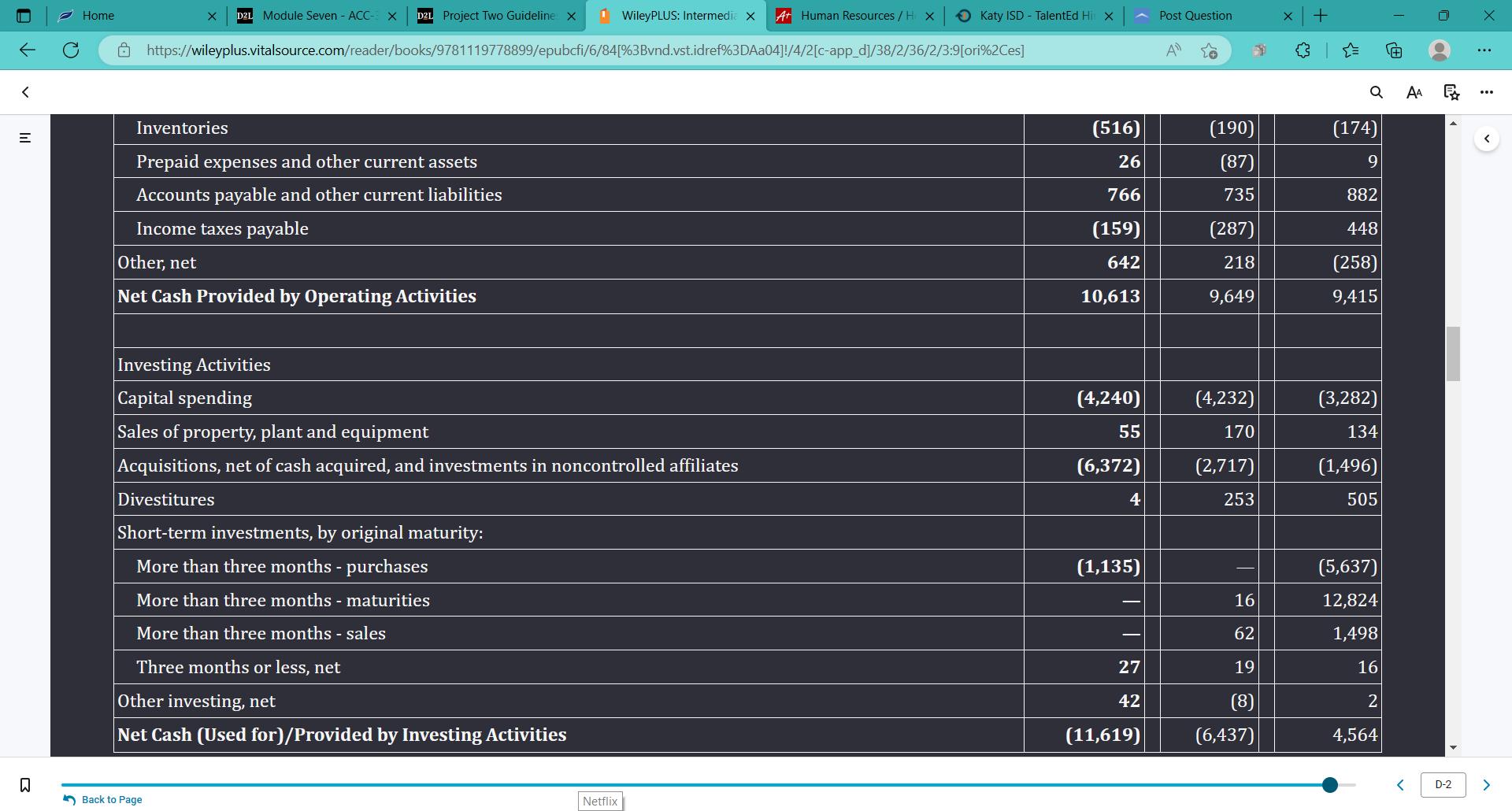

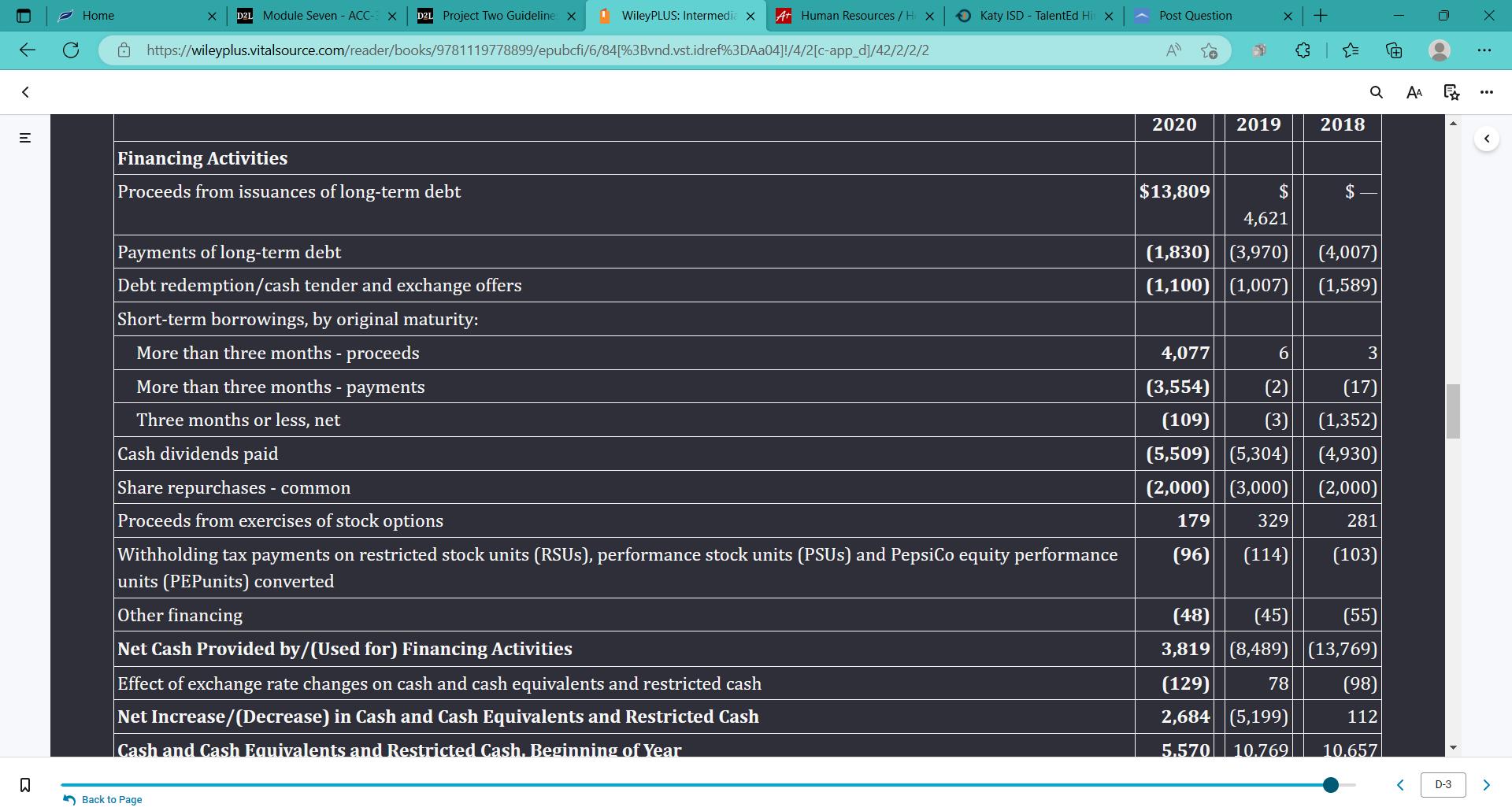

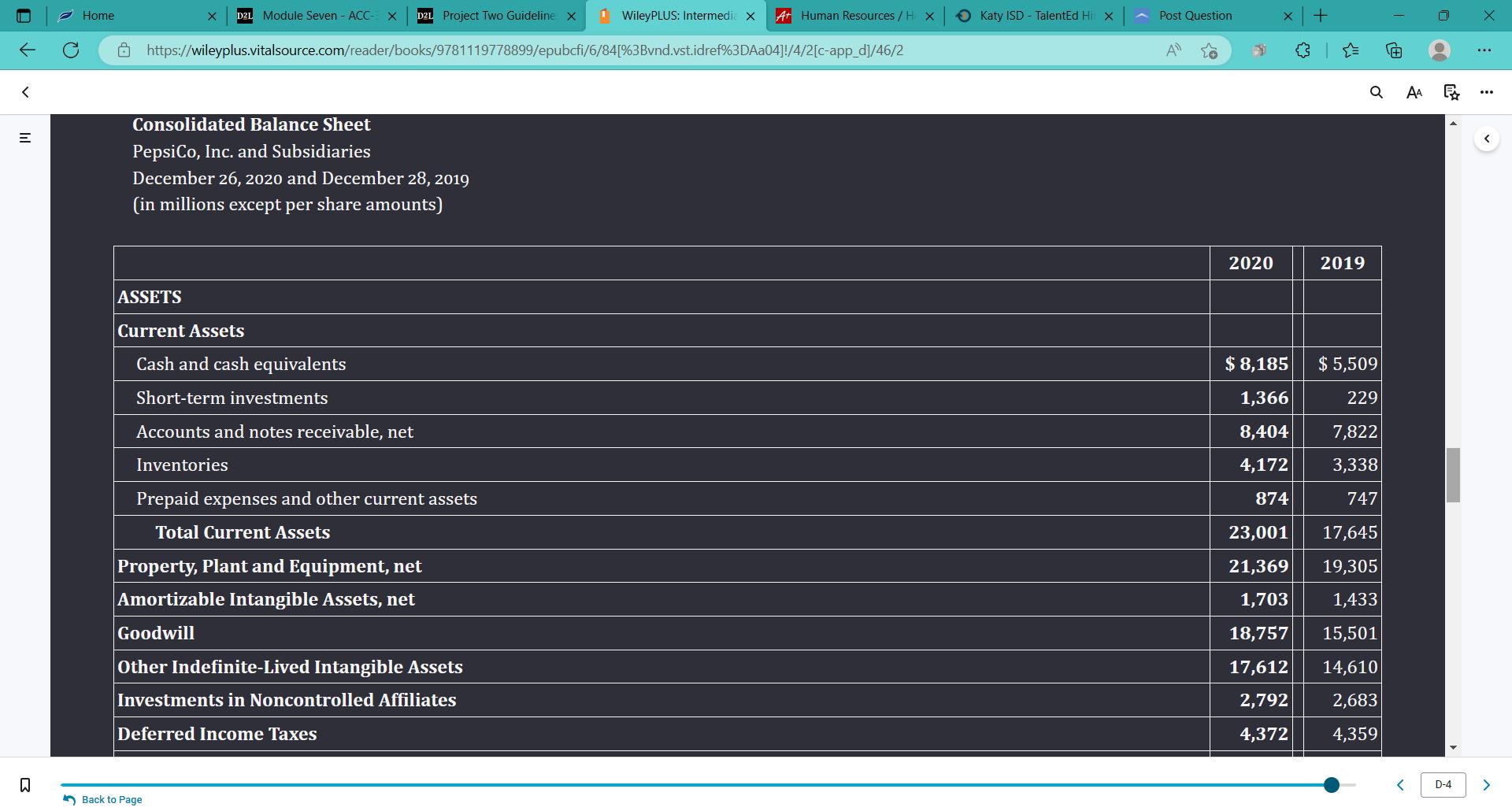

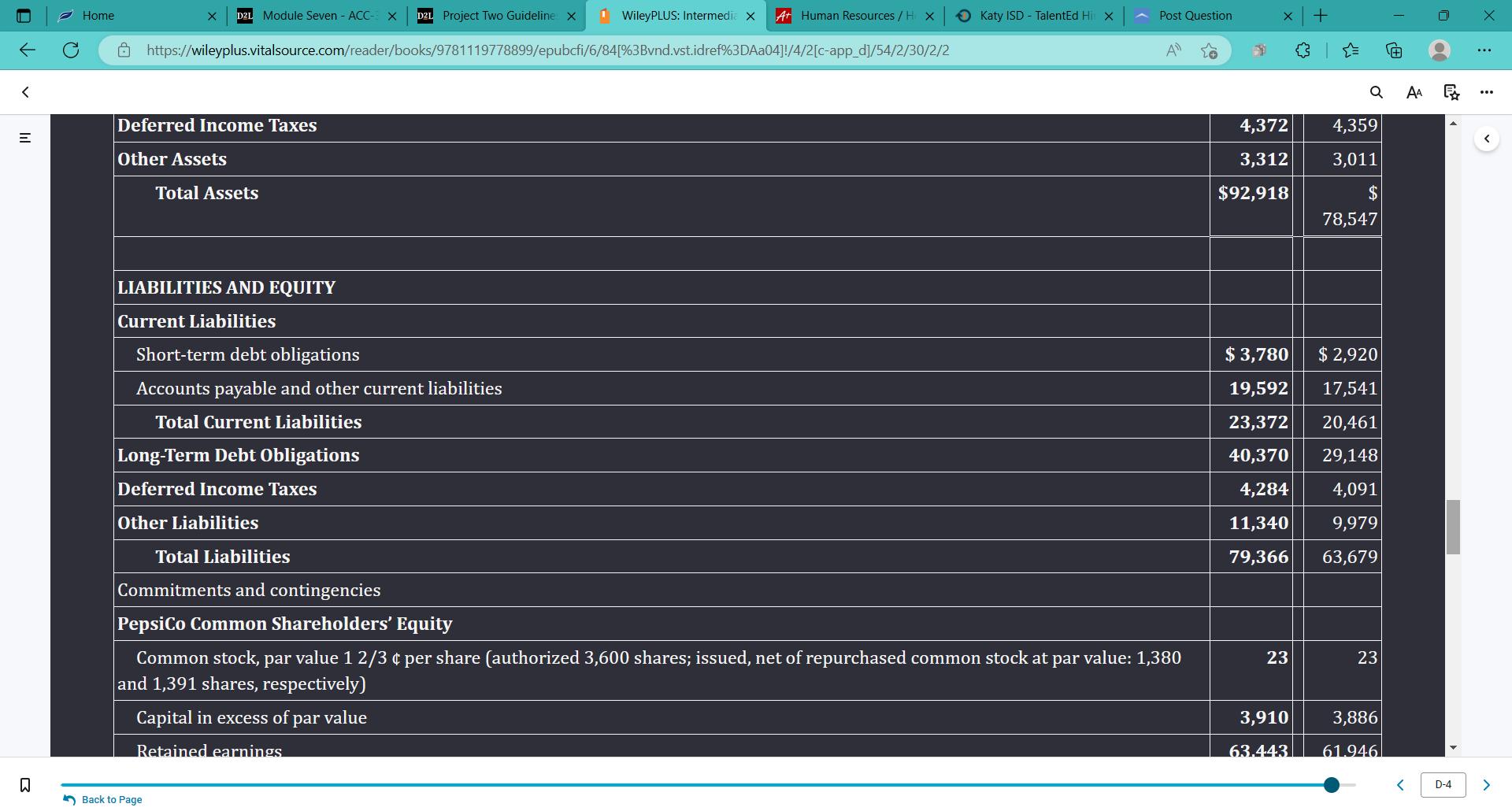

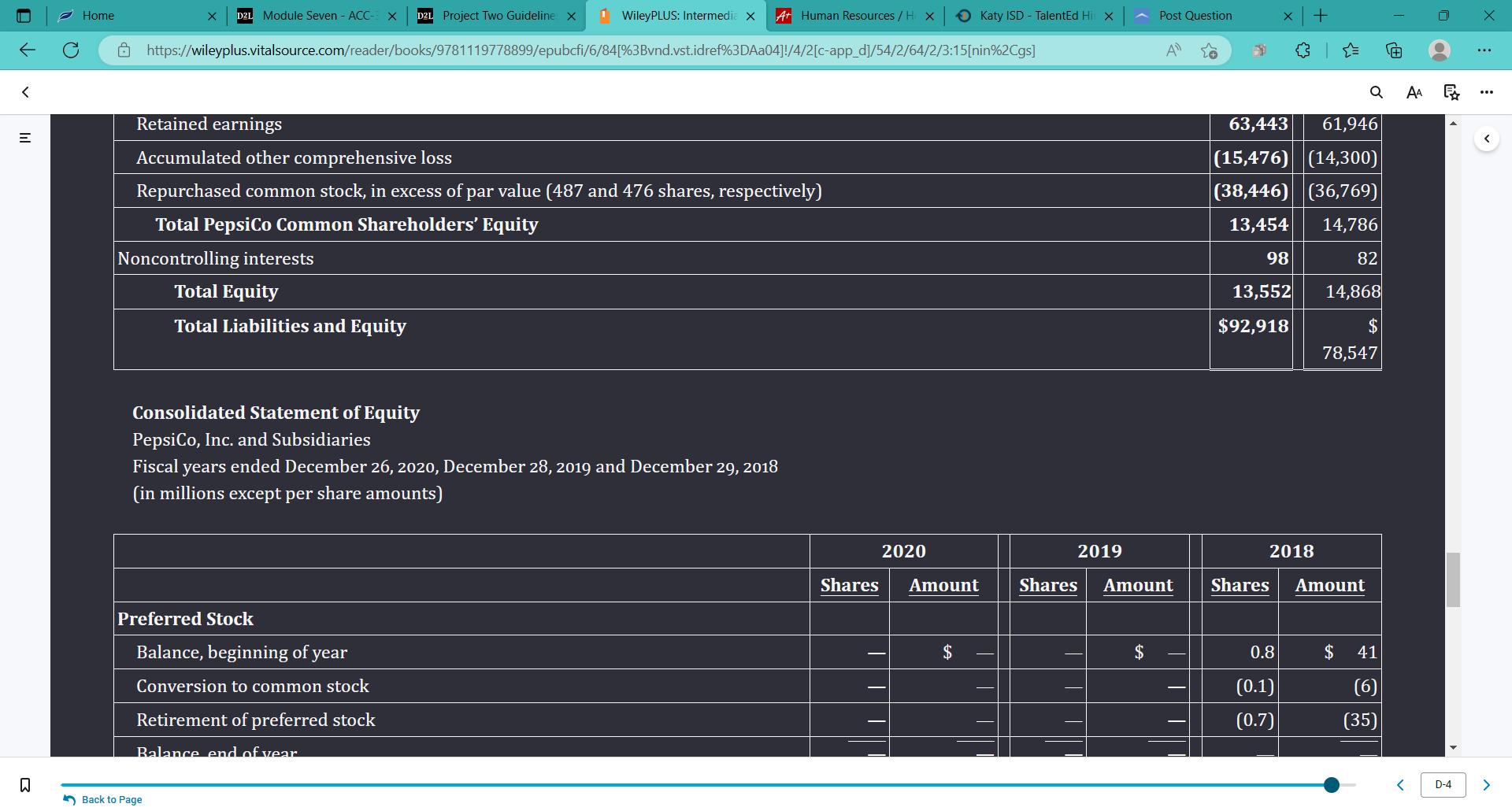

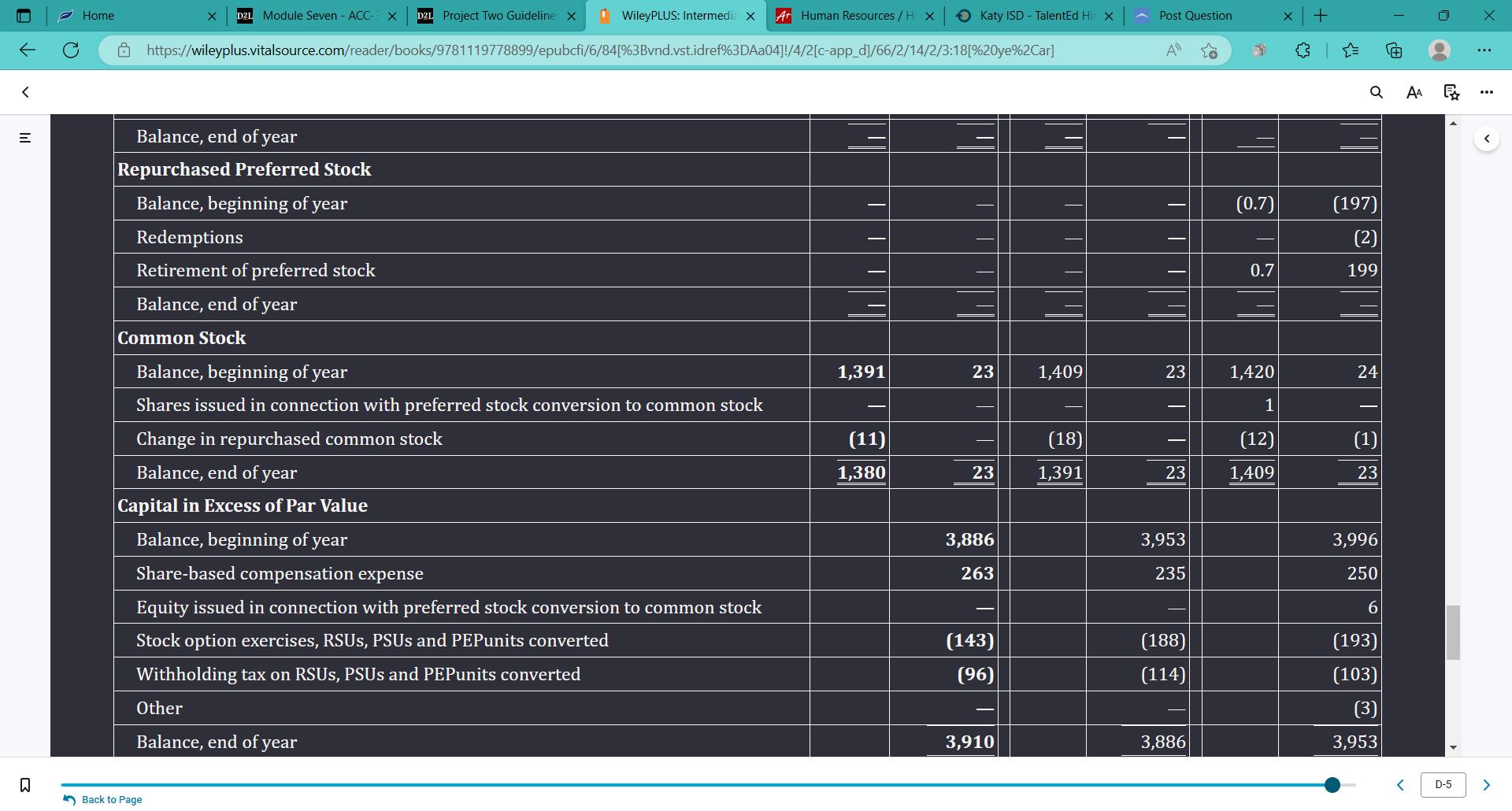

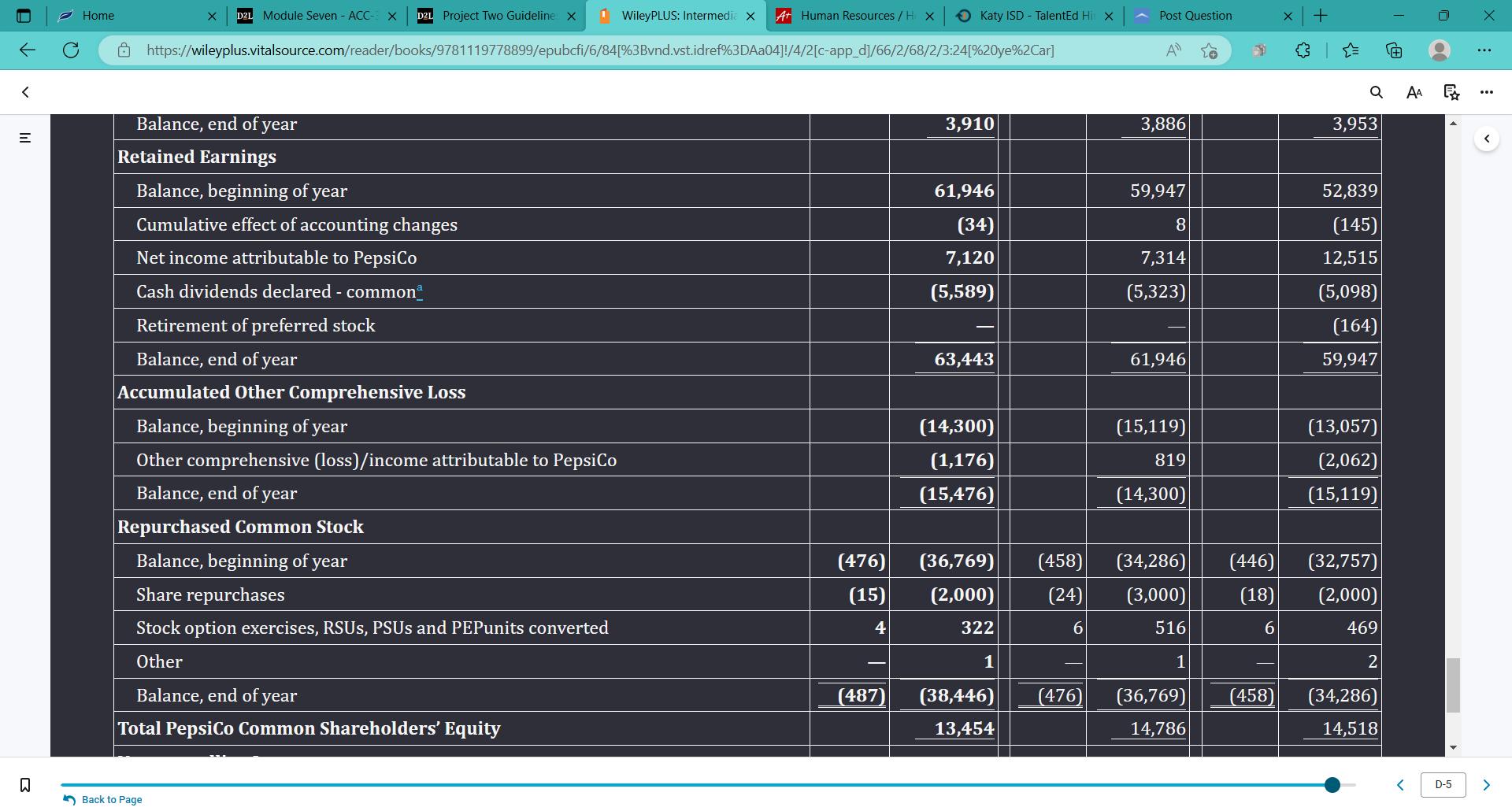

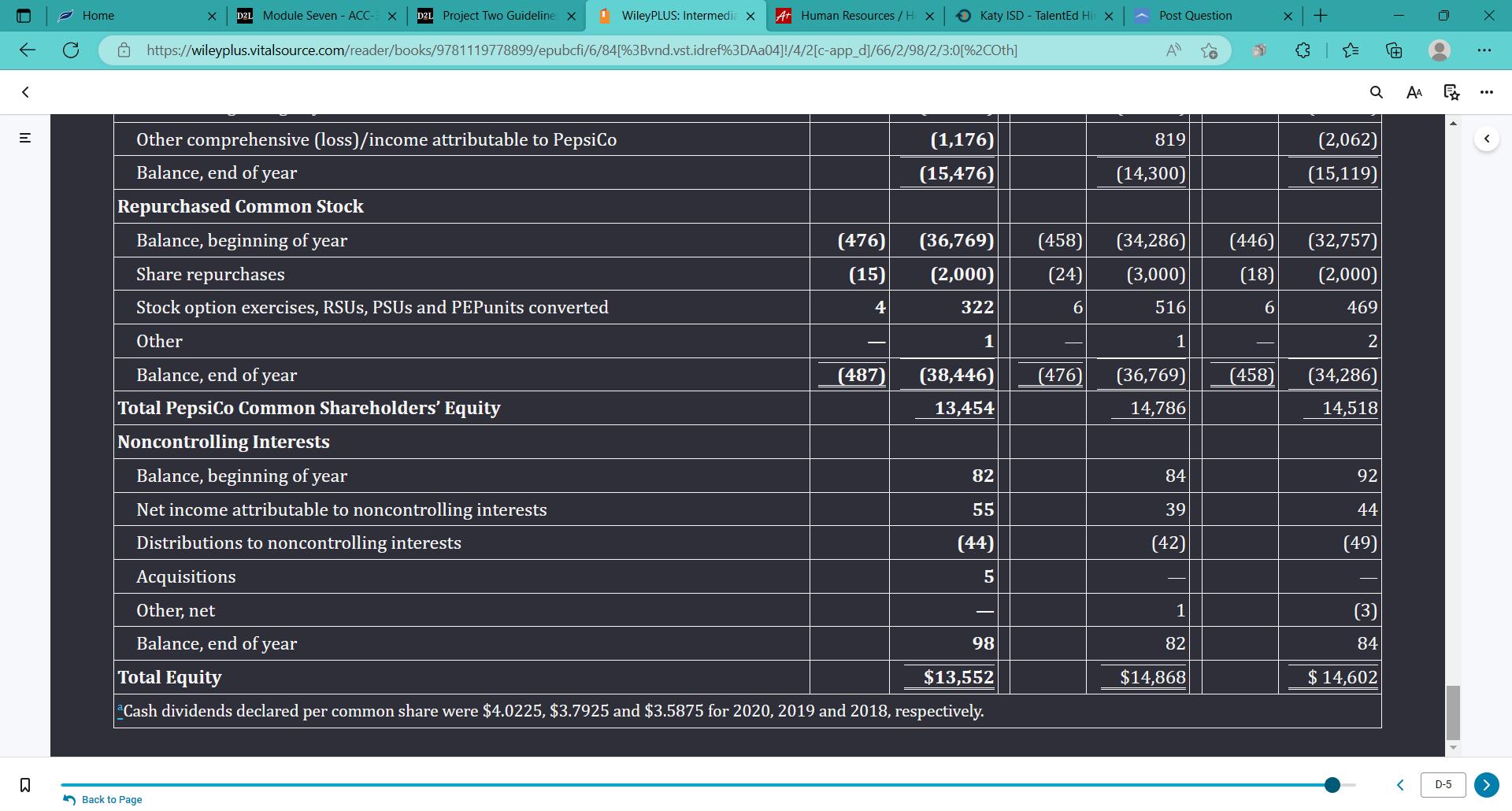

= Home x D2L Module Seven - ACC- X D2L Project Two Guideline X 1 WileyPLUS: Intermedia X At Human Resources / H X https://wileyplus.vitalsource.com/reader/books/9781119778899/epubcfi/6/84[%3Bvnd.vst.idref%3DAa04]!/4 Appendix D Specimen Financial Statements: PepsiCo, Inc. PepsiCo, Inc. and Subsidiaries Fiscal years ended December 26, 2020, December 28, 2019 and December 29, 2018 (in millions except per share amounts) Back to Page Net Revenue Cost of sales Gross profit Selling, general and administrative expenses Operating Profit Other pension and retiree medical benefits income/(expense) Katy ISD-TalentEd Hi X Post Question PepsiCo, Inc. is a leading global food and beverage company with a complementary portfolio of enjoyable brands, including Frito-Lay, Gatorade, Pepsi-Cola, Quaker, and Tropicana. Through its operations, authorized bottlers, contract manufacturers, and other third parties, PepsiCo makes, markets, distributes, and sells a wide variety of convenient and enjoyable beverages, foods, and snacks, serving customers and consumers in more than 200 countries and territories. The following are PepsiCo's financial statements as presented in its 2020 10-K report. The complete report, including notes to the financial statements, is available at the company's website. Consolidated Statement of Income 2020 2019 $70,372 31,797 38,575 28,495 26,738 10,080 117 $67,161 30,132 37,029 X 10,291 (44) + Q 2018 $64,661 29,381 35,280 25,170 10,110 298 AA < D-1 X: ... >

Step by Step Solution

3.40 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Explain the importance of the full disclosure principle The full disclosure principle is an important aspect of financial reporting and accounting It refers to the requirement that companies provide a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started