COMPLE THE ANSWER

SAT 1.5

SAT 1.6

SAT 1.7

SAT 1.8

SAT 1.9

SAT 1.10

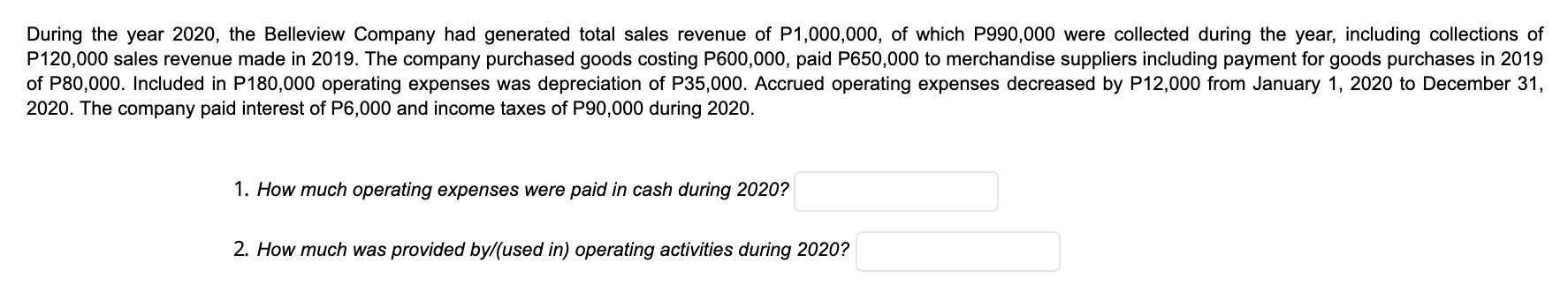

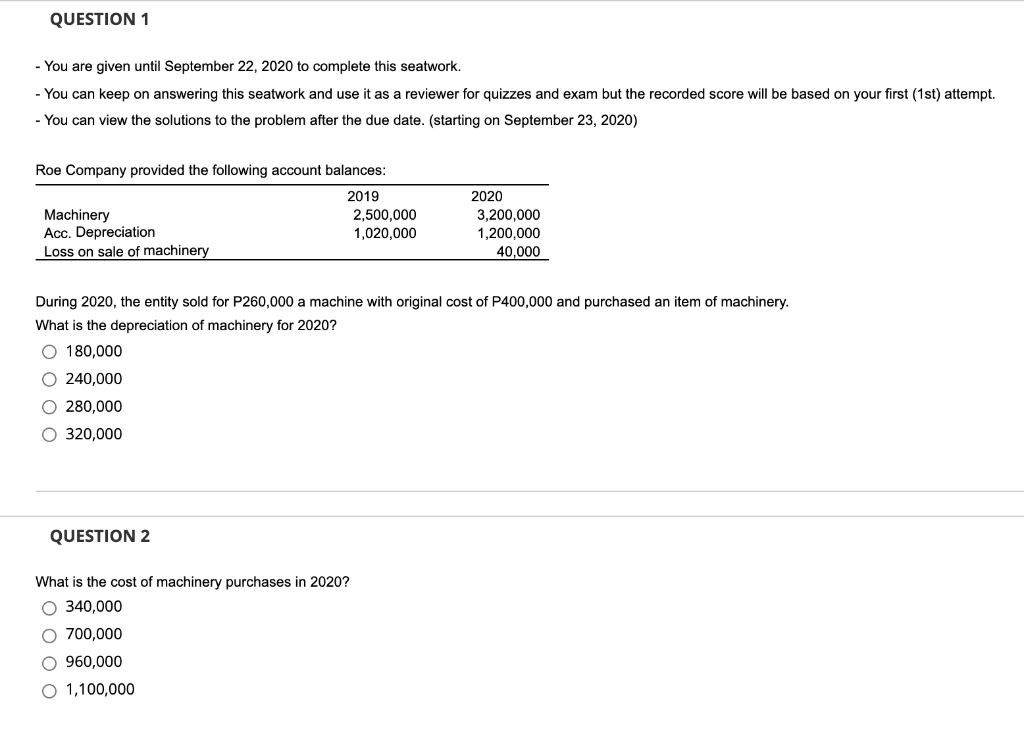

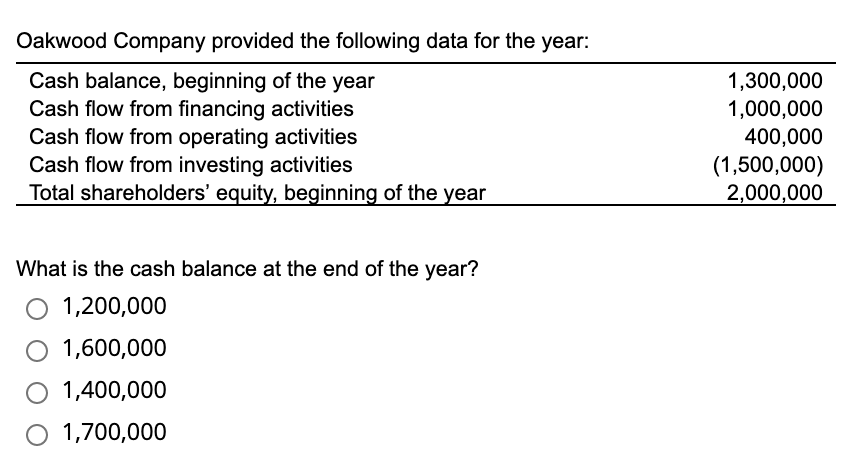

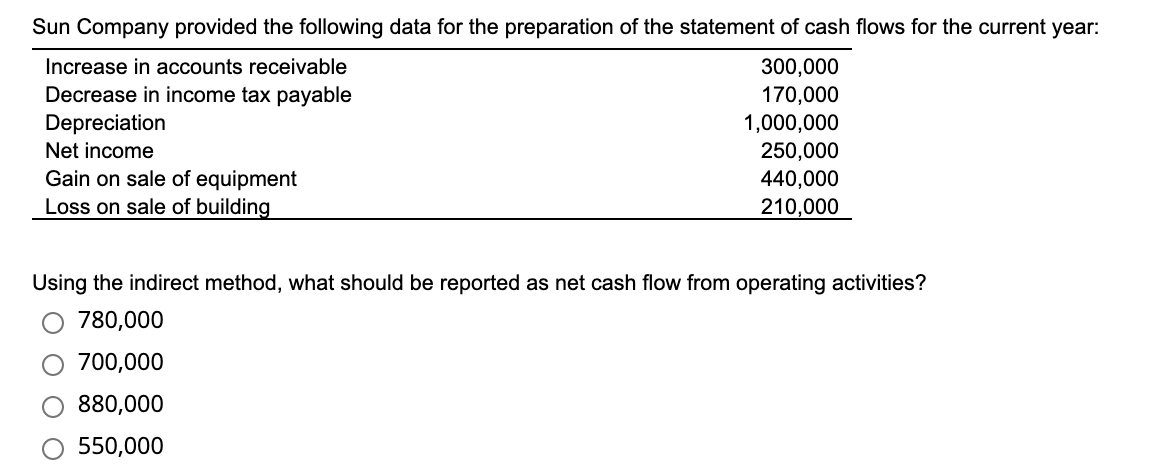

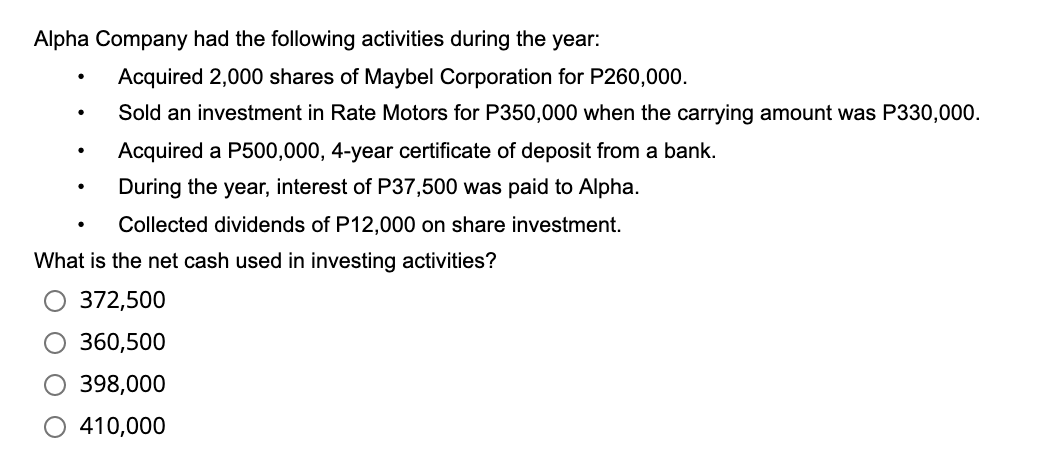

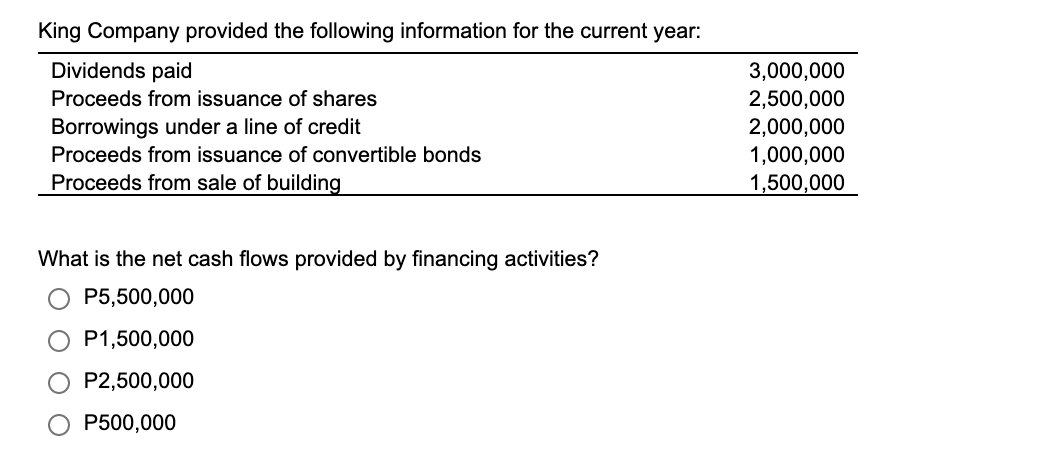

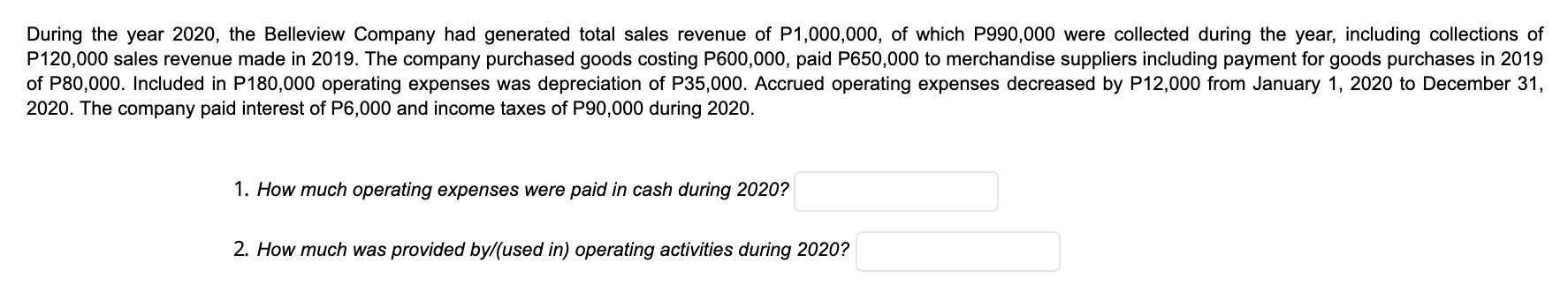

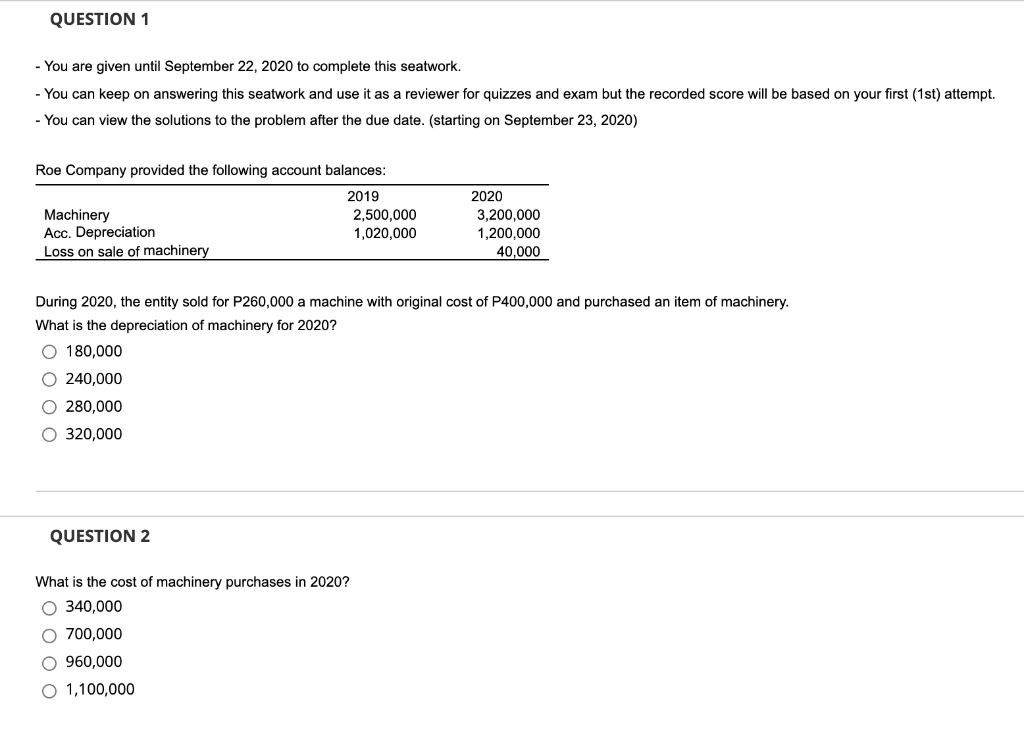

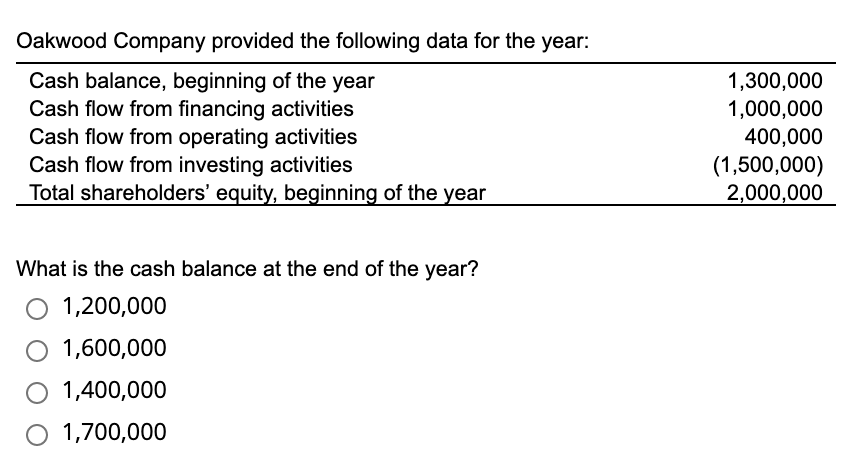

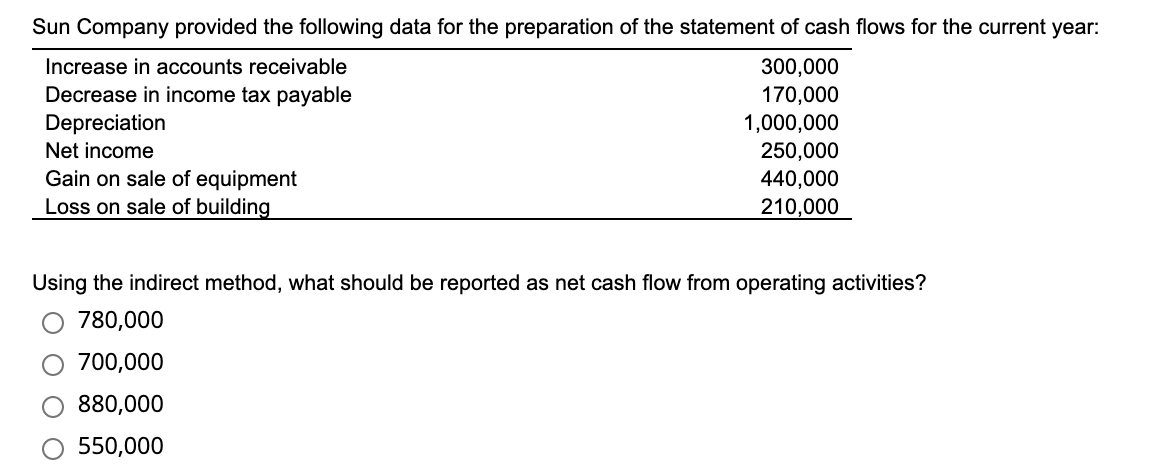

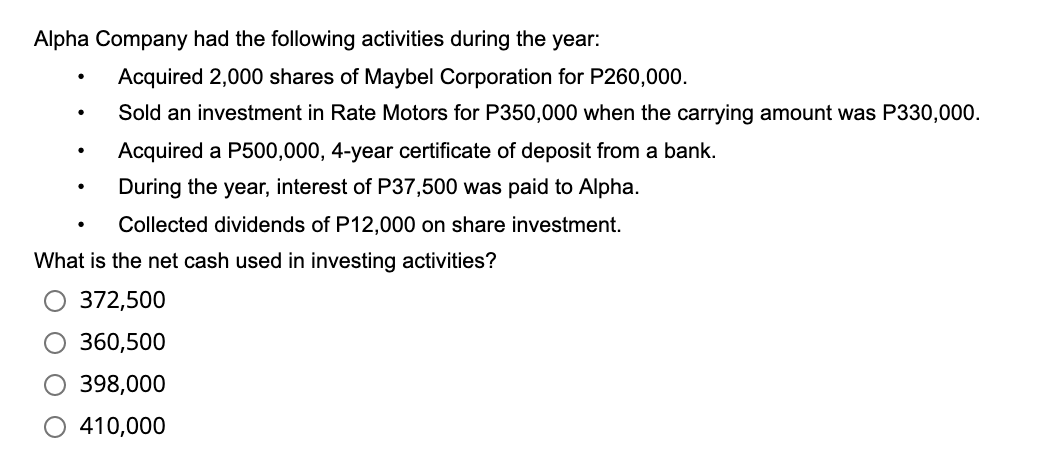

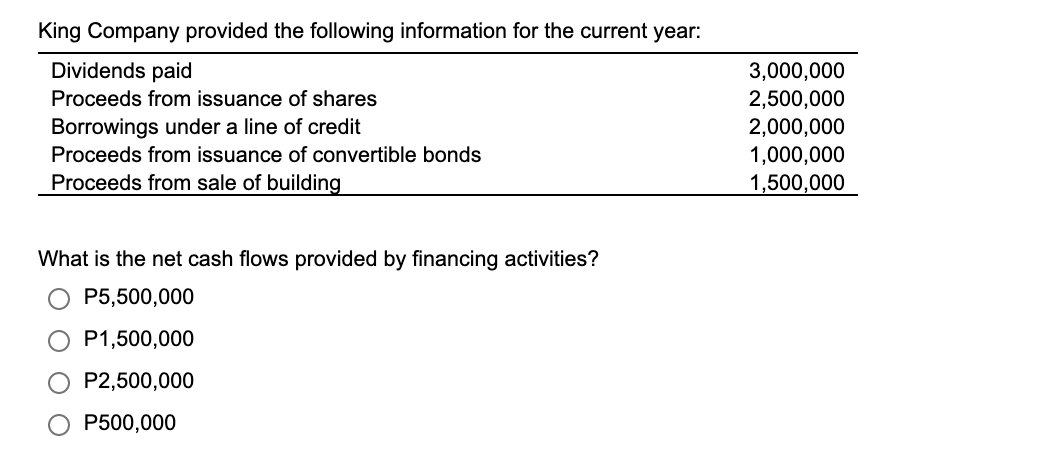

During the year 2020, the Belleview Company had generated total sales revenue of P1,000,000, of which P990,000 were collected during the year, including collections of P120,000 sales revenue made in 2019. The company purchased goods costing P600,000, paid P650,000 to merchandise suppliers including payment for goods purchases in 2019 of P80,000. Included in P180,000 operating expenses was depreciation of P35,000. Accrued operating expenses decreased by P12,000 from January 1, 2020 to December 31, 2020. The company paid interest of P6,000 and income taxes of P90,000 during 2020. 1. How much operating expenses were paid in cash during 2020? 2. How much was provided by/(used in) operating activities during 2020? QUESTION 1 - You are given until September 22, 2020 to complete this seatwork. - You can keep on answering this seatwork and use it as a reviewer for quizzes and exam but the recorded score will be based on your first (1st) attempt. - You can view the solutions to the problem after the due date. (starting on September 23, 2020) Roe Company provided the following account balances: 2019 Machinery 2,500,000 Acc. Depreciation 1,020,000 Loss on sale of machinery 2020 3,200,000 1,200,000 40,000 During 2020, the entity sold for P260,000 a machine with original cost of P400,000 and purchased an item of machinery. What is the depreciation of machinery for 2020? 0 180,000 O 240,000 O 280,000 O 320,000 QUESTION 2 What is the cost of machinery purchases in 2020? O 340,000 700,000 O 960,000 O 1,100,000 Oakwood Company provided the following data for the year: Cash balance, beginning of the year Cash flow from financing activities Cash flow from operating activities Cash flow from investing activities Total shareholders' equity, beginning of the year 1,300,000 1,000,000 400,000 (1,500,000) 2,000,000 What is the cash balance at the end of the year? O 1,200,000 O 1,600,000 O 1,400,000 O 1,700,000 Sun Company provided the following data for the preparation of the statement of cash flows for the current year: Increase in accounts receivable Decrease in income tax payable Depreciation Net income Gain on sale of equipment Loss on sale of building 300,000 170,000 1,000,000 250,000 440,000 210,000 Using the indirect method, what should be reported as net cash flow from operating activities? 780,000 700,000 880,000 550,000 Alpha Company had the following activities during the year: Acquired 2,000 shares of Maybel Corporation for P260,000. Sold an investment in Rate Motors for P350,000 when the carrying amount was P330,000. Acquired a P500,000, 4-year certificate of deposit from a bank. During the year, interest of P37,500 was paid to Alpha. Collected dividends of P12,000 on share investment. What is the net cash used in investing activities? 372,500 360,500 398,000 410,000 King Company provided the following information for the current year: Dividends paid Proceeds from issuance of shares Borrowings under a line of credit Proceeds from issuance of convertible bonds Proceeds from sale of building 3,000,000 2,500,000 2,000,000 1,000,000 1,500,000 What is the net cash flows provided by financing activities? O P5,500,000 O P1,500,000 P2,500,000 P500,000