Answered step by step

Verified Expert Solution

Question

1 Approved Answer

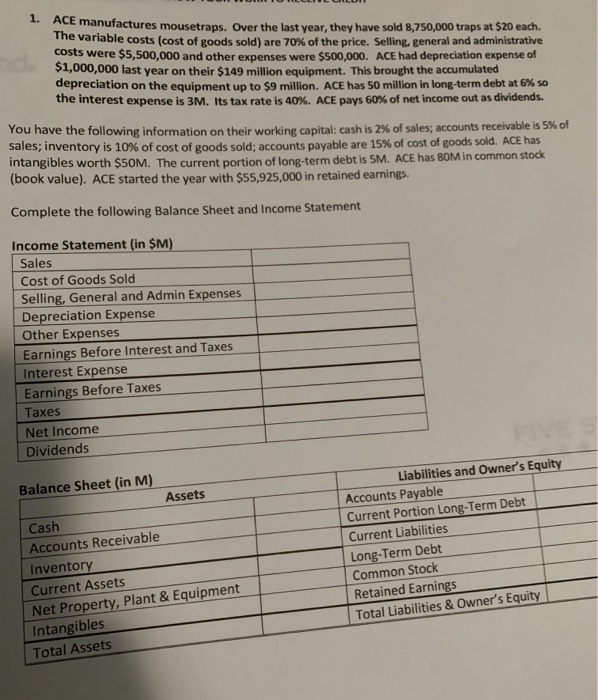

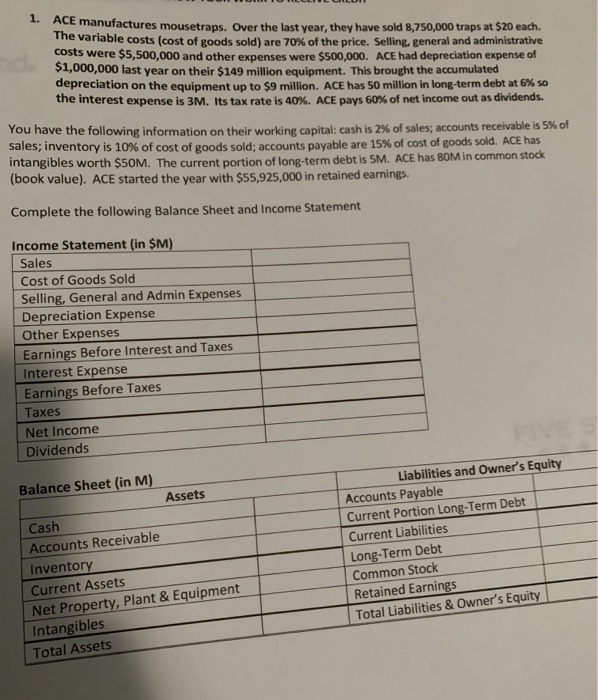

Complese the following income statement and balance sheet 1. ACE manufactures mousetraps. Over the last year, they have sold 8,750,000 traps at $20 each. The

Complese the following income statement and balance sheet

1. ACE manufactures mousetraps. Over the last year, they have sold 8,750,000 traps at $20 each. The variable costs (cost of goods sold) are 70% of the price. Selling, general and administrative costs were $5,500,000 and other expenses were $500,000. ACE had depreciation expense of $1,000,000 last year on their $149 million equipment. This brought the accumulated depreciation on the equipment up to $9 million. ACE has 50 million in long-term debt at 6% so the interest expense is 3M. Its tax rate is 40%. ACE pays 60% of net income out as dividends. You have the following information on their working capital: cash is 2% of sales; accounts receivable is 5% of sales; inventory is 10% of cost of goods sold; accounts payable are 15% of cost of goods sold. ACE has intangibles worth $50M. The current portion of long-term debt is SM. ACE has 8oM in common stock (book value). ACE started the year with $55,925,000 in retained earnings. Complete the following Balance Sheet and Income Statement Income Statement (in $M) Sales Cost of Goods Sold Selling, General and Admin Expenses Depreciation Expense Other Expenses Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Taxes Net Income Dividends Balance Sheet (in M) Assets Cash Accounts Receivable Inventory Current Assets Net Property, Plant & Equipment Intangibles Total Assets Liabilities and Owner's Equity Accounts Payable Current Portion Long-Term Debt Current Liabilities Long-Term Debt Common Stock Retained Earnings Total Liabilities & Owner's Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started