Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete 4 and 5 please. CASE 3A - AUERBACH ENTERPRISES Auerbach Enterprises manufactures air conditioners for automobiles and trucks manufactured throughout North America. The company

Complete 4 and 5 please.

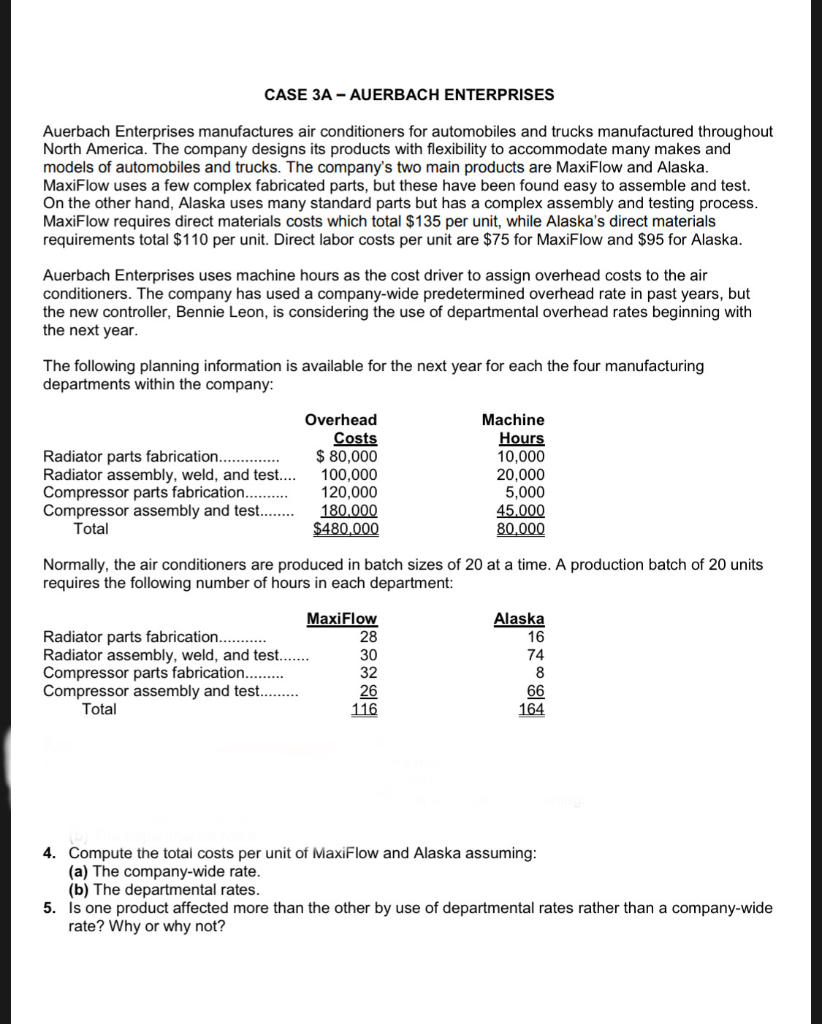

CASE 3A - AUERBACH ENTERPRISES Auerbach Enterprises manufactures air conditioners for automobiles and trucks manufactured throughout North America. The company designs its products with flexibility to accommodate many makes and models of automobiles and trucks. The company's two main products are MaxiFlow and Alaska. MaxiFlow uses a few complex fabricated parts, but these have been found easy to assemble and test. On the other hand, Alaska uses many standard parts but has a complex assembly and testing process. MaxiFlow requires direct materials costs which total $135 per unit, while Alaska's direct materials requirements total $110 per unit. Direct labor costs per unit are $75 for MaxiFlow and $95 for Alaska. Auerbach Enterprises uses machine hours as the cost driver to assign overhead costs to the air conditioners. The company has used a company-wide predetermined overhead rate in past years, but the new controller, Bennie Leon, is considering the use of departmental overhead rates beginning with the next year. The following planning information is available for the next year for each the four manufacturing departments within the company: Overhead Costs Radiator parts fabrication.............. $80,000 Radiator assembly, weld, and test.... 100,000 Compressor parts fabrication. 120,000 Compressor assembly and test....... 180.000 Total $480,000 Machine Hours 10,000 20,000 5,000 45.000 80,000 Normally, the air conditioners are produced in batch sizes of 20 at a time. A production batch of 20 units requires the following number of hours in each department: Alaska MaxiFlow Radiator parts fabrication... Radiator assembly, weld, and test...... Compressor parts fabrication......... Compressor assembly and test......... Total 4. Compute the total costs per unit of MaxiFlow and Alaska assuming: (a) The company-wide rate. (b) The departmental rates. 5. Is one product affected more than the other by use of departmental rates rather than a company-wide rate? Why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started