Answered step by step

Verified Expert Solution

Question

1 Approved Answer

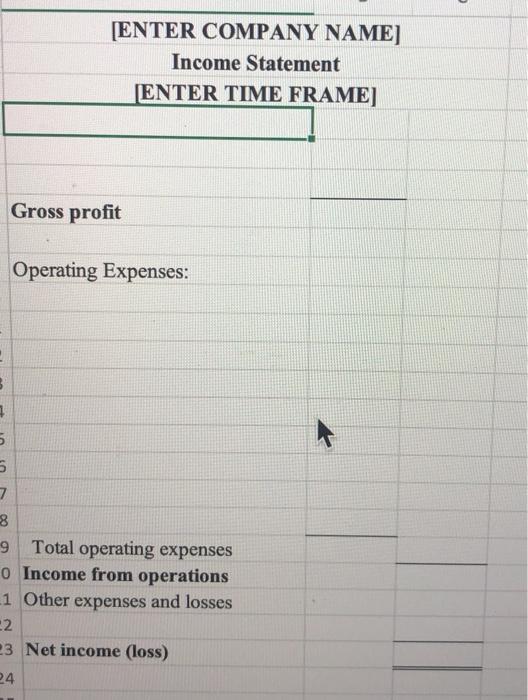

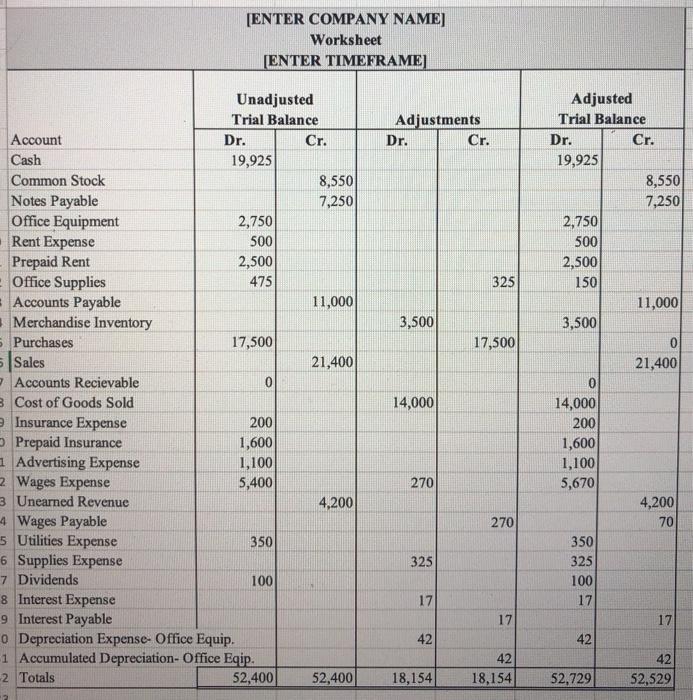

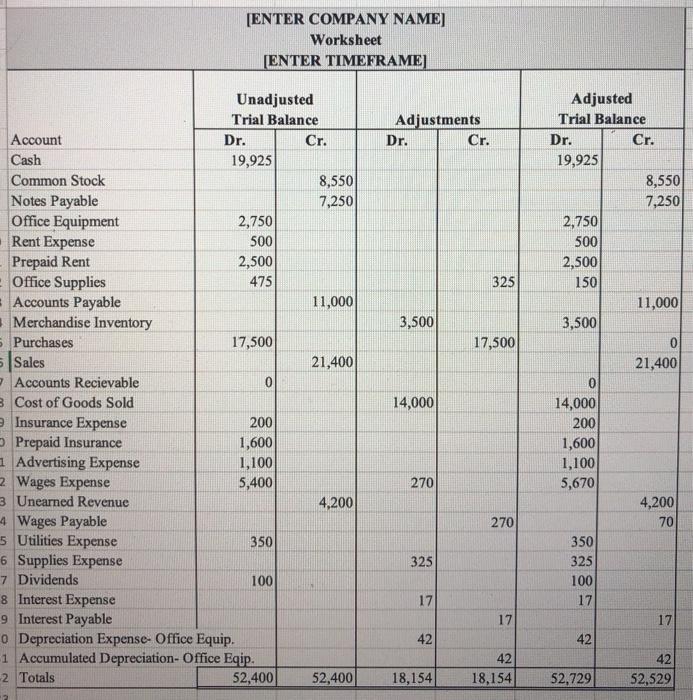

Complete a Multistep Income Statement using the numbers in the Adjusted Trial Balance columns of the Trial Balance Worksheet. [ENTER COMPANY NAME] Income Statement ENTER

Complete a Multistep Income Statement using the numbers in the Adjusted Trial Balance columns of the Trial Balance Worksheet.

[ENTER COMPANY NAME] Income Statement ENTER TIME FRAME] Gross profit Operating Expenses: . 5 8 9 Total operating expenses o Income from operations 1 Other expenses and losses 2 23 Net income (loss) 24 [ENTER COMPANY NAME] Worksheet [ENTER TIMEFRAME] Adjustments Dr. Cr. Adjusted Trial Balance Dr. Cr. 19,925 8,550 7,250 2,750 500 2,500 150 11,000 3,500 0 21,400 325 FE 3,500 17,500 Unadjusted Trial Balance Account Dr. Cr. Cash 19,925 Common Stock 8,550 Notes Payable 7,250 Office Equipment 2,750 Rent Expense 500 Prepaid Rent 2,500 Office Supplies 475 Accounts Payable 11,000 Merchandise Inventory Purchases 17,500 Sales 21,400 7 Accounts Recievable 0 3 Cost of Goods Sold Insurance Expense 200 Prepaid Insurance 1,600 1 Advertising Expense 1,100 2 Wages Expense 5,400 3 Unearned Revenue 4,200 4 Wages Payable 5 Utilities Expense 350 6 Supplies Expense 7 Dividends 100 8 Interest Expense 9 Interest Payable o Depreciation Expense-Office Equip. 1 Accumulated Depreciation- Office Eqip. 2 Totals 52,400 52,400 14,000 14,000 200 1,600 1,100 5,670 270 4,200 70 270 325 350 325 100 17 17 17 17 42 42 42 18,154 42 52,529 18,154 52,729

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started