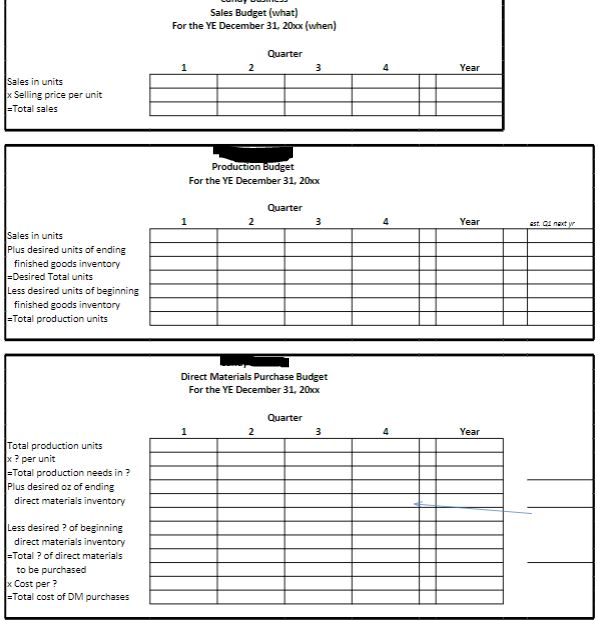

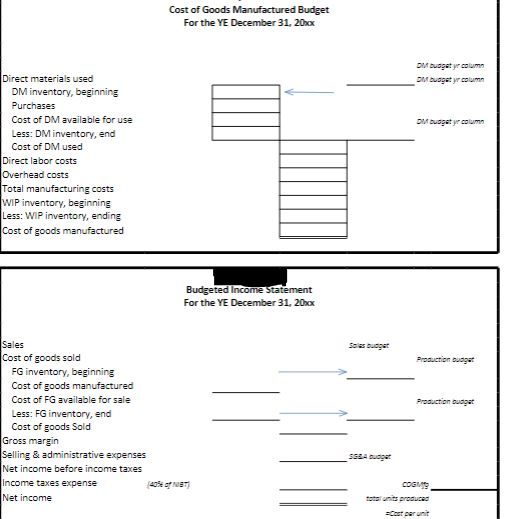

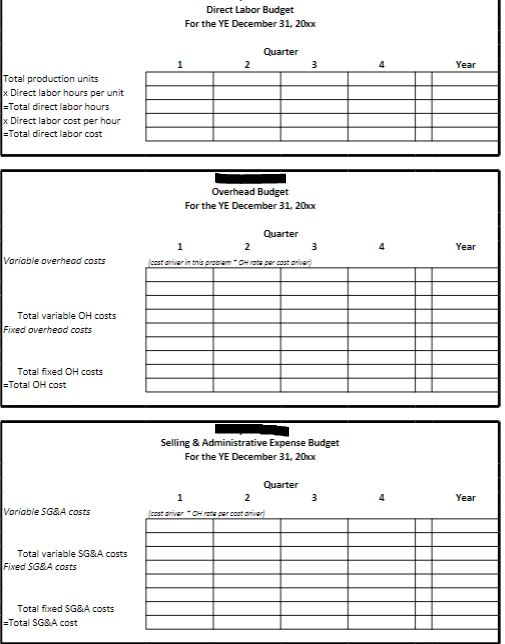

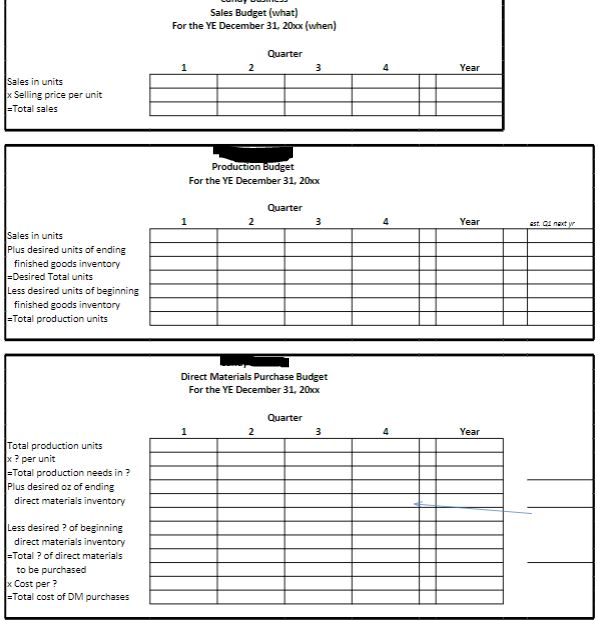

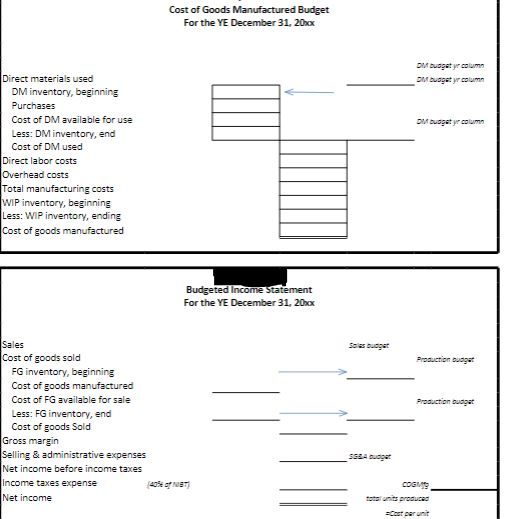

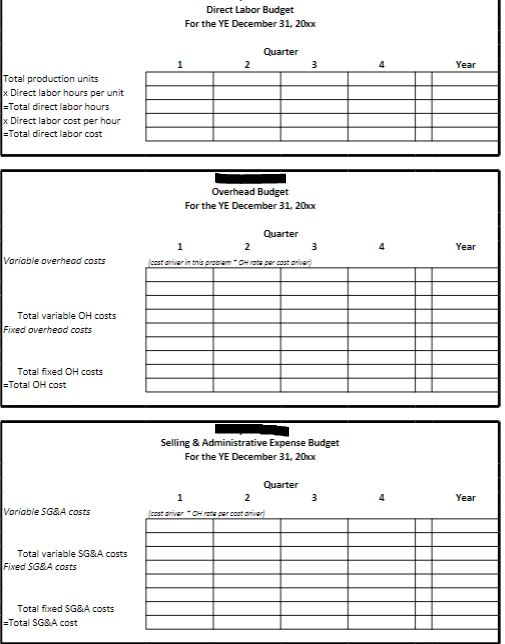

Complete a Sales, Production, Direct Materials Purchase, Direct Labor, Overhead, Selling/gen/admin, COGM and income statement using the following templates and information sheet.

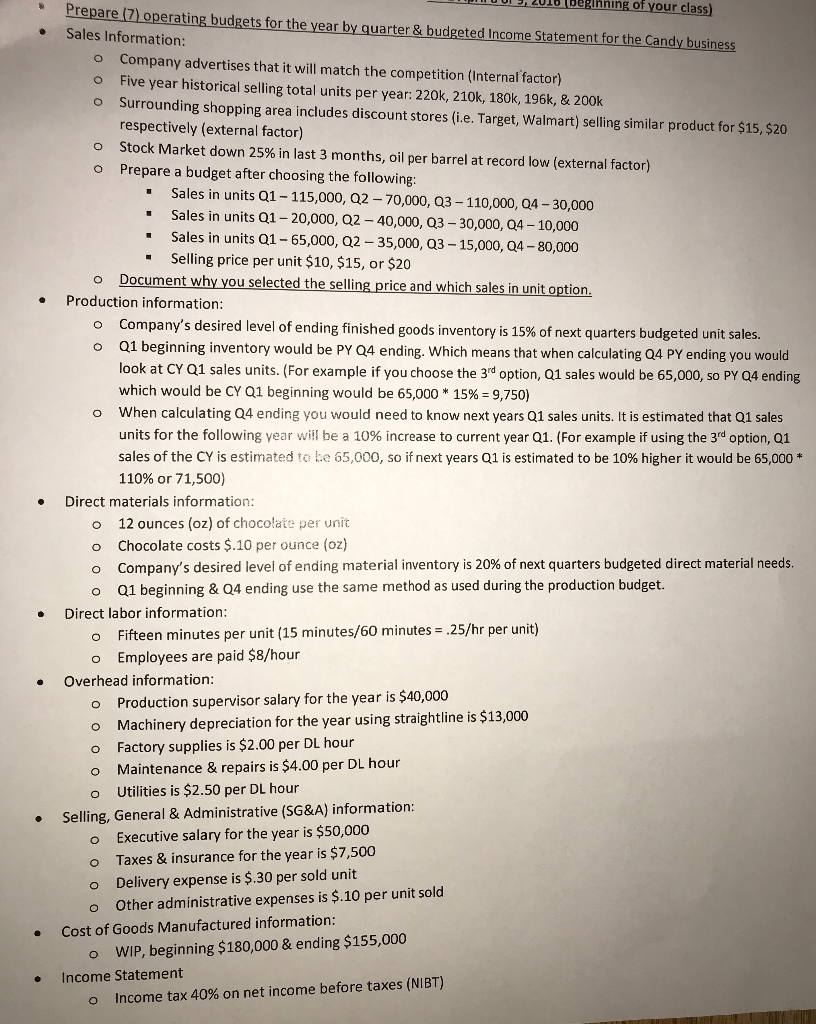

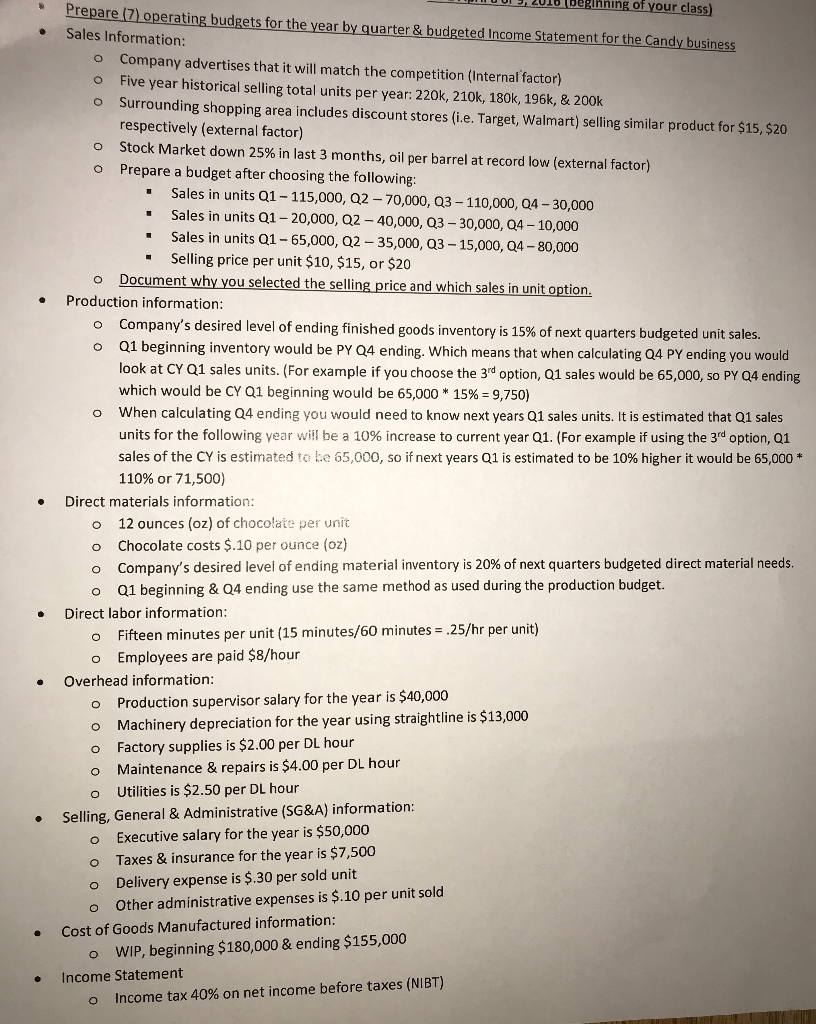

Sales Budget (what) For the YE December 31, 20box (when) Quarter Sales in units Selling price per unit =Total sales For the YE December 31, 20xx Sales in units Plus desired units of ending finished goods inventory Desired Total units Less desired units of beginning finished goods inventory Total production units Direct Materials Purchase Budget For the YE December 31, 20xx otal production units ? per unit Total production needs in ? Plus desired oz of endi direct materials inventory Less desired ? of beginning direct materials inventory Total? of direct materials to be purchased x Cost per? Total cost of DM purchases Direct Labor Budget For the YE December 31, 20xx Total production units Direct labor hours per unit Total direct labor hours Direct labor cost per hour =Total direct labor cost Overhead Budget For the YE December 31, 20x Year Voriable overheod costs Total variable OH costs Fixed overheod costs Total fixed OH costs =Total OH cost Selling & Administrative Expense Budget For the YE December 31, 20x Quarter Year Variable SG&A costs Total variable SG&A costs Fixed SGEA costs Total fixed SG&A costs Total SGA cost , |of yourcl 013 2010 beginning Prepare (7) operating budgets for the year by quarter & budgeted Income Statement for the Candy business Sales Information: ass) Company advertises that it will match the competition (Internal factor) o Five year historical selling total units per year: 220k, 210k, 180k, 196k, & 200k o Surrounding shopping area includes discount stores (i.e. Target, Walmart) selling similar product for $15, $20 respectively (external factor) Stock Market down 25% in last 3 months, oil per barrel at record low (external factor) Prepare a budget after choosing the following o o " Sales in units Q1- 115,000, Q2 -70,000, Q3- 110,000, 04-30,000 . Sales in units Q1- 20,000, Q2 - 40,000, Q3 30,000, Q4 10,000 " Sales in units 01 -65,000, Q2- 35,000, 03-15,000, 04-80,000 Selling price per unit $10, $15, or $20 o Document why you selected the selling price and which sales in unit option Production information: o Company's desired level of ending finished goods inventory is 15% of next quarters budgeted unit sales. o Q1 beginning inventory would be PY Q4 ending. Which means that when calculating 04 PY ending you would look at CY Q1 sales units. (For example if you choose the 3d option, 01 sales would be 65,000, so PY Q4 ending which would be CY Q1 beginning would be 65,000 * 15%-9,750 When calculating Q4 ending you would need to know next years Q1 sales units. It is estimated that Q1 sales units for the following year will be a 10% increase to current year Q1. (For example if using the 3rd option, Q1 sales of the CY is estimated to be 65,000, so if next years QI is estimated to be 10% higher it would be 65,000 * 110% or 71,500) o Direct materials information: o 12 ounces (oz) of chocolate per unit o Chocolate costs $.10 per ounce (oz) o Company's desired level of ending material inventory is 20% of next quarters budgeted direct material needs. o Q1 beginning & 04 ending use the same method as used during the production budget. Direct labor information: Fifteen minutes per unit (15 minutes/60 minutes- .25/hr per unit) Employees are paid $8/hour o o Overhead information o o o o o Production supervisor salary for the year is $40,000 Machinery depreciation for the year using straightline is $13,000 Factory supplies is $2.00 per DL hour Maintenance & repairs is $4.00 per DL hour Utilities is $2.50 per DL hour Selling, General & Administrative (SG&A) information: o o o o Executive salary for the year is $50,000 Taxes & insurance for the year is $7,500 Delivery expense is $.30 per sold unit Other administrative expenses is $.10 per unit sold Cost of Goods Manufactured information: . WIP, beginning $180,000 & ending $155,000 o Income Statement o Income tax 40% on net income before taxes (NBT) Sales Budget (what) For the YE December 31, 20box (when) Quarter Sales in units Selling price per unit =Total sales For the YE December 31, 20xx Sales in units Plus desired units of ending finished goods inventory Desired Total units Less desired units of beginning finished goods inventory Total production units Direct Materials Purchase Budget For the YE December 31, 20xx otal production units ? per unit Total production needs in ? Plus desired oz of endi direct materials inventory Less desired ? of beginning direct materials inventory Total? of direct materials to be purchased x Cost per? Total cost of DM purchases Direct Labor Budget For the YE December 31, 20xx Total production units Direct labor hours per unit Total direct labor hours Direct labor cost per hour =Total direct labor cost Overhead Budget For the YE December 31, 20x Year Voriable overheod costs Total variable OH costs Fixed overheod costs Total fixed OH costs =Total OH cost Selling & Administrative Expense Budget For the YE December 31, 20x Quarter Year Variable SG&A costs Total variable SG&A costs Fixed SGEA costs Total fixed SG&A costs Total SGA cost , |of yourcl 013 2010 beginning Prepare (7) operating budgets for the year by quarter & budgeted Income Statement for the Candy business Sales Information: ass) Company advertises that it will match the competition (Internal factor) o Five year historical selling total units per year: 220k, 210k, 180k, 196k, & 200k o Surrounding shopping area includes discount stores (i.e. Target, Walmart) selling similar product for $15, $20 respectively (external factor) Stock Market down 25% in last 3 months, oil per barrel at record low (external factor) Prepare a budget after choosing the following o o " Sales in units Q1- 115,000, Q2 -70,000, Q3- 110,000, 04-30,000 . Sales in units Q1- 20,000, Q2 - 40,000, Q3 30,000, Q4 10,000 " Sales in units 01 -65,000, Q2- 35,000, 03-15,000, 04-80,000 Selling price per unit $10, $15, or $20 o Document why you selected the selling price and which sales in unit option Production information: o Company's desired level of ending finished goods inventory is 15% of next quarters budgeted unit sales. o Q1 beginning inventory would be PY Q4 ending. Which means that when calculating 04 PY ending you would look at CY Q1 sales units. (For example if you choose the 3d option, 01 sales would be 65,000, so PY Q4 ending which would be CY Q1 beginning would be 65,000 * 15%-9,750 When calculating Q4 ending you would need to know next years Q1 sales units. It is estimated that Q1 sales units for the following year will be a 10% increase to current year Q1. (For example if using the 3rd option, Q1 sales of the CY is estimated to be 65,000, so if next years QI is estimated to be 10% higher it would be 65,000 * 110% or 71,500) o Direct materials information: o 12 ounces (oz) of chocolate per unit o Chocolate costs $.10 per ounce (oz) o Company's desired level of ending material inventory is 20% of next quarters budgeted direct material needs. o Q1 beginning & 04 ending use the same method as used during the production budget. Direct labor information: Fifteen minutes per unit (15 minutes/60 minutes- .25/hr per unit) Employees are paid $8/hour o o Overhead information o o o o o Production supervisor salary for the year is $40,000 Machinery depreciation for the year using straightline is $13,000 Factory supplies is $2.00 per DL hour Maintenance & repairs is $4.00 per DL hour Utilities is $2.50 per DL hour Selling, General & Administrative (SG&A) information: o o o o Executive salary for the year is $50,000 Taxes & insurance for the year is $7,500 Delivery expense is $.30 per sold unit Other administrative expenses is $.10 per unit sold Cost of Goods Manufactured information: . WIP, beginning $180,000 & ending $155,000 o Income Statement o Income tax 40% on net income before taxes (NBT)