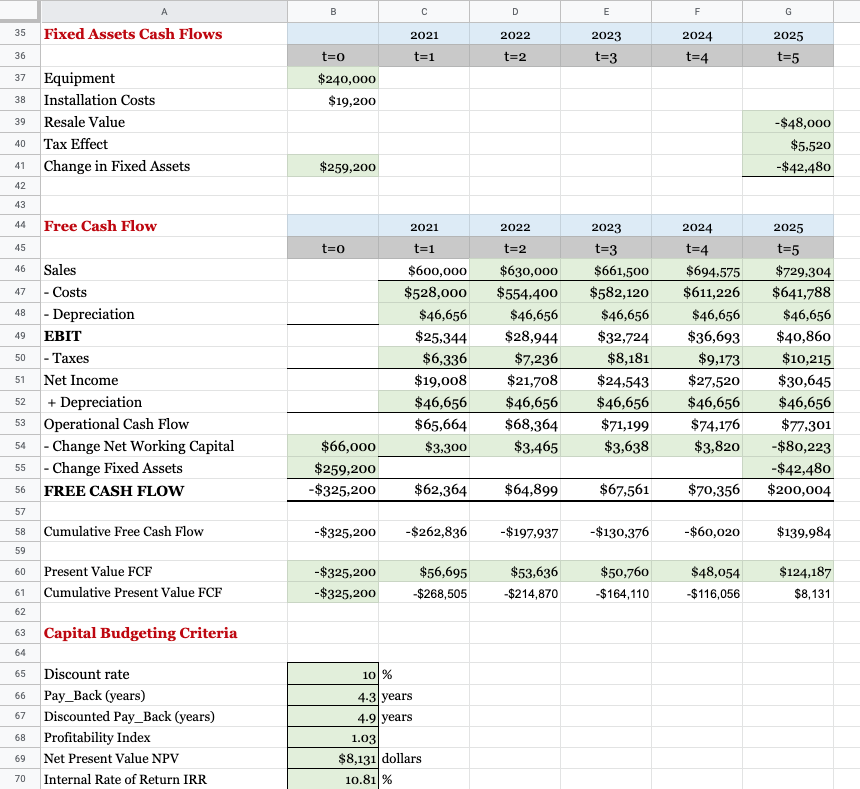

Complete a short analytical review of your capital budgeting project, explaining the main takeaways of the exercise. Use the indicated space. You should answer questions such as What does each of the criteria indicate? Is there any discrepancy among the criteria? Would you undertake the project? Why is the project feasible (or not feasible)?

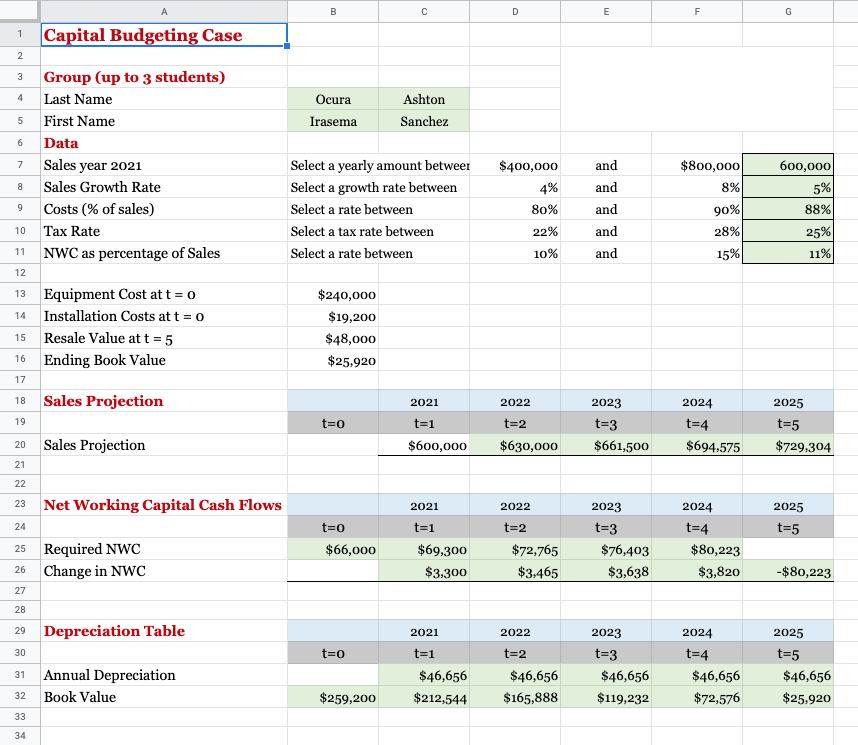

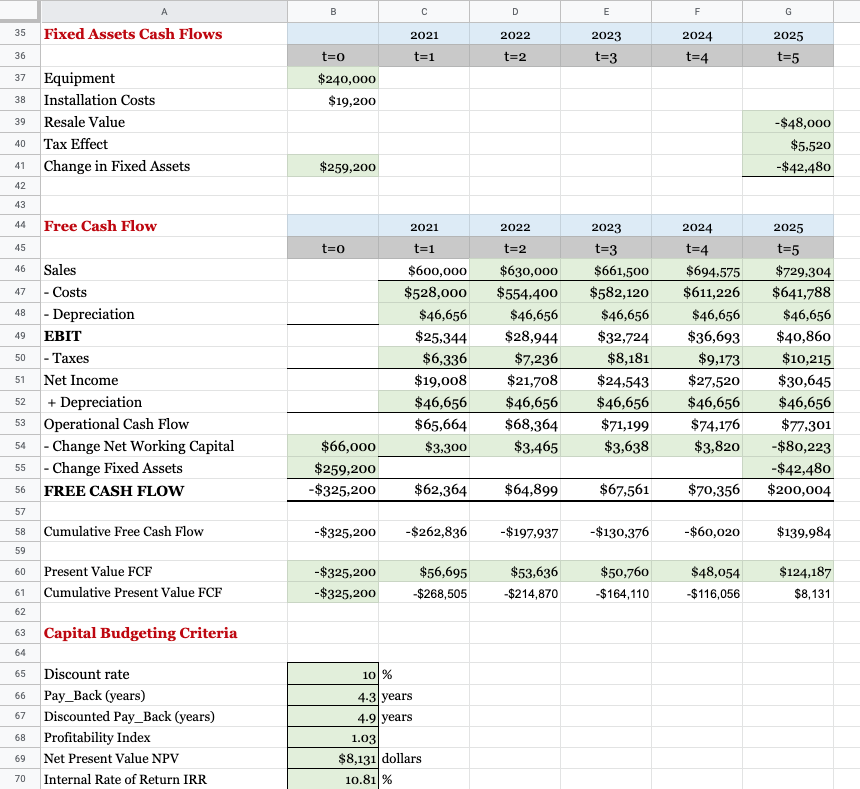

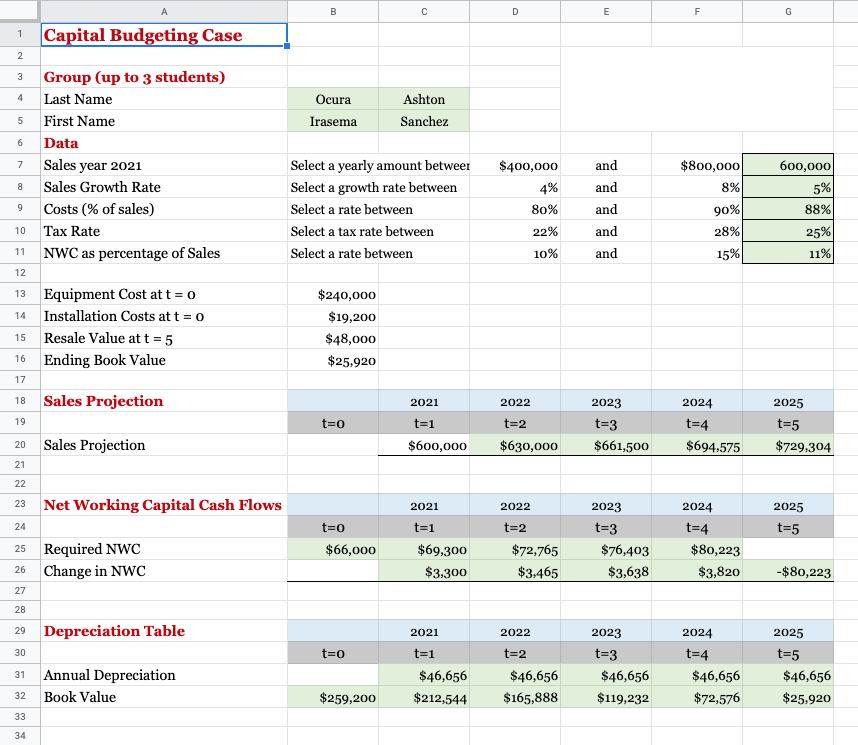

B D E F G 1 Capital Budgeting Case 2 3 4 Ocura Ashton Sanchez 5 Irasema 6 7 Group (up to 3 students) Last Name First Name Data Sales year 2021 Sales Growth Rate Costs (% of sales) Tax Rate NWC as percentage of Sales $800,000 8 $400,000 4% 80% 8% Select a yearly amount betweer Select a growth rate between Select a rate between Select a tax rate between Select a rate between 9 and and and and and 600,000 5% 88% 10 90% 28% 15% 25% 11% 11 10% 12 13 14 Equipment Cost at t = 0 Installation Costs at t = 0 Resale Value at t = 5 Ending Book Value $240,000 $19,200 $48,000 $25,920 15 16 17 18 Sales Projection 2024 19 t=0 2021 t=1 $600,000 2022 t=2 $630,000 2023 t=3 $661,500 2025 t=5 $729,304 t=4 $694,575 20 Sales Projection 21 22 23 Net Working Capital Cash Flows 2021 2022 2025 t=5 24 t=0 t=1 t=2 2023 t=3 $76,403 $3,638 2024 t=4 $80,223 $3,820 25 Required NWC 26 Change in NWC $66,000 $69,300 $3,300 $72,765 $3,465 -$80,223 27 28 29 Depreciation Table 2024 2025 30 t=0 t=4 2021 t=1 $46,656 $212,544 2022 t=2 $46,656 $165,888 2023 t=3 $46,656 $119,232 31 Annual Depreciation Book Value $46,656 $72,576 t=5 $46,656 $25.920 32 $259,200 33 34 B c D E F G 35 Fixed Assets Cash Flows 2021 2022 2025 2023 t=3 t=1 2024 t=4 36 t=2 t=5 37 t=0 $240,000 $19,200 38 39 Equipment Installation Costs Resale Value Tax Effect Change in Fixed Assets 40 -$48,000 $5,520 -$42,480 41 $259,200 42 43 44 Free Cash Flow 2021 2022 2025 45 t=0 46 49 t=1 $600,000 $528,000 $46,656 $25,344 $6,336 $19,008 $46,656 $65,664 $3,300 t=2 $630,000 $554,400 $46,656 $28,944 $7,236 $21,708 $46,656 $68,364 $3,465 Sales 47 - Costs 48 - Depreciation EBIT - Taxes Net Income + Depreciation Operational Cash Flow - Change Net Working Capital 55 - Change Fixed Assets FREE CASH FLOW 2023 t=3 $661,500 $582,120 $46,656 $32,724 $8,181 $24,543 $46,656 $71,199 $3,638 2024 t=4 $694,575 $611,226 $46,656 $36,693 $9,173 $27,520 $46,656 $74,176 $3,820 50 t=5 $729.304 $641,788 $46,656 $40,860 $10,215 $30,645 $46,656 $77,301 -$80,223 -$42,480 $200,004 51 52 53 54 $66,000 $259,200 -$325,200 56 $62,364 $64,899 $67,561 $70,356 57 58 Cumulative Free Cash Flow -$325,200 -$262,836 -$197,937 -$130,376 -$60,020 $139,984 59 60 Present Value FCF Cumulative Present Value FCF -$325,200 -$325,200 $56,695 -$268,505 $53,636 -$214,870 $50,760 $164,110 $48,054 $116,056 $124,187 $8,131 61 62 63 Capital Budgeting Criteria 64 65 10 % 66 4.3 years 4.9 years 67 Discount rate Pay_Back (years) Discounted Pay_Back (years) Profitability Index Net Present Value NPV Internal Rate of Return IRR 68 69 1.03 $8,131 dollars 10.811% 70