Answered step by step

Verified Expert Solution

Question

1 Approved Answer

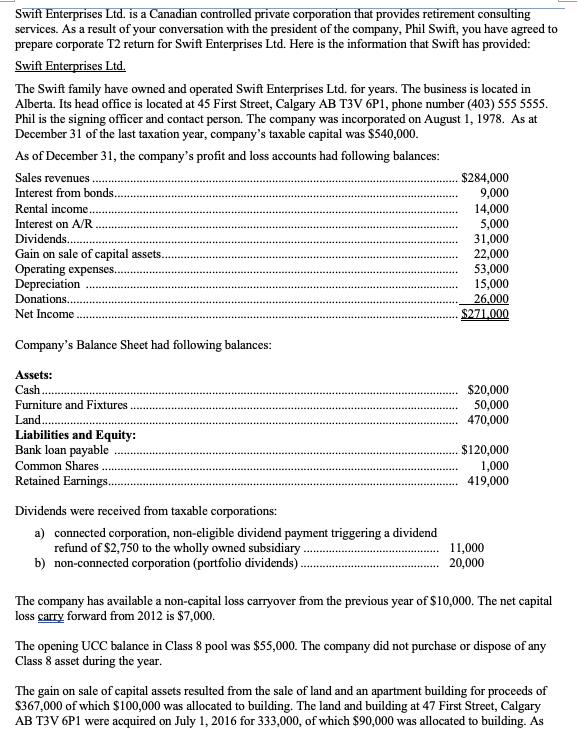

Swift Enterprises Ltd. is a Canadian controlled private corporation that provides retirement consulting services. As a result of your conversation with the president of

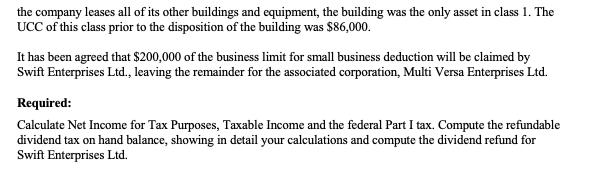

Swift Enterprises Ltd. is a Canadian controlled private corporation that provides retirement consulting services. As a result of your conversation with the president of the company, Phil Swift, you have agreed to prepare corporate T2 return for Swift Enterprises Ltd. Here is the information that Swift has provided: Swift Enterprises Ltd. The Swift family have owned and operated Swift Enterprises Ltd. for years. The business is located in Alberta. Its head office is located at 45 First Street, Calgary AB T3V 6P1, phone number (403) 555 5555. Phil is the signing officer and contact person. The company was incorporated on August 1, 1978. As at December 31 of the last taxation year, company's taxable capital was $540,000. As of December 31, the company's profit and loss accounts had following balances: Sales revenues. Interest from bonds. Rental income... Interest on A/R. Dividends...... Gain on sale of capital assets. Operating expenses.. Depreciation Donations.. Net Income Company's Balance Sheet had following balances: Assets: Cash.. Furniture and Fixtures. Land.... Liabilities and Equity: Bank loan payable Common Shares Retained Earnings... Dividends were received from taxable corporations: a) connected corporation, non-eligible dividend payment triggering a dividend refund of $2,750 to the wholly owned subsidiary. b) non-connected corporation (portfolio dividends).. $284,000 9,000 14,000 5,000 31,000 22,000 53,000 15,000 26,000 $271,000 $20,000 50,000 470,000 $120,000 1,000 419,000 11,000 20,000 The company has available a non-capital loss carryover from the previous year of $10,000. The net capital loss carry forward from 2012 is $7,000. The opening UCC balance in Class 8 pool was $55,000. The company did not purchase or dispose of any Class 8 asset during the year. The gain on sale of capital assets resulted from the sale of land and an apartment building for proceeds of $367,000 of which $100,000 was allocated to building. The land and building at 47 First Street, Calgary AB T3V 6P1 were acquired on July 1, 2016 for 333,000, of which $90,000 was allocated to building. As the company leases all of its other buildings and equipment, the building was the only asset in class 1. The UCC of this class prior to the disposition of the building was $86,000. It has been agreed that $200,000 of the business limit for small business deduction will be claimed by Swift Enterprises Ltd., leaving the remainder for the associated corporation, Multi Versa Enterprises Ltd. Required: Calculate Net Income for Tax Purposes, Taxable Income and the federal Part I tax. Compute the refundable dividend tax on hand balance, showing in detail your calculations and compute the dividend refund for Swift Enterprises Ltd.

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Net Income for Tax Purposes 284000 9000 14000 5000 31000 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started