Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete a trend analysis (time series) and comparative analysis (cross-section). interpret and identify potential problems. Paragraph Disney Ratios: Liquidity- Current-35,251/26,628=1.32383 Quick-35,251-3,754/26,628 = 1.18285 Networking Capital

complete a trend analysis (time series) and comparative analysis (cross-section). interpret and identify potential problems.

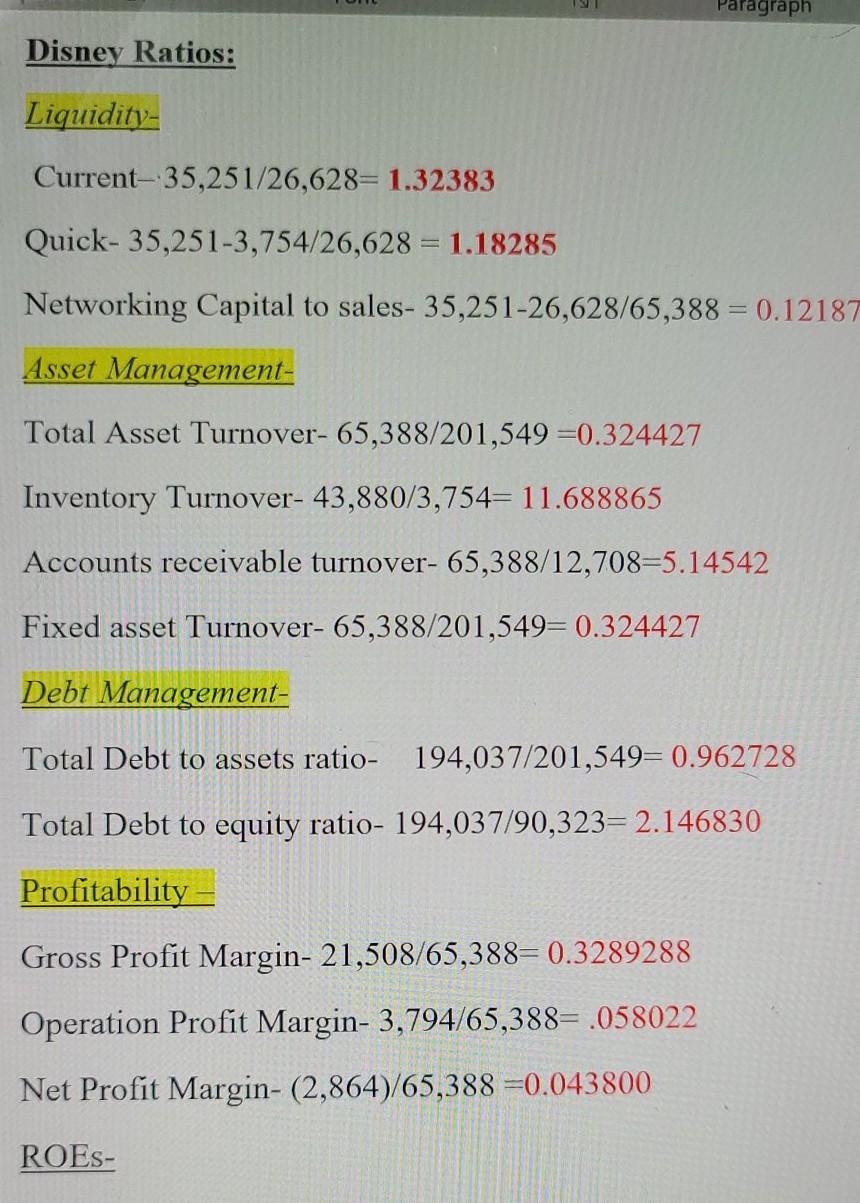

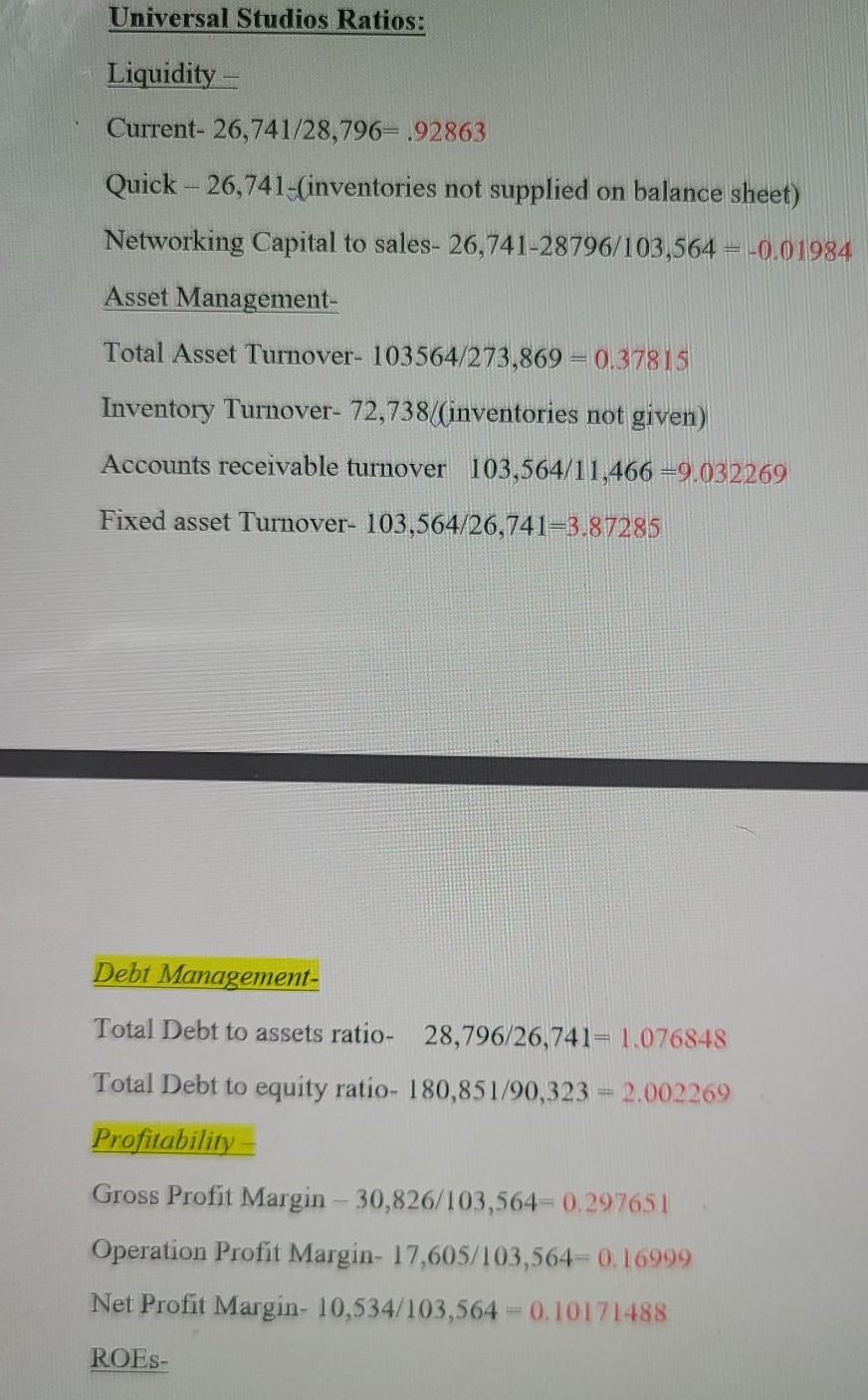

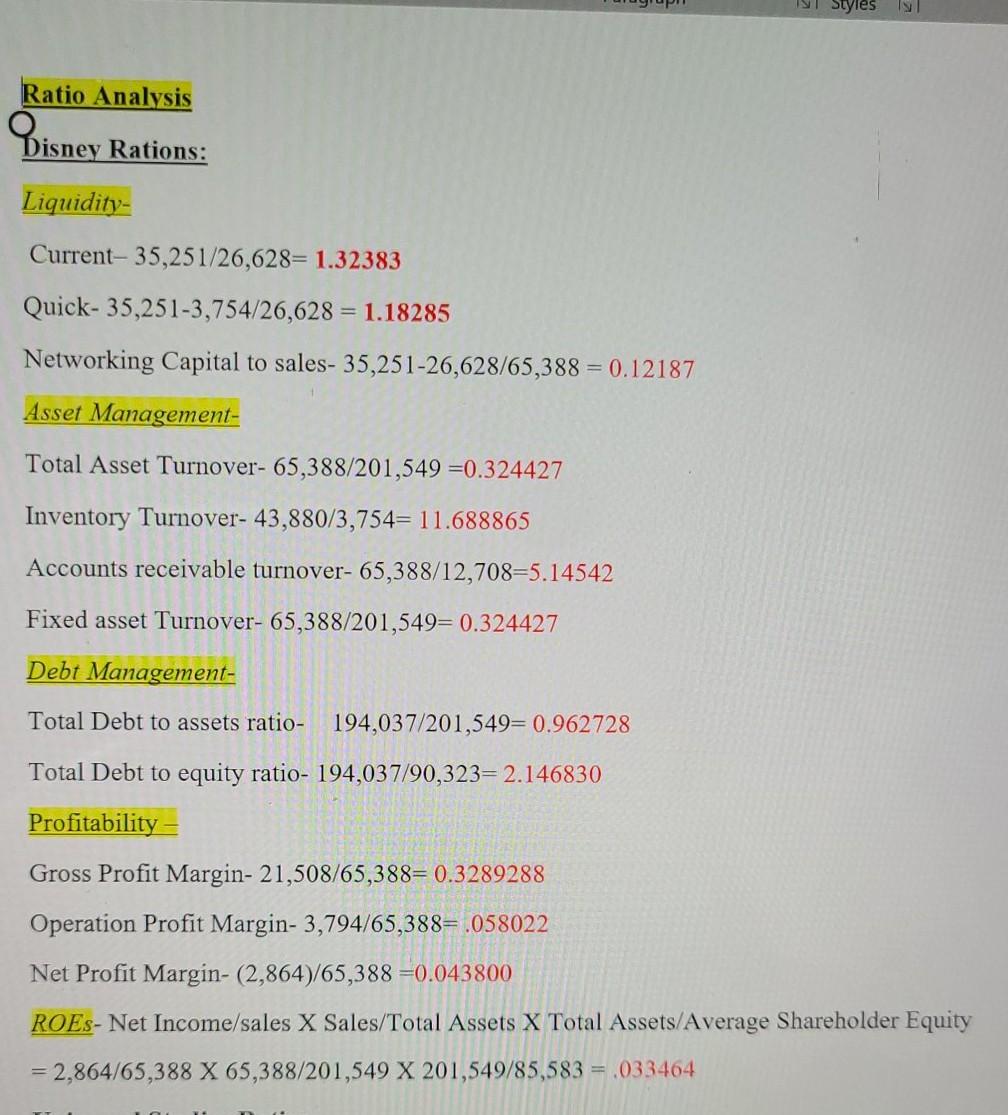

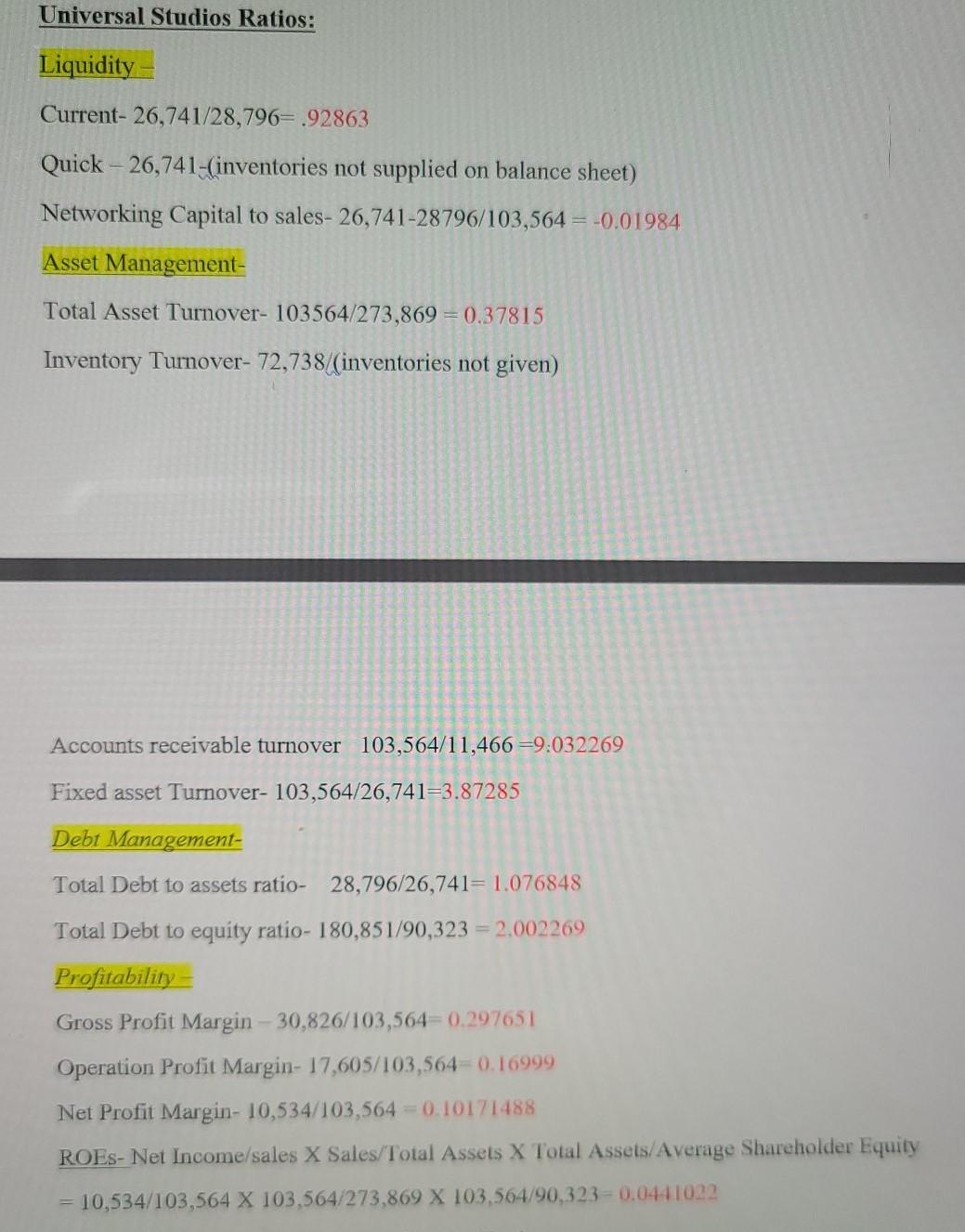

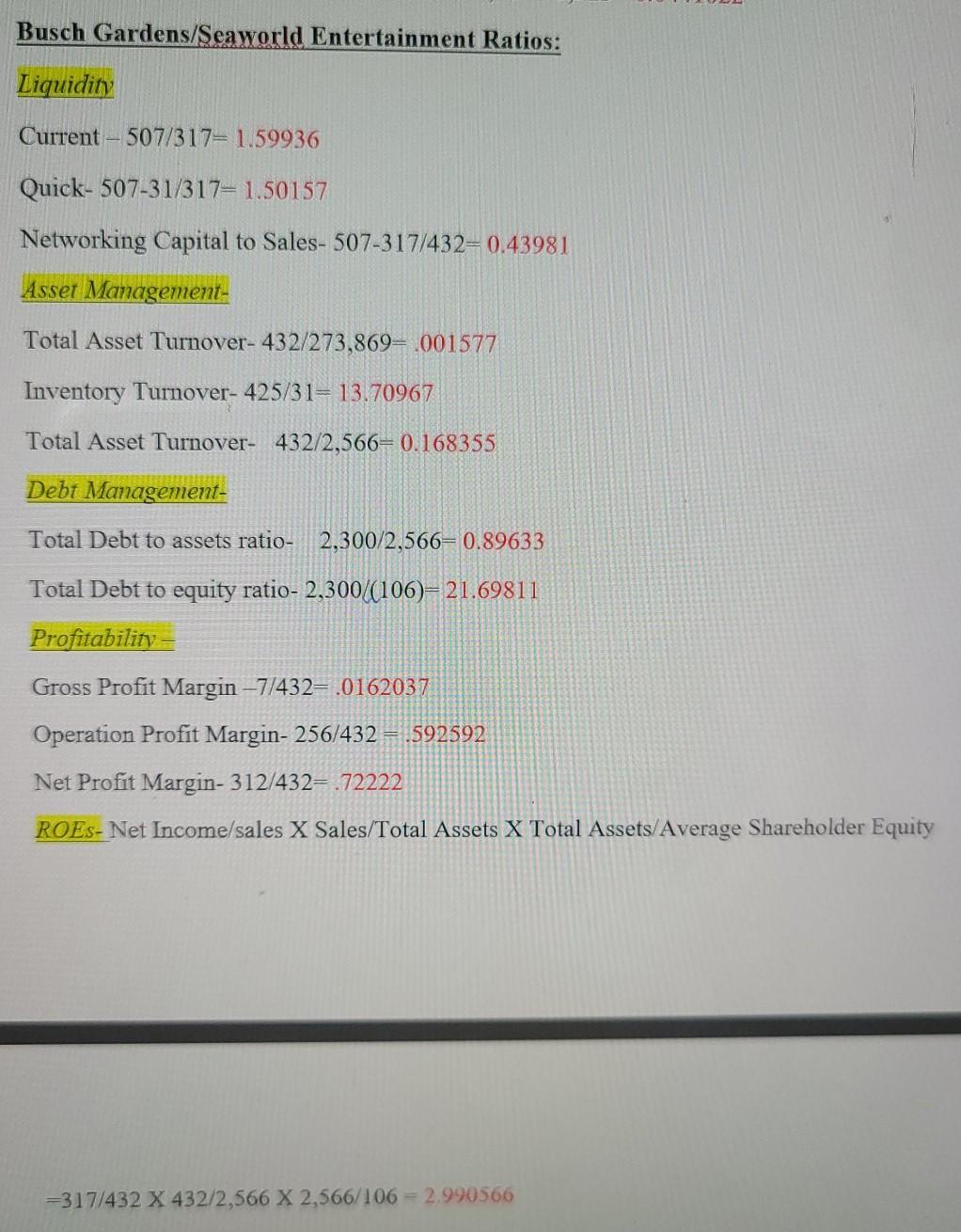

Paragraph Disney Ratios: Liquidity- Current-35,251/26,628=1.32383 Quick-35,251-3,754/26,628 = 1.18285 Networking Capital to sales-35,251-26,628/65,388 = 0.12187 Asset Management- Total Asset Turnover-65,388/201,549 =0.324427 Inventory Turnover-43,880/3,754= 11.688865 Accounts receivable turnover- 65,388/12,708=5.14542 Fixed asset Turnover- 65,388/201,549= 0.324427 Debt Management- Total Debt to assets ratio- 194,037/201,549= 0.962728 Total Debt to equity ratio- 194,037/90,323= 2.146830 Profitability Gross Profit Margin- 21,508/65,388=0.3289288 Operation Profit Margin- 3,794/65,388= .058022 Net Profit Margin- (2,864)/65,388 =0.043800 ROES- Universal Studios Ratios: Liquidity - Current-26,741/28,796= .92863 Quick - 26,741-(inventories not supplied on balance sheet) Networking Capital to sales-26,741-28796/103,564 = -0.01984 Asset Management- Total Asset Turnover- 103564/273,869 = 0.37815 Inventory Turnover- 72,738/(inventories not given) Accounts receivable turnover 103,564/11,466 =9.032269 Fixed asset Turnover- 103,564/26,741=3.87285 Debt Management- Total Debt to assets ratio- 28,796/26,741= 1.076848 Total Debt to equity ratio- 180,851/90,323 = 2.002269 Profitability Gross Profit Margin - 30,826/103,564= 0.297651 Operation Profit Margin- 17,605/103,564= 0.16999 Net Profit Margin- 10,534/103,564 = 0.10171488 ROES- Ratio Analysis Disney Disney Rations: Liquidity- Current-35,251/26,628= 1.32383 Quick- 35,251-3,754/26,628 = 1.18285 Networking Capital to sales- 35,251-26,628/65,388 = 0.12187 Asset Management- Total Asset Turnover-65,388/201,549 =0.324427 Inventory Turnover-43,880/3,754= 11.688865 Accounts receivable turnover- 65,388/12,708=5.14542 Fixed asset Turnover- 65,388/201,549= 0.324427 Debt Management- Total Debt to assets ratio- 194,037/201,549= 0.962728 Total Debt to equity ratio- 194,037/90,323= 2.146830 Profitability - Gross Profit Margin- 21,508/65,388= 0.3289288 Operation Profit Margin-3,794/65,388=.058022 Net Profit Margin- (2,864)/65,388 =0.043800 ROEs- Net Income/sales X Sales/Total Assets X Total Assets/Average Shareholder Equity = 2,864/65,388 X 65,388/201,549 X 201,549/85,583 = .033464 Universal Studios Ratios: Liquidity Current-26,741/28,796= .92863 Quick - 26,741-(inventories not supplied on balance sheet) Networking Capital to sales- 26,741-28796/103,564 = -0.01984 Asset Management- Total Asset Turnover-103564/273,869 = 0.37815 Inventory Turnover-72,738/(inventories not given) Accounts receivable turnover 103,564/11,466 =9:032269 Fixed asset Turnover- 103,564/26,741=3.87285 Debt Management- Total Debt to assets ratio- 28,796/26,741= 1.076848 Total Debt to equity ratio- 180,851/90,323 = 2.002269 Profitability Gross Profit Margin - 30,826/103,564=0.297651 Operation Profit Margin- 17,605/103,564 -0.16999 Net Profit Margin- 10,534/103,564 = 0.10171488 ROES- Net Income/sales X Sales/Total Assets X Total Assets/Average Shareholder Equity - 10,534/103,564 X 103,564/273,869 X 103,564/90,323= 0.0441022 Busch Gardens/Seaworld Entertainment Ratios: Liquidity Current -507/317= 1.59936 Quick-507-31/317= 1.50157 Networking Capital to Sales- 507-317/432=0.43981 Asset Management- Total Asset Turnover-432/273,869= .001577 Inventory Turnover- 425/31= 13.70967 Total Asset Turnover- 432/2,566= 0.168355 Debt Management- Total Debt to assets ratio- 2,300/2,566=0.89633 Total Debt to equity ratio- 2,300/(106)= 21.69811 Profitability Gross Profit Margin-77432= .0162037 Operation Profit Margin- 256/432 .592592 Net Profit Margin-312/432= 72222 ROES- Net Income sales X Sales/Total Assets X Total Assets/Average Shareholder Equity =317/432 X 432/2,566 X 2,566/106 = 2.990566 Paragraph Disney Ratios: Liquidity- Current-35,251/26,628=1.32383 Quick-35,251-3,754/26,628 = 1.18285 Networking Capital to sales-35,251-26,628/65,388 = 0.12187 Asset Management- Total Asset Turnover-65,388/201,549 =0.324427 Inventory Turnover-43,880/3,754= 11.688865 Accounts receivable turnover- 65,388/12,708=5.14542 Fixed asset Turnover- 65,388/201,549= 0.324427 Debt Management- Total Debt to assets ratio- 194,037/201,549= 0.962728 Total Debt to equity ratio- 194,037/90,323= 2.146830 Profitability Gross Profit Margin- 21,508/65,388=0.3289288 Operation Profit Margin- 3,794/65,388= .058022 Net Profit Margin- (2,864)/65,388 =0.043800 ROES- Universal Studios Ratios: Liquidity - Current-26,741/28,796= .92863 Quick - 26,741-(inventories not supplied on balance sheet) Networking Capital to sales-26,741-28796/103,564 = -0.01984 Asset Management- Total Asset Turnover- 103564/273,869 = 0.37815 Inventory Turnover- 72,738/(inventories not given) Accounts receivable turnover 103,564/11,466 =9.032269 Fixed asset Turnover- 103,564/26,741=3.87285 Debt Management- Total Debt to assets ratio- 28,796/26,741= 1.076848 Total Debt to equity ratio- 180,851/90,323 = 2.002269 Profitability Gross Profit Margin - 30,826/103,564= 0.297651 Operation Profit Margin- 17,605/103,564= 0.16999 Net Profit Margin- 10,534/103,564 = 0.10171488 ROES- Ratio Analysis Disney Disney Rations: Liquidity- Current-35,251/26,628= 1.32383 Quick- 35,251-3,754/26,628 = 1.18285 Networking Capital to sales- 35,251-26,628/65,388 = 0.12187 Asset Management- Total Asset Turnover-65,388/201,549 =0.324427 Inventory Turnover-43,880/3,754= 11.688865 Accounts receivable turnover- 65,388/12,708=5.14542 Fixed asset Turnover- 65,388/201,549= 0.324427 Debt Management- Total Debt to assets ratio- 194,037/201,549= 0.962728 Total Debt to equity ratio- 194,037/90,323= 2.146830 Profitability - Gross Profit Margin- 21,508/65,388= 0.3289288 Operation Profit Margin-3,794/65,388=.058022 Net Profit Margin- (2,864)/65,388 =0.043800 ROEs- Net Income/sales X Sales/Total Assets X Total Assets/Average Shareholder Equity = 2,864/65,388 X 65,388/201,549 X 201,549/85,583 = .033464 Universal Studios Ratios: Liquidity Current-26,741/28,796= .92863 Quick - 26,741-(inventories not supplied on balance sheet) Networking Capital to sales- 26,741-28796/103,564 = -0.01984 Asset Management- Total Asset Turnover-103564/273,869 = 0.37815 Inventory Turnover-72,738/(inventories not given) Accounts receivable turnover 103,564/11,466 =9:032269 Fixed asset Turnover- 103,564/26,741=3.87285 Debt Management- Total Debt to assets ratio- 28,796/26,741= 1.076848 Total Debt to equity ratio- 180,851/90,323 = 2.002269 Profitability Gross Profit Margin - 30,826/103,564=0.297651 Operation Profit Margin- 17,605/103,564 -0.16999 Net Profit Margin- 10,534/103,564 = 0.10171488 ROES- Net Income/sales X Sales/Total Assets X Total Assets/Average Shareholder Equity - 10,534/103,564 X 103,564/273,869 X 103,564/90,323= 0.0441022 Busch Gardens/Seaworld Entertainment Ratios: Liquidity Current -507/317= 1.59936 Quick-507-31/317= 1.50157 Networking Capital to Sales- 507-317/432=0.43981 Asset Management- Total Asset Turnover-432/273,869= .001577 Inventory Turnover- 425/31= 13.70967 Total Asset Turnover- 432/2,566= 0.168355 Debt Management- Total Debt to assets ratio- 2,300/2,566=0.89633 Total Debt to equity ratio- 2,300/(106)= 21.69811 Profitability Gross Profit Margin-77432= .0162037 Operation Profit Margin- 256/432 .592592 Net Profit Margin-312/432= 72222 ROES- Net Income sales X Sales/Total Assets X Total Assets/Average Shareholder Equity =317/432 X 432/2,566 X 2,566/106 = 2.990566

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started